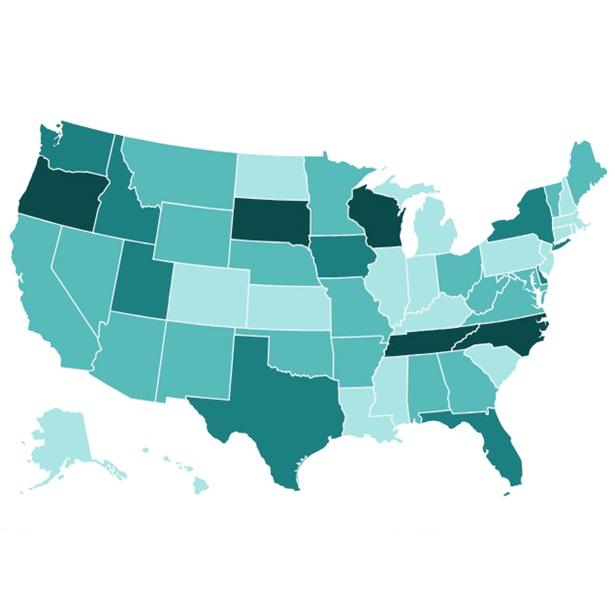

Although taxpayer contributions to state pension plans have nearly doubled as a share of state revenue over the past decade, the plans still face a more than $1 trillion shortfall. If these benefits aren’t sustainably funded, the cost of paying for them could hinder states’ ability to fund core government services such as schools, public safety, and infrastructure.

Policymakers need better information—including successful models—to help develop financially sound retirement systems that protect taxpayers, maintain the government’s ability to deliver important public services, and put state and local workers on the path to a secure retirement.

But there’s no one-size-fits-all solution. Every city and state has a unique set of policy preferences and budgetary challenges, and will choose its own approach. Pew provides the nonpartisan, evidence-based data and analysis that policymakers need to ensure that public sector retirement systems are financially sound for current and future workers, retirees, and taxpayers.

Issue Brief

October 19, 2022

Stable Public Pension Funding Within Reach

Issue Brief

December 10, 2021

Pew's Fiscal Sustainability Matrix Assess Pension Health

Article

December 17, 2021

Vermont Strengthens Governance of State Pensions

Fact Sheet

May 18, 2021