Societal changes drive public policy. These shifts include an aging population; the growth of high tech and service sector jobs; evolving views on race, ethnicity, and immigration; and changes in family structure.

Pew studies these attitudes and trends and their impact through the use of original public opinion survey research, along with social, economic, and demographic data analysis. Pew’s work includes a major study of the millennial generation and the distinct path it is forging toward adulthood, with fewer ties to traditional religious and political institutions and more use of social media to build personal networks.

Trend Magazine

February 9, 2021

Winter 2021

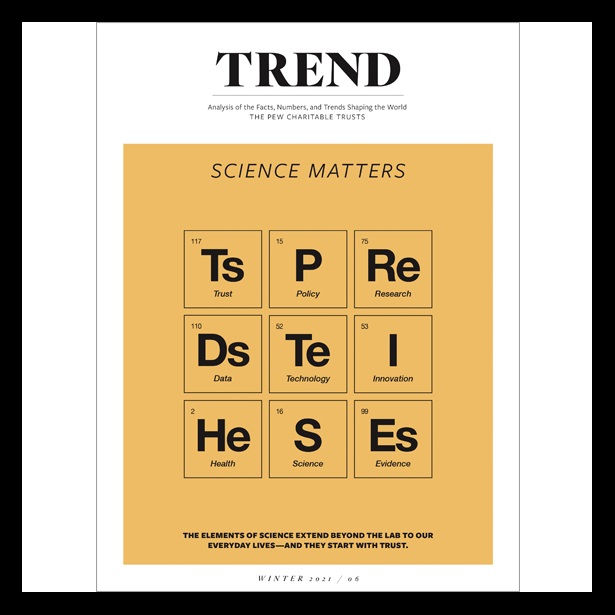

In this issue of Trend we step back to explore public attitudes about science and how science can inform policy.