State Public Pension Investments Shift Over Past 30 Years

OVERVIEW

As of 2012, the most recent year for which comprehensive data are publicly available, state and local public workers had earned more than $4 trillion in expected benefit payouts, and public pension plans had approximately $3 trillion in assets to make those payouts—leaving a gap of more than $1 trillion between the two.1

Although governments and employees make contributions to public pensions, investment earnings on the plans’ assets are expected to fund about 60 percent of promised pension benefits.2 Recent investment performance for public pension funds has been strong: for example, large funds posted returns of over 12 percent in the fiscal year ending June 2013.3

Future investment returns, however, are inherently uncertain, and a significant funding gap remains. The way these investments are managed by policymakers and pension plan administrators has significant influence on both the cost and the health of our nation’s public pension systems.

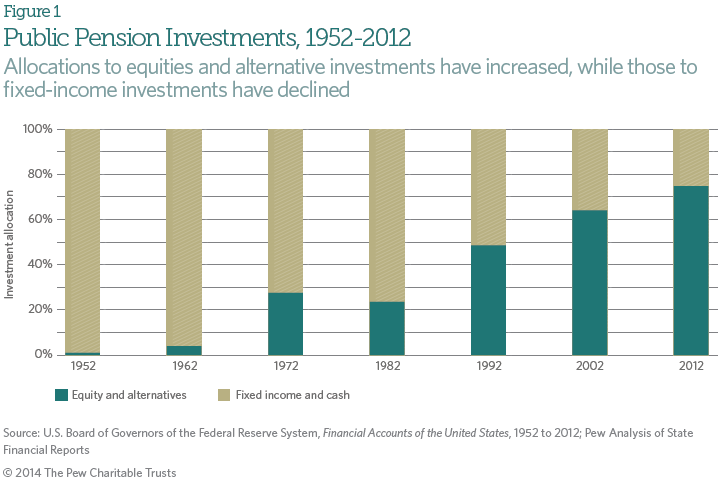

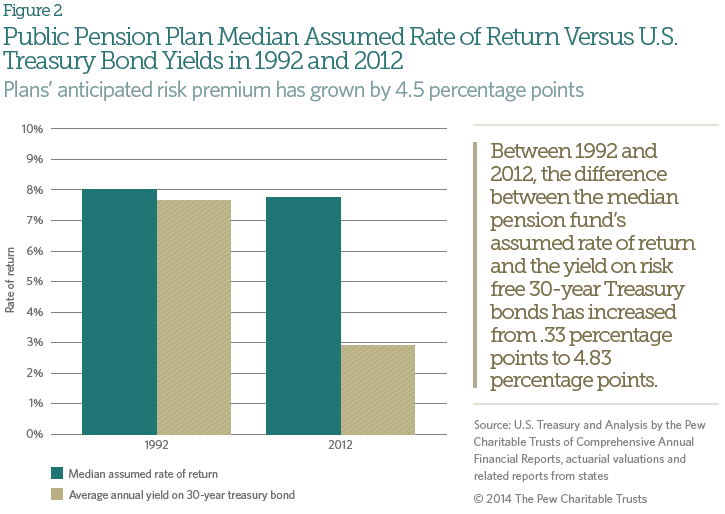

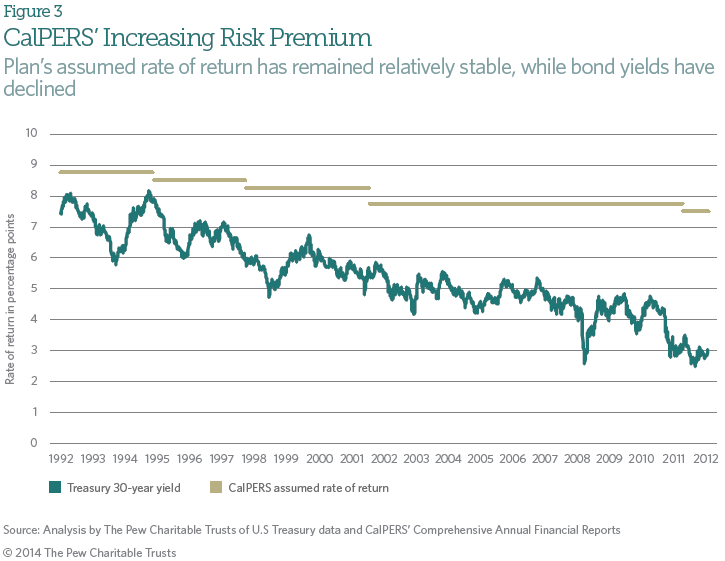

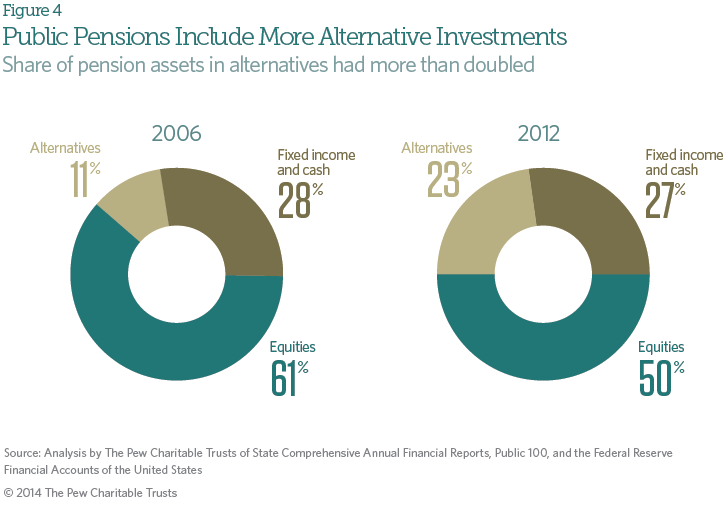

In a bid to boost investment returns, public pension plans in the past several decades have shifted funds away from fixed-income investments such as government and high-quality corporate bonds. During the 1980s and 1990s, plans significantly increased their reliance on stocks, also known as equities. And during the past decade, funds have increasingly turned to alternative investments such as private equity, hedge funds, real estate, and commodities to achieve their target investment returns.

It is understandable that public pension plans have implemented these changes in asset allocation in order to maximize long-term returns and diversify their investment portfolios. But these changes in investment practice have coincided with an increase in fees as well as uncertainty about future realized returns, both of which may have significant implications for public pension funds’ costs and long-term sustainability.

In short, increased investments in equities and alternatives could result in greater financial returns but also increased volatility and the possibility of losses on these assets. Even relatively small differences in returns resulting from investment performance or fees can have a major effect on the asset values of pension funds. A difference of just one percentage point in returns in a single year on $3 trillion equates to $30 billion.

These trends underscore the need for additional public information on plan performance, insight on best practices in fund governance, and attention to the effect of investment fees on plan health. With $3 trillion in assets and the retirement security of 14.5 million state and local employees at stake, sound investment strategy is critical.4

Endnotes

1 U.S. Federal Reserve, Federal Reserve Statistical Release (December 2012); "The Widening Gap Update," The Pew Center on the States, (June 2012), http://www.pewstates.org/uploadedFiles/PCS_Assets/2012/Pew_Pensions_Update.pdf.

2 National Association of State Retirement Administrators, "NASRA Issue Brief: Public Pension Plan Investment Return Assumptions" (Updated April 2014), http://www.nasra.org/files/Issue%20Briefs/NASRAInvReturnAssumptBrief.pdf.

3 Kevin Olsen, "U.S. Equity, Credit Boost Public Plan Return," Pensions & Investments, Sept. 16, 2013.

4 United States Census, Annual Survey of Public Pensions: State- and Locally-Administered Defined Benefit Data, Table 1. National Summary of Public Employee Retirement Systems; United States Census, Annual Survey of Public Pensions: State- and Locally- Administered Defined Benefit Data, Table 5a, Number and Membership of State and Local Retirement Systems by State (2012).