Policy Proposal: Reducing the Exclusivity Period for Biological Products

A series that examines policies to manage drug spending

What problem is this policy meant to address?

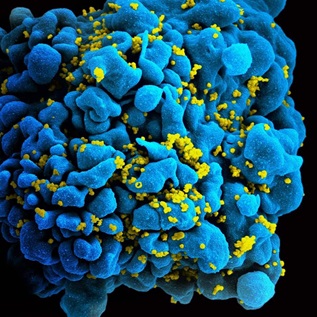

Biological products, or biologics, are drugs made up of proteins or other materials derived from living cells through a complex manufacturing process. They are used to treat a wide range of health conditions, including cancer, rheumatoid arthritis, and multiple sclerosis, and are some of the most expensive drugs on the market, measured by both unit price and net contribution to spending. In 2015, eight of the 10 highest-expenditure drugs in Medicare Part B were biological products,1 and growth in the spending on biologics has exceeded 10 percent for each of the past five years.2

Biologics approved by the U.S. Food and Drug Administration are granted 12 years of exclusivity3 —substantially longer than the five years typically granted to traditional, small-molecule pharmaceuticals.4 Other high-income countries grant biologics fewer years of exclusivity than the U.S.,5 and many provide small-molecule drugs and biologics the same period of exclusivity.6

During the exclusivity period, these medicines do not face competition from biosimilars, which are follow-on, highly similar products to FDA-approved biologics. After the expiration of all patents and 12 years of FDAgranted exclusivity, drug developers can obtain FDA approval to market a biosimilar through an abbreviated licensure pathway for biological products.7 Instead of having to reproduce evidence that demonstrates safety and effectiveness, developers must only demonstrate that a biosimilar is “highly similar” or “interchangeable” with the previously approved reference biologic.8

However, analysis has shown that costs to develop biological and traditional, small-molecule drugs are similar,9 which has prompted some to argue that 12 years of protection from biosimilar competition is excessive.10 Policies that reduce this period would allow lower-cost biosimilars to enter the market sooner and could increase competition among biological products. Increased competition has the potential to reduce drug spending in the U.S.11

How could this policy work?

Policymakers have proposed reducing the length of exclusivity for biologic drugs, which would allow biosimilars to come to market more quickly. The Obama administration proposed reducing biologic exclusivity to seven years in its budget for fiscal year 2017.12 This proposal also included a prohibition on “additional periods of exclusivity for brand biologics due to minor changes in product formulations.”13 According to the Office of Management and Budget, these proposals together would have generated federal savings of $6.96 billion over 10 years.14

The Price Relief, Innovation, and Competition for Essential Drugs (PRICED) Act, introduced in 2016, would reduce exclusivity for biological drugs from 12 to seven years.15 The Congressional Budget Office has not publicly released an estimate of the impact this policy would have on federal government spending.

What should policymakers consider?

Exclusivity for new drugs allows manufacturers to set higher prices, because no biosimilars can be approved during this time. This is a powerful incentive for drugmakers to bring new products to market, especially given the high costs involved with developing novel therapies. Experts estimated in 2016 that an average of $2.6 billion is spent to bring a drug to market, which includes the opportunity cost of not using these funds for other purposes, as well as expenses companies incur developing products that fail to reach the market.16

Shorter biologic exclusivity could allow biosimilar developers to bring products to market more quickly, which has the potential to reduce drug spending at a cost of reduced revenue for the reference product developer.

Reducing the period of FDA-granted exclusivity would have limited effect when patent protections exceed the exclusivity period. For example, Humira—a biologic used to treat inflammatory conditions such as rheumatoid arthritis and Crohn’s disease—was initially FDA-approved in 2002,17 yet some experts believe it may be shielded from biosimilar competition until 2022.18 While biosimilar developers can challenge existing patents, the time and costs associated with these disputes can discourage manufacturers from such attempts.

Savings from biologic competition may be less marked than those achieved with traditional generic drugs. Compared with generic drugs, follow-on biologics will probably take longer to develop (three to five years versus eight to 10 years, respectively), and their development costs are likely to be higher ($1 million to $5 million versus $100 million to $200 million, respectively).19 Additionally, under current federal law, biosimilars that have been deemed interchangeable by FDA may be automatically substituted for a reference biologic by a pharmacist without provider intervention.20 However, states may place limits on when these products can be substituted. Biosimilar uptake will probably be limited by the fact that not all biosimilars will be approved with the interchangeable designation.21 In the traditional drug market, savings have been driven in large part by laws that typically allow pharmacists to automatically substitute generics for brand drugs that are therapeutically equivalent.

Because of the factors outlined above, most experts believe that biosimilar uptake rates will be lower than those of generic drugs and that savings from biosimilars will be restrained by more modest price decreases.22 As a result, innovator biological product developers are likely to experience a smaller reduction in revenue from the expiration of exclusivity and patents than currently experienced by brand drug developers. This suggests that though reducing the length of biological exclusivity may increase competition, biological product developers may still be able to maintain significant revenue after biosimilars have entered the market.

Endnotes

- In 2015, spending on drugs in Medicare Part B reached approximately $26 billion. Spending on the eight highest-expenditure biologics in Part B was approximately $10 billion. Medicare Payment Advisory Commission, “Report to the Congress: Medicare and the Health Care Delivery System” (June 2017), http://www.medpac.gov/docs/default-source/reports/jun17_reporttocongress_sec.pdf?sfvrsn=0.

- QuintilesIMS Institute, “Medicines Use and Spending in the U.S.: A Review of 2016 and Outlook to 2021” (May 2017), http://www.imshealth.com/en/thought-leadership/quintilesims-institute/reports/medicines-use-and-spending-in-the-us-review-of-2016-outlook-to-2021.

- Patient Protection and Affordable Care Act, 42 U.S.C. § 262(k) (2010). Data exclusivity granted by the U.S. Food and Drug Administration to a drug manufacturer prevents other companies from relying on the same clinical data to obtain market approval.

- Food, Drug, and Cosmetic Act § 505(j)(5)(F). Manufacturers can also receive seven years of exclusivity for drugs that are approved to treat an orphan condition and six months of additional exclusivity in return for conducting pediatric studies. Food and Drug Administration, “Frequently Asked Questions on Patents and Exclusivity,” last updated Dec. 5, 2016, https://www.fda.gov/drugs/developmentapprovalprocess/ucm079031.htm.

- Megan Kendall and Declan Hamill, “A Decade of Data Protection for Innovative Drugs in Canada: Issues, Limitations, and Time for a Reassessment,” Biotechnology Law Report 35, no. 6 (2016): 259–267, http://dx.doi.org/10.1089/blr.2016.29030.mk.

- Jenny Wong, “Data Protection for Biologics—Should the Data Exclusivity Period Be Increased to 12 Years?” UNSW Student Law Legal Studies Research Paper Series, June 3, 2016, https://ssrn.com/abstract=2831262.

- Biosimilar developers can also challenge brand patents in effect. If successful, these developers would be allowed to bring a biosimilar to market sooner. Benjamin P. Falit, Surya C. Singh, and Troyen A. Brennan, “Biosimilar Competition in the United States: Statutory Incentives, Payers, and Pharmacy Benefit Managers,” Health Affairs 34, no. 2 (2015): 294–301, http://content.healthaffairs.org/content/34/2/294.full.pdf+html.

- Food and Drug Administration, “Information on Biosimilars,” last updated May 10, 2016, https://www.fda.gov/drugs/developmentapprovalprocess/howdrugsaredevelopedandapproved/approvalapplications/therapeuticbiologicapplications/biosimilars/default.htm.

- Joseph A. DiMasi and Henry G. Grabowski, “The Cost of Biopharmaceutical R&D: Is Biotech Different?” Managerial and Decision Economics 28, no. 4–5 (2007): 469–79, http://dx.doi.org/10.1002/mde.1360.

- U.S. Federal Trade Commission, “Emerging Health Care Issues: Follow-On Biologic Drug Competition” (June 2009), https://www.ftc.gov/sites/default/files/documents/reports/emerging-health-care-issues-follow-biologic-drug-competition-federal-trade-commission-report/p083901biologicsreport.pdf.

- The Pew Charitable Trusts, “Can Biosimilar Drugs Lower Medicare Part B Drug Spending? Leveraging New Drug Alternatives Could Reduce Costs” (January 2017), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/01/can-biosimilar-drugs-lower-medicare-part-b-drug-spending.

- Office of the White House, “Meeting Our Greatest Challenges: Opportunity for All,” Budget for Fiscal Year 2017, accessed Aug. 9, 2017, https://obamawhitehouse.archives.gov/sites/default/files/omb/budget/fy2017/assets/opportunity.pdf.

- This practice, also known as “product hopping” or “evergreening,” involves a brand manufacturer modifying the formulation of its drug (e.g., to allow extended release so that it can be taken less frequently or changing it from a capsule to a tablet). Competition from generics would be prevented if the manufacturer is able to switch patients to the new version, since state pharmacy substitution laws typically require that drugs be therapeutically equivalent based in part on the dosage and form of a drug.

- Office of the White House, “The Budget for Fiscal Year 2017: Summary Tables,” accessed Aug. 9, 2017, https://obamawhitehouse.archives.gov/sites/default/files/omb/budget/fy2017/assets/tables.pdf.

- Price Relief, Innovation, and Competition for Essential Drugs Act, S. 3094, 114th Cong. (2015-2016), https://www.congress.gov/bill/114th-congress/senate-bill/3094/text.

- No estimate is available in this report for the cost of developing a biologic. Joseph A. DiMasi, Henry G. Grabowski, and Ronald W. Hansen, “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs,” Journal of Health Economics 47 (2016): 20–33, http://dx.doi.org/10.1016/j.jhealeco.2016.01.012.

- Food and Drug Administration, Center for Drug Evaluation and Research and Center for Biologics Evaluation and Research, Application Number: 125057/0, Approval Letter(s), https://www.accessdata.fda.gov/drugsatfda_docs/nda/2002/BLA_125057_S000_HUMIRA_APPROV.PDF.

- Carly Helfand, “Key Humira Patent Goes Down via IPR—but Biosims Makers Shouldn’t Celebrate Yet, Analysts Warn,” FiercePharma, May 17, 2017, http://www.fiercepharma.com/pharma/key-humira-patent-goes-down-via-ipr-but-biosims-makers-shouldn-t-celebrate-yet-analysts-warn.

- U.S. Federal Trade Commission, “Emerging Health Care Issues: Follow-On Biologic Drug Competition.”

- Regulation of biological products, 42 U.S.C. Sect. 262(i)(3) (2013).

- As of August 2017, five biosimilars had been approved by the Food and Drug Administration, though none with the interchangeable designation.

- Andrew W. Mulcahy, Zachary Predmore, and Soeren Mattke, “The Cost Savings Potential of Biosimilar Drugs in the United States,” RAND Corp. (2014), http://www.rand.org/content/dam/rand/pubs/perspectives/PE100/PE127/RAND_PE127.pdf.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Biologic and Biosimilar Drugs—How Federal and State Policy Will Affect Their Use

Can Biosimilar Drugs Lower Medicare Part B Drug Spending?

Leveraging new drug alternatives could reduce costs