House Bill Would Reduce Costly Rebuilding of Repeatedly Flooded Properties

Reforms take steps to increase flood risk transparency for homebuyers and lower program's debt

Residences along the banks of the Meramec River in Fenton, Missouri, are submerged in floodwater on May 4, 2017. Towns along the river regularly face flooding as it crests after days of rainfall.

© Michael B. Thomas/Getty Images

The National Flood Insurance Program (NFIP), the federal program that helps residents, business owners, and communities recover from flooding, may be getting some help from Congress. After months of discussion, the House of Representatives Financial Services Committee on Wednesday passed legislation to reauthorize and improve the NFIP, which is $25 billion in debt. And, while those deliberations underscored the difficulty of reducing the program’s debt and assisting those who live in flood-prone areas, the committee did advance two sensible solutions.

One provision included in the flood reauthorization, the Repeatedly Flooded Communities Preparation Act (H.R. 1558), prompts local communities with severe flooding problems to take steps to reduce recurring damages. In addition, other changes to the NFIP included in H.R. 2874 increase the transparency of the program to help families and communities better understand and prepare for flood hazards.

The NFIP expires Sept. 30 for all policyholders and as the reauthorization bill moves to the Senate, it is critical that these provisions are included:

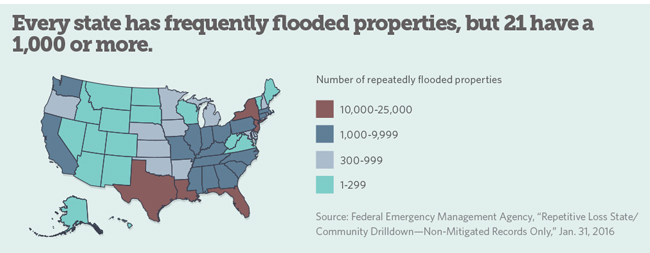

Repeatedly flooded properties: While they make up just 1 percent of the claims filed through the NFIP, these properties have historically accounted for between 25 and 30 percent of the program’s losses. H.R. 1558 aims to limit the federal resources spent on properties that flood multiple times by requiring communities to develop plans to reduce flood risk rather than continually rebuilding after disasters.The legislation, sponsored by Representatives Ed Royce (R-CA) and Earl Blumenauer (D-OR), would spur local action to reduce risk, for example, by improving drainage, promoting voluntary buyouts of particularly vulnerable properties, or otherwise helping owners safeguard their homes. A poll conducted by the research firm Public Opinion Strategies for The Pew Charitable Trusts found that 64 percent of registered voters support such efforts to break the costly cycle of damage and repair.

Flood-risk disclosure: In order to protect homebuyers and renters, H.R. 2874 The 21st Century Flood Reform Act as amended would require property owners to disclose what they know about a property’s flood history and risk. Also championed by Representative Royce, the bill would require that states enact flood disclosure laws by 2022. This would ensure that all of the relevant information is shared before individuals commit to buying or renting a home. Results from the same Pew poll found that 81 percent of respondents support a single national standard to disclose a property’s flood risk.

Managing flood risk and responding to disasters is a shared responsibility among homeowners, communities, and the federal government. The above provisions in House bills H.R. 1558 and 2874 would help all parties meet that responsibility, address the growth of community flood hot spots, and reduce flood-claim payouts that contribute to the growing debt of the NFIP.

Laura Lightbody leads The Pew Charitable Trusts’ initiative to help communities reduce the effects of weather-related catastrophes on the U.S. economy and environment through national policy reform.