Regulatory Changes Expected to Increase Access to Financing for Manufactured Homes

Updates modernize Title I, the only federal program focused on safe, affordable home-only loans

Editor's note: This analysis was updated March 20, 2024 to correctly refer to the Federal Housing Administration.

The White House; the Federal Housing Administration (FHA); and Ginnie Mae, the government-owned guarantor of federally insured home loans, announced on Feb. 29 important changes to the Title I lending program to increase access to safe, affordable loans for the purchase of manufactured homes.

Manufactured housing—modern mobile homes built to a specific federal standard—can save buyers upward of $100,000 compared with homes constructed on-site. Making more manufactured homes available has been a key aspect of the White House’s Housing Supply Action Plan, with officials noting the need to improve financing mechanisms in 2022, but complex ownership arrangements and outdated rules create hurdles for lenders and homebuyers. And that limits the use of such housing at a time when lower-cost options are desperately needed.

Title I is the only federal program designed to increase access to personal property loans—the kind of credit that manufactured home buyers can apply for when a home is owned separately from the land. In these instances, a real estate mortgage is not possible. The market for personal property loans has not been competitive. However, these changes to Title I loan limits and lender requirements will help to create sustainable opportunities for lenders and expand credit access for tens of thousands of Americans looking for low-cost homes. Additional updates could further strengthen the market for such borrowing.

Lessons learned from federally backed mortgage programs

Federal loan programs play a critical role in creating a competitive mortgage market with thousands of lenders. In particular, FHA provides insurance for lenders and increased access to credit for borrowers who are eligible for mortgages to purchase manufactured homes. The data shows that denial rates are far lower for FHA loans than they are for mortgages without federal insurance; more than 1 in 3 manufactured-home mortgage borrowers overall used one of these FHA loans.

But nothing comparable exists for personal property lending. Without a source of government backing, few lenders participate and few applicants are approved. In fact, just five lenders made 78% of personal property loans from 2018 through 2022. Such concentration means that these lenders have a lot of market power—and nearly two-thirds of loan applications were denied during that period.

However, appropriate updates to the Title I program could help fill the gap and allow the FHA to play a similarly important role in establishing a functioning market for federally backed personal property loans.

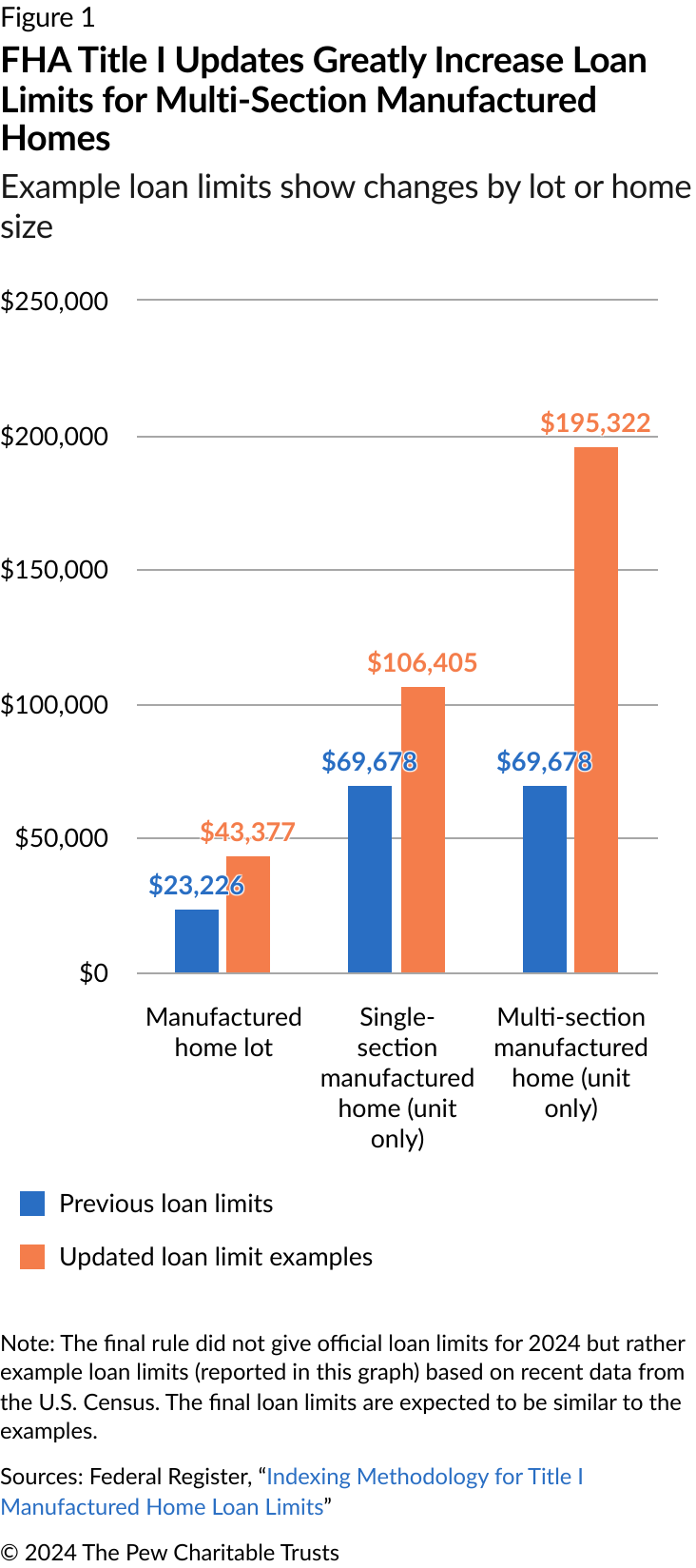

FHA increases loan limits to better align with current housing prices

Under the Title I program, approved lenders can offer credit within certain loan limits to eligible borrowers buying a manufactured home with or without the purchase of the lot where the structure will be located. Loan limits had not been increased since 2009, but average housing prices have nearly doubled in the past 10 years.

To address this, FHA is increasing loan limits in its Title I program to keep pace with home prices. The agency will now set different loan limits, depending on whether the home is a single-section or multi-section (double or larger). This change will increase loan limits for multi-section homes by about $125,000, while limits for single-section homes will increase by more than $35,000. As a result, tens of thousands of families that were formerly shut out of the program because of low loan limits will now have the option of applying for the Title I program. Further, loan limits will be updated annually to ensure that loan amounts stay aligned with home prices, which is critical for the program’s longer-term success. (See Figure 1.)

Ginnie Mae reduces barriers for lenders to make loans

The second significant policy change is being made by Ginnie Mae, which facilitates homeownership by connecting the U.S. housing market to low-cost financing. In 2010, Ginnie Mae set strict limits for manufactured home lenders, presuming high levels of loan losses. The goal was to better balance risk and credit access, but the limits required lenders to retain a net worth of $10 million plus amounts equal to 10% of all outstanding Title I obligations for manufactured home financing—four times higher than the amounts required for mortgage lenders.

The mortgage industry has noted that this discrepancy caused a “significant impediment to more lenders originating Title I loans and securitizing them as a Ginnie Mae issuer.” Currently, just a small number of lenders participate in Ginnie Mae’s guarantee program for Title I, and no loans have been made in recent years. In comparison, 99% of all FHA single-family mortgages (including those for manufactured homes) use Ginnie Mae’s guarantee. On Feb. 28, Ginnie Mae announced “the first of a series of modernizations.” Importantly, the loan guarantor is decreasing lender net worth requirements to align closely with its mortgage guarantee program. Reducing these requirements is a key step to enabling more lenders to issue personal property loans.

More updates would improve lender adoption and consumer protections and reduce default risk

The changes made so far will help to revive the market for federally backed personal property loans, but there is more work to do. FHA has several other opportunities to update Title I to reduce barriers to entry for new lenders to adopt the program, improve borrower outcomes, and reduce default risk. The agency should consider allowing automated underwriting for FHA Title I financing, which greatly reduces the time and costs to make loans. In addition, loss mitigation strategies (which help borrowers who are behind on their loan payments avoid losing their homes) are mandatory for FHA mortgages and should be considered for Title I loans as well.

In addition, the agency could improve land stability and reduce default risk for the half of personal property loan borrowers who pay to rent their land. Although the Title I program has some requirements in place already, there are other land lease protections that FHA could consider. For example, Freddie Mac, the government-sponsored enterprise (GSE) that buys loans along with Fannie Mae, implemented such protections for people who rent land purchased using loans owned by either of the two GSEs, Fannie Mae and Freddie Mac.

The combination of the updates just made and these additional improvements to the Title I program could improve access to personal property loans while making them safer for borrowers when getting a mortgage isn’t possible.

Tara Roche is the project director and Rachel Siegel is a senior officer with The Pew Charitable Trusts’ housing policy initiative.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Enhancing Credit Access for Manufactured Home Buyers

Expand Lower-Cost Housing With Manufactured Homes