Student Loan Interest Deduction Should Factor Into Debates on Student Debt, Tax Code

Provision’s federal price tag has grown rapidly in recent years; cost in many states is unclear

Parts of this analysis were updated March 20, 2018, to include a recent debate in Congress on student loan tax provisions.

The student loan interest deduction, which allows taxpayers to subtract interest paid on student debt from their taxable income to help families reduce the cost of borrowing for higher education, is a significant part of the federal and state toolkit for promoting student debt affordability. During congressional debate over last year’s federal tax overhaul, lawmakers considered changes to this provision; in fact, the bill initially passed by the U.S. House of Representatives slated the deduction for elimination. However, the final law left the provision intact.

Although federal lawmakers have completed their work on tax reform, that should not be the end of the conversation about the role of the student loan interest deduction in overall higher education policy. As federal lawmakers prepare for upcoming deliberations over reauthorization of the Higher Education Act, they should consider not only spending, but also tax provisions, including the deduction. And as states make decisions about their systems for financing higher education, they also should bear the deduction and other higher education tax benefits in mind.

The analysis below, published by The Pew Charitable Trusts on Sept. 21, 2017, provides key context for understanding the deduction and how it fits within the broader system of federal and state support for higher education.

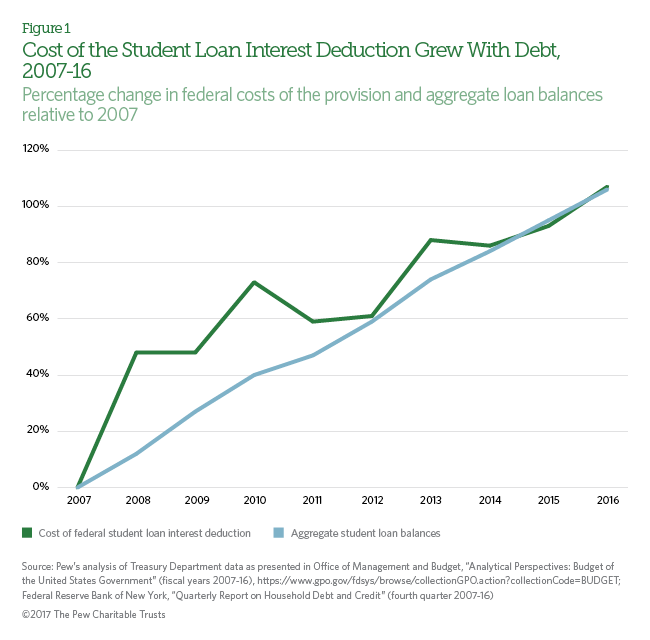

The federal government and nearly every state with an income tax offer the student loan interest deduction. This provision allows taxpayers to subtract interest paid on student debt from their taxable income to help families reduce the cost of borrowing for higher education. The maximum federal deduction, $2,500, has not changed since 2001, but between 2007 and 2016, student loan balances increased by 106 percent in real terms and the cost to the federal government of the deduction more than doubled—rising 107 percent, after adjusting for inflation. (See Figure 1.)

As policymakers begin work on a major overhaul to the federal tax code, which could include eliminating or changing the deduction, and amid widespread concern about rising student debt levels, leaders should bear in mind that altering the provision would have implications for higher education and tax policy across levels of government.

The student loan interest deduction applies to federal, state, and private higher education loans, and is open to all eligible taxpayers who pay interest on student debt, even if they do not itemize their deductions. Despite this wide applicability, the provision has historically been relatively small as a share of total government support for higher education and compared with the biggest higher education tax provisions. For example, the deduction cost the federal government $2 billion in forgone revenue in 2016, significantly less than some of the largest federal higher education programs such as Pell Grants, which cost $27.3 billion that year, and the American Opportunity Tax Credit, which cost $17.8 billion.

However, the provision is on par with or larger than some other federal higher education tax benefits and spending programs with similar goals. For example, the forgone revenue from the deduction in 2016 was about 12.1 percent higher than that from tax benefits associated with “529” plans, which help students and families save for college. Further, the Treasury Department projects that between 2018 and 2026, the cumulative cost of the deduction will be slightly less than $20 billion, roughly comparable to that of the Public Service Loan Forgiveness Program, which provides loan forgiveness after 10 years for borrowers working in public service and was targeted for elimination in President Donald Trump’s proposed budget. Estimates of the cost of the program over the 2018-26 period range from $19.6 billion to $24 billion.

State connections

Filers in all 50 states and the District of Columbia can claim the federal student loan interest deduction, but the average amount deducted per filer varies across the states. Figure 2 shows the deduction amount per person who files taxes in each state to allow for comparisons among states of differing sizes and includes all filers, not just those who claim the deduction, to capture differences in the share of filers in each state who claim it and the amounts they deduct. The benefit to those who claim the deduction and the cost to the federal government of each deduction depend on the filer’s tax rate.

In addition to the federal deduction, 37 states and the District offer an identical or similar provision, usually through their connections to the federal tax code: Most of these states start their income tax calculations with one of the federal definitions of income—adjusted gross income or taxable income—that include the student loan interest deduction. At least one state, Massachusetts, goes further than the federal government, placing no limits on either the amount of interest on undergraduate student loans that filers can deduct or on the income levels of filers who take the deduction for the interest on those loans.

Unlike the federal government, most states do not make cost information for their student loan interest deductions publicly available; in previous research, Pew identified 17 states and the District that provide estimates of forgone revenue, although the figure may have changed because the bulk of that data collection was completed in July 2016. (See Table 1.) Some of those states also include growth trends for their deductions, and they appear to be generally similar to that of the federal provision, with cost growth exceeding the rate of inflation in recent years. For example in California, which uses federal cost estimates as a starting point for state calculations, costs rose from $37 million in fiscal year 2010 to $85 million in fiscal 2016, an increase of 130 percent, after adjusting for inflation. During the same period, the cost of the federal deduction rose 20 percent.

Estimating the costs

Several factors could cause the costs of the student loan interest deduction to the federal government and states to remain a moving target in the future, including:

- How many people borrow to finance an education. If the number continues to increase, so will the number who are potentially eligible to claim the deduction on their tax returns.

- How much each person borrows. All else being equal, the more people borrow the more they will pay in interest and the more they could potentially claim.

- How many people fall into delinquency or default or are in deferment or forbearance on their loans. When borrowers miss loan payments, they also do not make interest payments that they might have been able to deduct from their income taxes.

- The types of loans borrowers take out and the interest rate on those loans. In addition to the total amount borrowed, the interest rate on student loans informs how much interest borrowers pay. Rates can fluctuate from year to year, and vary by types of loans, such as federal Direct PLUS loans and private loans.

Because the deduction’s cost can change with trends in student borrowing and repayment, among other factors, policymakers should consider the provision’s costs and periodically evaluate its merits alongside other programs and proposals with similar goals, such as income-based repayment and federal and state financial aid grants. Taking steps to integrate the provision into broader student loan and education finance debates would help to ensure that federal and state governments are using higher education resources in the most efficient and effective ways to achieve their key policy goals, which often include lowering the cost of higher education and reducing the risk of delinquency and default.

However, getting policymakers to focus on the provision and think about it as part of a larger system of support for higher education that includes spending and tax programs will not happen automatically. As we have noted, in debates over higher education finance, policymakers often do not consider tax programs such as the student loan interest deduction in tandem with spending programs. Integrating all support for higher education into those debates will require a concerted effort, and a key step is knowing and understanding the federal and state costs of this rapidly growing deduction.

Phillip Oliff manages and Brakeyshia Samms is an associate with The Pew Charitable Trusts’ fiscal federalism initiative.

Higher Education Spending

Research and analysis on state and federal policies to aid students, families, and institutions

What Role Does Postsecondary Education Play in Veterans' Economic Opportunity?

Experts explore the needs and experiences of military-connected students