The Actual Value Initiative: Overhauling Property Taxes in Philadelphia

For decades, Philadelphia's property tax system has been criticized as outdated and unfair. In many cases, assessments have had little relation to actual property values—or to assessments of similar structures across the street. In the spring of 2013, Philadelphia City Council is expected to adopt an overhaul of the city's property tax system, effective for tax bills due early in 2014. It is called the Actual Value Initiative (AVI).

The Actual Value Initiative would transform property taxation in Philadelphia in three significant ways, changing the certified market value of every piece of property in the city, the way individual assessments are used to calculate tax bills, and how property owners deal with any big tax increases that might result from the new system.

The report, The Actual Value Initiative: Overhauling Property Taxes in Philadelphia finds that in recent years, no large city has set out to change all three at once. And while transformations of property tax systems in other jurisdictions have been the result of court orders and state mandates, Philadelphia is preparing to act on its own volition.

Perhaps the most important component of the city's plan is the simultaneous reassessment of all 579,383 pieces of real estate in the city. Some properties have not been reassessed since 2004, many others not since the 1980s. According to the city's chief assessment officer, Richie McKeithen, Philadelphia has never experienced a thorough citywide field inspection of every property and its various characteristics.

As the city prepares to undergo what will be a painful transition for some, we set out to better understand the challenges involved. This study looks at the experiences of other cities and counties, the long history of fitful reforms and partial reassessments that have brought Philadelphia to this point, and the measures that the city is considering to help mitigate the steep tax increases that await some homeowners.

Among the key findings of this report:

- A central reason why the city's assessment system has become plagued with inequities is that the state does not regulate it; Pennsylvania is one of only nine states that impose no reassessment timetables or standard assessment methods on local governments. It also is one of just three states to receive a grade of F in “standardized procedures” from the Council on State Taxation, a Washington-based trade group.

- Numerous jurisdictions have adopted measures intended to mitigate the spikes in property taxes that AVI is likely to create for some residents. Some of these measures go beyond the levels of relief currently envisioned or allowed by law in Philadelphia. Whatever programs the city adopts would have several downsides. They would add layers of complexity to a new system that is meant to be simpler and more transparent than the status quo. They also would raise the property tax rate, at least slightly, for everyone.

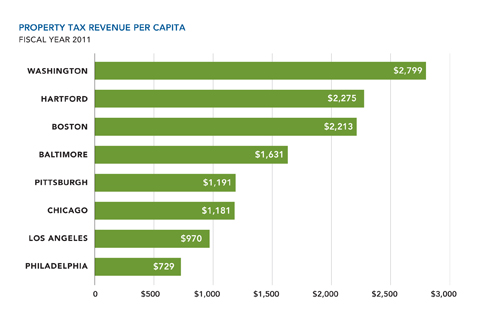

- One reason Philadelphians have been relatively complacent about longstanding inequities in assessments, analysts say, is that they pay less in property taxes (and more in wage taxes) than residents of many other jurisdictions. On a per capita basis, Philadelphia's property tax produces only about one quarter the amount generated in Washington and a third of what is collected in Boston and Hartford. These numbers include taxes that help pay for city government and those that fund the school system.