Business Owners’ Perspectives on Workplace Retirement Plans and State Proposals to Boost Savings

Focus groups with small and midsize employers show common concerns and differences on policy initiatives

© Getty Images

© Getty ImagesOverview

As policymakers in more states consider measures to help private sector workers save for retirement, they should take into account the needs and concerns of employers—particularly small and medium-size businesses—as they develop legislation and regulations.

Most policymakers have emphasized expanding access to what are known as employer-sponsored defined contribution plans, such as 401(k)s. The ability of employees to contribute directly from their paychecks and the use of features such as automatic enrollment make the workplace an effective venue for encouraging saving. Americans accumulate the vast majority of their retirement funds through employer-sponsored plans, but many lack access to one.1

To help provide more workers with retirement savings options, states are looking at various policy initiatives. Among these are state-sponsored individual retirement accounts that would automatically enroll eligible workers—although they could opt out of these auto-IRAs—or retirement “marketplace exchanges” that would offer information on retirement plans to businesses interested in providing their own.

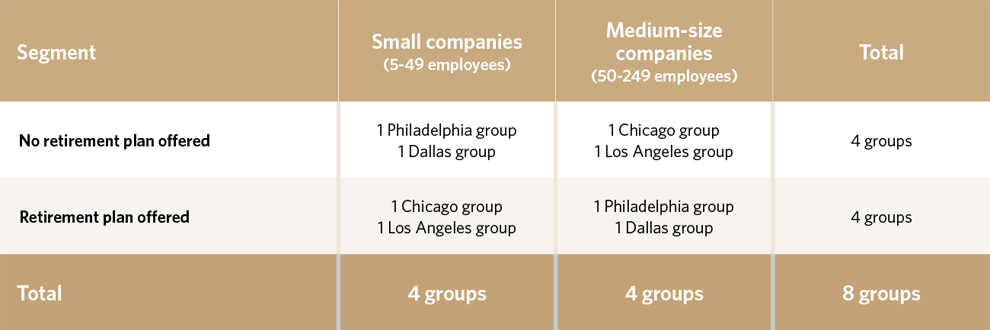

The Pew Charitable Trusts recently convened focus groups to explore employers’ views on retirement programs and potential policy initiatives. Pew conducted focus groups in Philadelphia, Chicago, Dallas, and Los Angeles that included 63 representatives of small (five to 49 employees) and medium-size (50 to 249 employees) employers. The eight sessions were largely split between employers who did and who did not offer retirement plans to their workers.

Participants were asked questions intended to elicit their thoughts on the motivations for and challenges in offering a plan, their perspectives on new state-level policies, and their views on specific plan features to encourage savings.2

These findings are taken from the focus group conversations and provide insight into employers’ views and experiences—perspectives that helped with development of questions for a nationally representative survey.

Among the conclusions of the focus group research:

- Most employers who offer a retirement savings plan said a plan helps attract and retain talent, and several said they see offering workers a way to save for a secure retirement as a fundamental responsibility that reflects company values.

- Employers without retirement plans said they saw multiple challenges with the prospect of offering one, including beliefs that their workers value higher salaries over increased benefits and that low-wage workers would have difficulty affording regular contributions. These employers also cited worries about their own financial costs and difficulties setting up plans.

- When asked about state proposals to set up automatic payroll deposit IRAs for private sector workers, the majority of employers expressed concerns about states’ administrative capabilities and questioned the motives for such plans. Still, some business representatives without plans said they would be willing to take on disseminating information to employees and facilitating contributions if it meant improving workers’ financial futures.

- Many employers said they thought workers might opt out of state-based auto-IRAs because of distrust of state-affiliated savings programs, limited incomes, or tight household budgets. Younger workers also might not take part because their focus is not on retirement needs, some said. Employers who offer retirement benefits said they would not drop plans if a state program were available to employees.

- Most employers reacted negatively to proposals to use automatic savings features. Though a small group saw benefits to the general idea of automatically enrolling employees, most argued that such a feature would be an overreach by employers who adopt it and many did not see the ability to opt out as a meaningful option for employees. None of the participants offering plans said they automatically escalate contributions; that concept had less support than auto-enrollment among employers with and without plans.

- Participants said creating a state-approved online marketplace for private firms to offer plans to small employers would be redundant because existing internet-based tools are available.

Employer motivations for offering retirement plans

Companies that offer retirement plans see them as an important benefit that helps attract and retain talent. Those in the focus groups universally listed having a plan as second in importance only to offering health insurance. They said potential employees see the plans as financial benefits, noting that having a plan helps differentiate their businesses and makes them more competitive in their fields.

Many employers with plans said providing retirement benefits helped project an image of a stable and enduring company to their workers and other businesses. For example, a participant from a medium-size business in Dallas said offering a plan “attracts good employees”; another said his company offers a plan “to be competitive.” In addition, many said that employees who participate in plans are more likely to stay with the business.

If you don’t have [a plan], it’s conspicuous in its absence. … Most companies today have it. Your competitors have it. And it would come off kind of odd if you didn’t.—a participant in Philadelphia from a medium-size business

If you do offer them something that’s competitive in a benefit package that offers retirement … it brings loyalty, where I won’t have to be doing turnover and turnover and turnover because … Joe has found a different job that does offer those things. It’s not constantly paying to train and paying to find people.—a participant in Chicago from a small business

Business owners also expressed philosophical or altruistic motives for sponsoring plans. “Because it’s the right thing to do,” said one participant in Chicago from a small business. Several said they see offering workers a way to save for a secure retirement as a fundamental responsibility; doing so reflects their personal and their business’s values.

Additionally, two-thirds of participants who offer plans provide workers with some level of employer contribution or match. Doing so, they said, helps employers compete to recruit and keep workers. Employer funding also boosts employee participation, several said. Participants said they try to convey to younger employees that the employer match represents an instant return on employee contributions.

Still, most employers who offer plans but do not contribute say doing so would be too costly. “Just can’t afford it,” a participant from a medium-size business in a Philadelphia session said. A few said they preferred to focus on other benefits, such as pay raises, bonuses, and more generous health coverage.

Employer reasons for not offering a plan

When those employers who do not offer a plan were asked why, they typically cited the lack of a clear benefit to the business. Some participants said their employees often are younger, part-time, and seasonal workers or in industries (e.g., transportation) that have higher turnover. That often means they are likely to be short-term employees who value higher salaries over benefits. Employers also emphasized that many low-wage workers would have difficulty affording regular plan contributions. Others saw offering a plan as something they might do in the future, but few had yet sponsored, or seriously considered sponsoring, a retirement plan.

High turnover, number one, and then we’ve got a lot of seasonal people in the summer and then at the holiday time. … Those people aren’t going to [participate], because they’re only there for three months or two months at a time. And then there’s also a lot of turnover with [the employees], because they tend to get the people in their 20s and they’re kind of hopping around jobs.—a participant in Chicago from a midsize business

The whole idea, originally, is to be able to keep employees to stay with you for the longer periods of time. But now people, if you look into the younger set, the millennials and stuff, they’re not planning to be there anyway.—a small-business participant in Los Angeles who does not offer a plan

Our salary levels are unfortunately quite low. So it would be difficult for people to contribute … because just general deductions, with taxes and all of that, take-home ends up being a lot less than planned.—a small-business participant in Philadelphia

Companies without plans cited a variety of other barriers as well.

- For some, the financial costs were perceived as too great for their business.

- Others assumed administering a plan would be difficult and said they were dissuaded from learning more by the perceived complexity. These participants acknowledged limited familiarity with which plan features would be appropriate for their businesses.

- Most participants did not have a full understanding of how 401(k) plans work, and few were familiar with plans or incentives designed for small businesses, such as the Simplified Employee Pension Plan (SEP), the Savings Incentive Match Plan for Employees (SIMPLE), or the small employer tax credit for retirement plan startup costs. At the same time, several suggested that a tax credit would make them more likely to offer a plan.

As a result of these concerns, many of the representatives from businesses without retirement plans said that they are not likely to offer one in the future.

I think one of the other reasons I don’t offer it is the profit margin that I have doesn’t allow it.—a participant in Philadelphia from a small business

I know what I’ve done for me, but the marketplace changes every year. So have I invested the time to keep up with it now? Not enough for me to be comfortable to talk to employees or suggest or back it until I do more research.—a small-business participant in Dallas without a plan explaining her limited familiarity with retirement plan options

Employer perspectives on state-level auto-IRA savings initiatives

Several states have proposed initiatives to reduce the barriers employers face in offering retirement plans to employees. Participants were asked their thoughts on a hypothetical program that mirrors payroll deduction auto-IRA laws enacted in Illinois and Oregon:

The state would set up a savings fund for all workers without a retirement plan at their work. Workers would be enrolled in the program unless they decided to opt out. Worker contributions would be a fixed amount—like 3 percent of pay— but workers could change that, too. Contributions would be in a separate fund managed by an investment company under contract with the state and would be conservatively invested.

As part of this program, businesses would send the worker contributions to the state retirement plan via payroll contributions. Businesses would also hand out forms and information from the state about the program. Other than sending payroll contributions and handing out information, employers would have no role in the program.

Let’s assume the government made it clear that businesses would not have fiduciary responsibility for the new state-run retirement savings program.

Initial reactions were largely negative. Participants who already offer a plan did not see any added value to their business. When pressed on the value to employers that did not have or could not afford to offer a plan, several said this would be a good, “better-than-nothing” option.

Employers without a plan were skeptical but generally supportive. Such a program, they said, could help “level the playing field” with competitors that offer retirement benefits and could help their employees save. Many said they were willing to undertake small additional burdens—such as disseminating information and facilitating payroll contributions on behalf of their employees—if that could improve their workers’ financial futures.

However, most said they do not trust states’ abilities to manage these programs, with many considering such an approach government overreach. Most expressed an ideological objection to government involvement in private business, but several raised more specific objections:

- Some questioned whether a state could effectively manage customer service for employees and business owners, pointing to perceptions that governments at all levels often do not manage budgets and other programs well.

- Though the moderator noted that the government would not be involved in managing the investment funds, some raised concerns that the state would make claims on the funds.

- Participants found some individual features appealing, such as limiting the employer role to payroll deductions and disseminating information, as well as the lack of employer fiduciary responsibility. For most, these protections were still not enough to overcome an aversion to government involvement.

If I need to talk to somebody, what red tape am I going to have to go through? Because you’re talking about millions of people, probably, that are going to be enrolled in this. And so if I have an immediate personal issue, am I going to be able to talk to somebody? Or am I going to go through what I go through if I have to call the city for anything? Or the state for anything? Which is a nightmare.—a participant in Chicago from a small business that offers a plan

We don’t have a state that is organized enough to handle its own future. We’re in really big trouble, and you’re talking about they’re going to organize a retirement plan.—a participant in Los Angeles with a small business

Large employers who offer their workers 401(k) plans increasingly automatically enroll new hires who can opt out, which has proved successful in dramatically increasing participation.3 Still, the majority of focus group participants who sponsored plans were not comfortable with this feature.Almost all in that group do not automatically enroll employees. Among both groups of employers, several said they did not know autoenrollment was an option. Most participants saw auto-enrollment as beyond the scope of what an employer should do. Many saw this as an unethical way to keep employees in the plan.

I think it’s very un-American. I don’t like it. I don’t want someone telling me or my employees they’re automatically enrolled, and then now you have to figure out a way, you have to call somebody, you have to get on the computer, you have to do something to get out of it.—a participant in Dallas with a small business

—Chicago representatives of three small businesses expressed concern about auto-enrollment:

Participant A: “It’s like you’ve been forced. You’ve been tricked. You know, you haven’t been treated as an adult that’s able to make their own decision.”

Participant B: “And you may not be able to afford to have that money taken out.”

Participant A: “Depends, depends on your plan and how it’s set up because, like she was saying, that’s how it used to be, where it’s like, open enrollment, we’re closed, got to wait until the next time. Until then, it’s coming out of your check.”

But a participant in Los Angeles from a small business raised strong objections: “It has a Big Brother feeling to it. It’s a little too heavy-handed.”

Even so, a smaller number of participants said an opt-out plan, despite its possible intrusiveness, would benefit employees by helping them start saving earlier in their careers. They noted that employees were unlikely to do anything on their own. Auto-enrollment could get employees into the habit of saving with little hardship.

We … automatically enroll. And very few opt out. You don’t put a lot in. You put a little to start with. And they realize it’s not that much when it’s after tax. … They keep talking about, well, I can’t afford it. Anybody can afford it. It’s just how you choose to live your life. Nobody is going to miss $10 a paycheck.—a participant in Chicago with a small business

It’s not costing my business anything, right, and it’s helping people, it’s helping the employees. They might not see it now, but you got to prepare for when you’re going to get up there. And I just think it would be very, a good thing for the employees and really no trouble for the government.—a participant in Philadelphia with a small business that does not offer a plan

Many participants said that payroll deductions would not pose a burden on them. That was especially the case for those who use third-party human resource or payroll services. Still, many raised concerns about potential costs to employers, the time needed to explain a program, and the possibility of getting sued. For example, many said they felt directing employees with questions about the plan or their paycheck to a state website or toll-free phone number could be difficult or put employers in an uncomfortable position of fielding questions when they may not have answers.

I’m not interested in paying people to facilitate a government program. I mean, I’m not interested in using my employee pool to input numbers, to pass out forms, my copier, my toner. You know, like if I worked for a company, maybe I wouldn’t care. But since it’s a family business, we are successful for many years because we watch our expenses.—a participant in Dallas from a medium-size business that offers a plan.

—On the other hand, participants at the Los Angeles focus group from small businesses that offer plans saw only a limited burden from managing automatic enrollment:

Participant E: “All we have to do is it’s another line on the payroll thing.”

Moderator: “Yes. And you’d have to hand out some information … that you would be provided by the state about them. So it’s not like you would not have to do anything. You’d have to do that.”

Participant F: “So we have to check off a box and give some papers?”

Moderator: “Yeah.”

Participant G: “Well, you do that with a new employee anyway. They have to decide on deductions, they have to fill out a form and sign it, so I don’t see this as a, you know, a burden.”

Moderator: “So does it seem like a big thing to anybody?”

Participant H: “No.”

Participant I: “A no-brainer. That’s not a problem, I mean, it’s the same as SUI, SDI [state unemployment insurance and disability programs].”

He’s going to come back and say, well, you never told me about that, all right? … That is a liability right there, you know, if it’s a state mandated type of thing, because we’re supposed to know all this stuff. Not only are we supposed to know our business, but we have to know the government’s business.—a participant in Los Angeles with a small business

These employers generally agreed that offering employees a mechanism to save would benefit workers, but views were more mixed on the gains for the businesses. Several employers said they feared they might not see the same competitive retention and recruitment benefits if everyone is participating in a basic, state-sponsored plan. Conversely, some noted that the program would reduce the competitive disadvantage from not offering a plan.

From an employer’s standpoint, if all employers will have the same program … it’s of no benefit for us to say, well, this is something that you can enroll in here, because it’s not attracting more employees or better employees. It’s just something that everybody now has the option of.—a small business representative in Dallas without a plan

I totally am not for this whole state thing, but if I were a new business owner and I was just trying to stay afloat, it could make me competitive to future employees because I can offer them something, versus offering them nothing.—a small business representative in Chicago with a plan

None of the employers with plans expressed a desire to terminate theirs to shift workers to a proposed state plan. Many of those without plans thought that large minorities of their workers might opt out for a range of reasons, including distrust of a state-affiliated savings program, limited income or tight household budgets, fear of levies in cases of unpaid taxes or child support, and the small amounts that were likely to be saved with a default contribution of 3 percent of pay. Many younger workers, they said, also might not see the importance of retirement savings.

Some people are living paycheck to paycheck as it is. They can barely afford the health insurance, and even though 3 percent sounds low, when you’re living paycheck to paycheck, you know, might not be so low.—a participant in Chicago without a plan

So in my case, that’s beer money that the staff would not want to give up, so, but there would be some people that might want to do it, maybe some of the older people.—a participant in Dallas from a small business without a plan

I feel like it wouldn’t be a good pitch to some of the employees that I’ve come across because they have state issues. The state confiscated for other stuff. … So I would think for the state to set up something, you know, a big concern of some of my guys would be, well, you know, what if I have child support, they’re already going to take it. They’re taking it out of my check, you know, are they going to be able to take things from me?—a participant in Chicago from a midsize business without a plan

Finally, focus group members were asked about the idea of auto-escalation of contributions. For example, contributions would start at 3 percent of pay and then increase by 1 percentage point a year until reaching a maximum, such as 10 percent. This feature is gaining acceptance in traditional 401(k) plans, but none of the participants with plans had auto-escalation, and the feature had little support among both groups of employers.4

As with opt-out provisions, the opportunity for employees to set their own contribution levels and avoid any escalation was not seen as a real choice. Although several participants mentioned that an initial contribution rate of 3 percent was unlikely to generate enough retirement savings given low wages and inflation, virtually no one thought the idea of auto-escalation was a solution.

I don’t think it’s fair to do it. It’s up to the employee. They know what they can afford, they know what their expenses are, they know what their college tuition that they still [are] paying back and, you know, household [expenses].—a participant in Dallas with a medium-size business that offers a plan

Employer perspectives on state-level retirement marketplaces

Focus group participants were also asked to share their thoughts on a hypothetical policy proposal that would create a retirement plan marketplace:

Suppose the state takes steps to encourage and assist businesses in offering retirement plans but does not require any specific actions. For example, they might set up a website for service providers, like mutual fund and insurance companies, to offer plans. Small businesses could find information and request quotes but would not be required to select any plan.

Reactions to this were universally negative. In addition to general reservations about the role of government, virtually all participants who commented said that sufficient resources were already available on plan products and that a marketplace was not needed. Many without plans said that it was not a lack of information that prevented them from offering one but a lack of resources to support a plan or manage its administration. Furthermore, some of those without plans expressed doubt that they would be able to make appropriate decisions for their business and workers even if they could easily compare plan options, citing a lack of basic retirement plan knowledge. “You don’t know what you don’t know,” one participant summed up.

That’s redundant. My investment company already does that, and I don’t want my tax dollars going into this particular program. That money could be better spent someplace else.—a participant in Chicago from a small business that offers a plan

You could do this on your own! You get on the website, go online. Why do you need the government to give you a list?—a participant in Philadelphia from a small business that does not offer a plan

Conclusion

Many Americans face the prospect of inadequate retirement savings, mainly because they lack access to an employer-sponsored retirement savings program. To address this issue, states are proposing a variety of reforms, and early indications are that they can feasibly implement retirement savings programs. However, the focus groups show that state policymakers can expect skepticism from small and medium-size business owners toward retirement initiatives.

The focus group discussions highlighted the ideas that state and federal policymakers should take into consideration when weighing proposals. For example:

- Initially negative reactions to automatic enrollment in general and state-sponsored plans in particular pose a communications and outreach challenge for policymakers. Employers without plans were receptive to the idea that these tools would result in more savings, and policymakers might stress that employees would receive extensive and timely notification of the automatic processes. However, employers made clear the difficulty of persuading lower-income employees that it’s worth contributing from their limited income.

- To ease employer concerns about the time and effort needed to start a plan, policymakers could simplify the array of retirement products that would most appeal to small businesses and educate employers on how a streamlined program would minimize the administrative burden.

- Because many employers admit limited knowledge of retirement benefits in general and plan types in particular, new policies should be designed to help small-business owners get up to speed with how the programs work.

- Focus group participants showed interest in tax incentives for small businesses to help offset the costs of setting up a plan. The fact that many did not know about existing credits suggests a need for better education and highlights the possible limits of addressing retirement savings through the tax code.5

- A retirement plan marketplace also faces skepticism. A marketplace should have a financial education component and increase competition among providers to lower costs.

Methodology

Pew sponsored two focus groups each in Philadelphia, Chicago, Dallas, and Los Angeles in October 2015. Separate groups included representatives of small (five to 49 employees) and medium-size (50 to 249 employees) businesses that did or did not currently offer retirement plans. Table 1 provides a breakdown of the focus groups’ distribution by retirement plan sponsorship, employer size, and location.

After the focus group sessions, the audio recordings were transcribed and coded using NVivo, software for analyzing textual and audio material. The transcripts were then evaluated further by comparing sections on specific topics, such as the state policy initiatives, across the focus groups and across employer types.

Participants were asked a range of questions to elicit their thoughts on the motivations and challenges in offering a plan, their perspectives on new state-level policies, and their views on plan features intended to encourage savings. The following is a selection of questions asked of employers who did not offer retirement plans, although adjustments were made to the questions over the course of the sessions. Additional details are available upon request.

Questions

General benefits discussion

A. What types of benefits does your business currently offer to workers? (Flip chart list.)

B. Which type of benefits does management view as most important to offer to workers? (Moderator will annotate flip chart list.)

C. Which benefits do you think your employees view as most important? (Moderator will annotate flip chart list.)

Retirement benefits discussion

Now, we are going to talk more specifically about retirement plans. Going forward, for the purposes of this discussion, a retirement plan is not Social Security, but a plan sponsored by a business. A retirement plan either promises participants a specified monthly benefit at retirement or allows workers to contribute to an investment account design for retirement savings, or includes some combination of these features. Examples include pension plans, thrift and savings plans, 401(k) plans, and profit-sharing plans.

A. What are some of the reasons your business currently does not offer a retirement plan? (Unaided, then probe if not mentioned.)

- Employees not interested.

- Costs (distinguish between fees and employer contributions).

- Complexity.

- Tax advantages to owners and key employees.

B. Have you considered offering a retirement plan in the past? If so, why did you decide against it?

C. Do you think your business might offer a retirement plan in the future?

- What might prompt your firm to offer a retirement plan?

- From an employer perspective, what are some potential benefits to doing this?

D. Overall, how familiar would you say you are regarding retirement plan options for businesses like yours? Use a scale where 1 = not at all familiar and 5 = very familiar. (Moderator will poll group, may ask selected participants reason for their rating.)

- Are you familiar with any federal retirement plans, such as the SIMPLE IRA and the Simplified Employee Pension, or SEP, which are designed for businesses like yours?

E. If you wanted to start a retirement plan for your employees, who would you go to for more information?

- What sources do you consider most credible?

- What specific questions would you have? What topics would you seek information about?

New policy initiatives

We are going to ask you a few questions about some different policy ideas about how to increase retirement savings.

We first want to talk about the role of state government in improving retirement savings. State policymakers around the country are discussing a number of ideas.

- In general, what role do you think state government can play in encouraging retirement savings for workers at businesses like yours?

Now imagine that state policymakers in your state are designing a new retirement savings program for businesses that don’t offer a plan for their workers. Policymakers want your input on this program.

Scenario 1

1. In one scenario, the state would set up a savings fund for all workers without a retirement plan at their work. Workers would be enrolled in the program unless they decided to opt out. Worker contributions would be a fixed amount—like 3 percent of pay—but workers could change that, too. (Addition: Contributions would be put into a separate fund that would be invested, and employees would not be able to access the contributions until they retire.)

- What do you think of this approach?

- What are the benefits? Challenges?

- Thinking about your own employees, how do you think they would react if they were covered under this plan?

2. As part of this program, businesses would send the worker contributions to the state retirement plan via payroll contribution. Businesses would also hand out forms and information from the state about the program. Other than sending payroll contributions and handing out information, employers would have no role in the program.

- What reactions do you have to this element of the program?

- What are the benefits? Challenges?

- How much work would it be for your business to send these payroll contributions to the state? (For instance, this could include withdrawing contributions from paychecks, forwarding contributions to the state, and changing or stopping contributions at the employee’s request.)

- Are there any changes that would make this plan more attractive to your business?

- If this scenario became law, would you do anything to introduce it to your workers? What would you do?

3. Policymakers are also considering the issue of fiduciary responsibility. Fiduciaries are in a position of trust with respect to a retirement plan. For example, employers who make decisions about the plan’s investments or investment firms that manage the plan assets are usually fiduciaries. Fiduciaries must act solely in the interest of the plan participants and their beneficiaries, and carry out duties with care and diligence. Failure to do so can create potential legal and financial liability. Let’s assume the government made it clear that businesses would not have fiduciary responsibility for the new state-run retirement savings program.

- What reactions do you have to this element of the program?

- Would not having fiduciary responsibility change your view on the desirability of any of the policies we’ve discussed?

Scenario 2

Let’s talk about a different situation: Suppose the state takes steps to encourage and assist businesses in offering retirement plans but does not require any specific actions. For example, they might set up a website for service providers like mutual fund and insurance companies to offer plans. Small businesses could find information and request quotes but would not be required to select any plan.

- What do you think of this approach?

- What are the benefits? Challenges?

- How does this compare to the other ideas that we just discussed, like the state retirement savings plan?

Endnotes

- The Pew Charitable Trusts, Who’s In, Who’s Out: A Look at Access to Employer-Based Retirement Plans and Participation in the States (January 2016), 1, http://www.pewtrusts.org/~/media/assets/2016/01/retirement_savings_report_jan16.pdf. See also U.S. Government Accountability Office, Retirement Security: Federal Action Could Help State Efforts to Expand Private Sector Coverage (September 2015), 15, http://www.gao.gov/assets/680/672419.pdf; U.S. Bureau of Labor Statistics, “National Compensation Survey: Employee Benefits in the United States, March 2015” (September 2015), http://www.bls.gov/ncs/ebs/benefits/2015. In 2015, the private sector employee take-up rates for defined benefit and defined contributions plans were 84 and 71 percent, respectively.

- All quotations have been edited for clarity and exclude any identifiers, such as the names of participants or businesses.

- Vanguard Group Inc., “Vanguard: 401(k) Plan Auto Enrollment Paying Off in Getting More Americans to Save for Retirement,” news release, June 10, 2014, https://pressroom.vanguard.com/press_release/Vanguard_401k_plan_auto_enroll_getting_more_Americans_save_for_retirement_2014.06.10.html.

- Ibid.

- Internal Revenue Service, “Retirement Plan Startup Costs Tax Credit,” accessed April 19, 2016, https://www.irs.gov/Retirement-Plans/Retirement-Plans-Startup-Costs-Tax-Credit.

Employer-based Retirement Plan Access and Participation

Who’s in, who’s out