Slow Growth for State Personal Income Persists in 2017

Note: These data have been updated. To see the most recent data and analysis, visit Fiscal 50

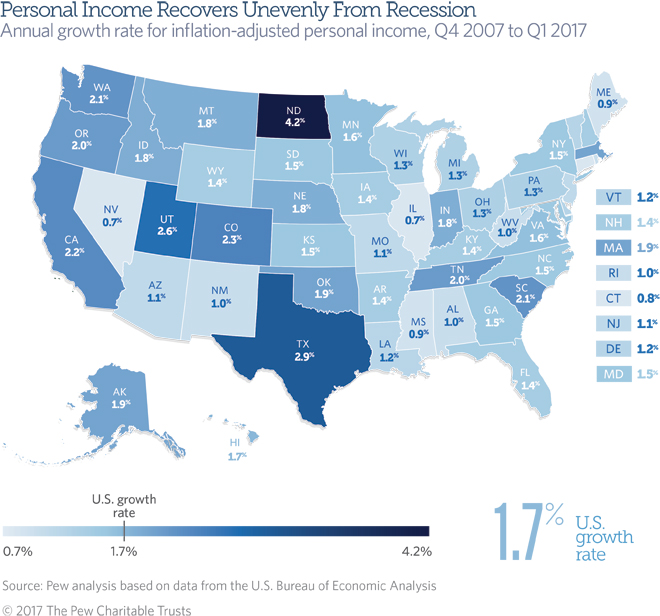

One of the longest U.S. economic expansions has lifted personal income in all states above pre-recession levels. But growth has varied, ranging from a constant annual rate of 0.7 percent in Illinois and Nevada to 4.2 percent in North Dakota. In eight states, personal income fell over the year ending in the first quarter of 2017, as U.S. growth remained slow—less than half the rate seen two years earlier.

Since the recession began, national growth in personal income has been lower than its historical pace. Estimated U.S. personal income increased by the equivalent of 1.7 percent a year from the fourth quarter of 2007 through the first quarter of 2017, compared with the equivalent of 2.7 percent a year over the past 30 years, after accounting for inflation.

States have recovered at different paces. Only in mid-2015 did the final state—Nevada—recoup its personal income losses and return to its pre-recession level, after accounting for inflation. Since the end of 2007, personal income in 17 states has grown faster than that of the nation as a whole.

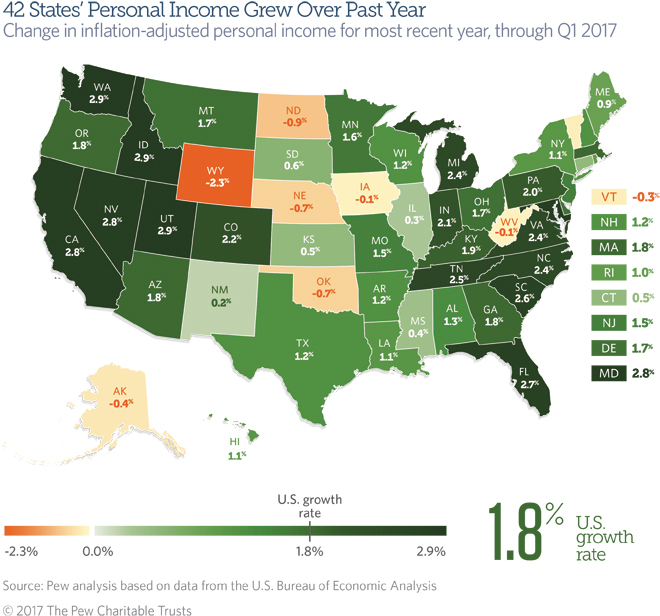

Looking at recent trends, one-year growth in U.S. personal income through the first quarter of 2017 was close to its lowest level in three years, according to preliminary data. Inflation-adjusted U.S. personal income rose by 1.8 percent in the first quarter of 2017 from a year earlier—the second-slowest one-year pace since the end of 2013, when personal income contracted. At the end of 2016, personal income rose a downwardly revised 1.5 percent from a year earlier, the leanest growth in three years.

Personal income growth in 20 states outpaced the U.S. rate for the year that ended in the first quarter of 2017. Elsewhere, personal income fell in eight states, as some were hit by lingering weakness in farming and mining. The construction and manufacturing industries and state and local governments also cut residents’ earnings to varying degrees. These results are based on estimates and subject to revision, as is Pew’s ranking of state growth rates.

Personal income estimates are widely used to track state economic trends. Trends in personal income matter not only for individuals and families but also for state governments, because tax revenue and spending demands may rise or fall along with residents’ incomes. Comprising far more than simply employees’ wages, the measure sums up all sorts of income received by state residents, such as earnings from owning a business or investing, as well as benefits provided by employers or the government.

Trends in personal income from the recession’s onset in 2007 through the first quarter of 2017:

- North Dakota has enjoyed the fastest annualized growth (4.2 percent) since the start of the recession. However, a worldwide drop in petroleum prices has cooled its oil boom, and the state’s personal income has trended down for two years.

- The next-fastest growth over the past nine years has been in Texas (2.9 percent), Utah (2.6 percent), Colorado (2.3 percent), and California (2.2 percent).

- Illinois and Nevada have had the weakest expansions since the start of the recession (each at 0.7 percent). But Nevada tied for the fourth-fastest growth over the year that ended in the first quarter of 2017 (2.8 percent), while the expansion in Illinois (0.3 percent) was the second-slowest.

- The next-slowest growth since the start of the recession has been in Connecticut (0.8 percent), Maine and Mississippi (each at 0.9 percent), and Alabama, New Mexico, Rhode Island, and West Virginia (each at 1.0 percent).

Trends in personal income for the first quarter of 2017, compared with a year earlier:

- Growth was fastest in Idaho, Utah, and Washington (each at 2.9 percent), followed by California, Maryland, and Nevada (each at 2.8 percent).

- The eight states where personal income fell were Wyoming (by 2.3 percent), North Dakota (0.9 percent), Nebraska and Oklahoma (each 0.7 percent), Alaska (0.4 percent), Vermont (0.3 percent), and Iowa and West Virginia (each 0.1 percent). Residents’ earnings dropped in these states, hit variously by weakness in farming, construction, manufacturing, state and local government, and mining.

- Among the 42 states with gains, New Mexico’s was the smallest, at just 0.2 percent.

- Utah stands out as the only state with a one-year growth rate that ranked among the five fastest during each of the most recent four quarters.

- Alaska, North Dakota, Oklahoma, West Virginia, and Wyoming stand out for recording year-over-year drops during each of the four most recent quarters.

- In 27 states, personal income rose slower than growth rates since the end of 2007, showing an economic slowdown.

Trends in personal income for calendar years beginning in 2007

Personal income has fluctuated since the recession, which lasted from December 2007 to June 2009. Growth in each calendar year shows the variation that occurred from 2007 to 2016. (See the “Year by year” tab for annual results in each state between calendar years 2007 and 2016.) By contrast, constant annual rates show the steady pace that income would have to rise each year to reach its latest level.

- West Virginia was the only state to escape the Great Recession, without a calendar year drop in personal income.

- As the country rebounded from the recession, personal income rose in 46 states in 2010—Arizona, Delaware, Kansas, and North Carolina were the exceptions. All states saw increases in 2011, and all but Delaware and Georgia recorded gains in 2012.

- In 2013, personal income fell in 36 states, reflecting a number of taxpayers accelerating income into 2012 in anticipation of a potential federal tax hike in 2013.

- The rebound resumed over the next two years, with personal income rising in every state but Kansas in 2014, and every state but North Dakota and Wyoming in 2015.

- Last year, weak energy and farm earnings cut personal income in six states—Alaska, North Dakota, Oklahoma, South Dakota, West Virginia, and Wyoming.

What is personal income?

Personal income sums up residents’ paychecks, Social Security benefits, employers’ contributions to retirement plans and health insurance, income from rent and other property, and benefits from public assistance programs such as Medicare and Medicaid, among other items.

Federal officials use state personal income to determine how to allocate support to states for certain programs, including funds for Medicaid. State governments use personal income statistics to project tax revenue for budget planning, set spending limits, and estimate the need for public services.

Growth in personal income should not be interpreted solely as wage growth; wages and salaries account for about half of U.S. personal income. Personal income also differs from income measured at the household level.

Looking at personal income per capita or state gross domestic product, which measures the value of all goods and services produced within a state, can yield different insights on state economies.

Download the data to see state-by-state growth rates for personal income from 2007 through the first quarter of 2017. Visit Pew’s interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.