Employer-Based Retirement Plans: Access Varies Greatly

More than 40 percent of full-time workers have no pension or 401(k); geography, ethnicity, employer size, and worker income all play a part

For many Americans, setting aside money in a workplace retirement plan has become a critical component of ensuring financial security in their later years. Yet more than 40 percent of full-time private sector workers say they lack access to either a pension or an employer-based retirement savings plan such as a 401(k).

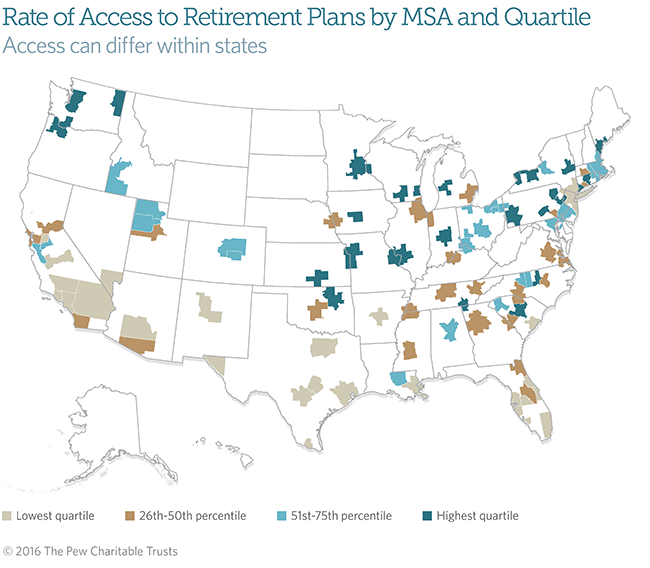

Access to workplace retirement plans varied greatly—nearly 50 percentage points—among the 104 metropolitan statistical areas (MSAs) with populations of at least 500,000 that were surveyed during a recent retirement study by The Pew Charitable Trusts.

Access rates can differ greatly within states and are often lower in metropolitan statistical areas with a large proportion of small employers. MSAs with higher proportions of lower-income workers also have lower access rates, as do those with greater numbers of Hispanic workers.

Lowest quartile: 23% to 54% of workers have access

26th-50th percentile: 54% to 60% of workers have access

51st-75th percentile: 61% to 67% of workers have access

Highest quartile: 67% to 71% of workers have access

Note: Numbers are rounded; however, entries are ordered using exact digits.

See more charts and data on retirement access across U.S. metro areas (PDF)

The highest access rate—71 percent—was in Grand Rapids, Michigan (although many other areas had rates within a few percentage points), and the highest regional rates were in the Northeast, Upper Midwest, and Pacific Northwest.

The lowest rates of retirement plan access were concentrated in the metropolitan areas of three states: Florida, Texas, and California.

Differences pop up even within the same state. For example, 68 percent of workers in Columbia, South Carolina—the state’s capital and largest city—have access to a retirement plan, while less than 120 miles away, just 50 percent of workers do in Charleston, the state’s second-largest city. The variation probably results from each area’s mix of industry and worker characteristics.

The data show how employer size and type, worker salary and income, and worker ethnicity and race can be correlated with rates of access and participation in employer-based retirement plans. Metropolitan areas with higher shares of workers at small employers generally have lower access to plans.

This held true across all 50 states: Only 22 percent of workers at companies with fewer than 10 employees report having access to workplace retirement plans, compared with 74 percent of workers at businesses with at least 500 employees.

Workers who earn less than $25,000 in wage and salary per year had an access rate more than 50 percentage points below that of workers earning $100,000 or more (22 percent versus 75 percent).

And Hispanic workers tend to have lower access to retirement plan coverage. Nationally, 38 percent of Hispanic workers reported having access to an employer-based retirement plan, compared with 63 percent of white non-Hispanic workers.

Industries and workers that tend to have lower access rates are heavily clustered in certain metropolitan areas, which means that government efforts can reach large numbers of people in these places. New York City, for example, is considering a proposal to expand retirement plan coverage for the private sector workers within its boroughs.

John Scott directs the retirement savings project at The Pew Charitable Trusts.