Ohio Has the Highest Payday Loan Prices in the Nation

Major facts and figures

Nationwide, Americans in all demographic groups use payday loans. The only requirements to obtain such credit are a checking account and a source of income. Typical borrowers earn about $30,000 per year, and most use the loans to cover recurring expenses such as rent, mortgage payments, groceries, and utilities.1

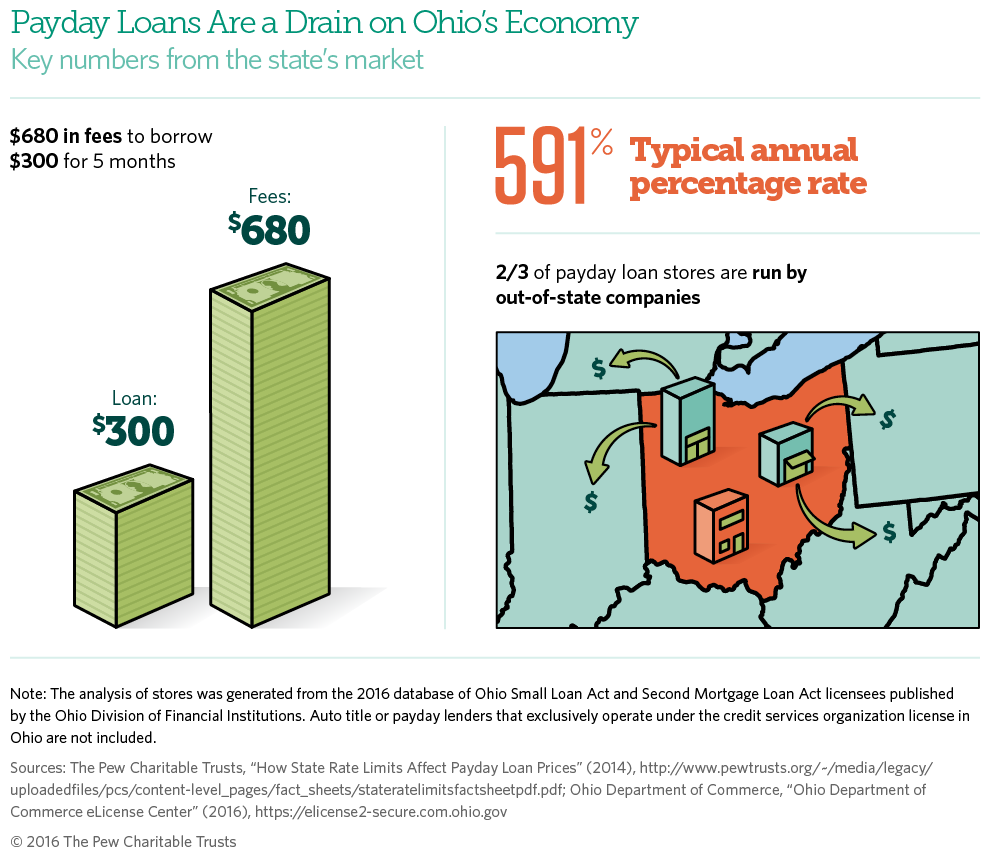

Payday loans in Ohio are the country’s most expensive, with a typical annual percentage rate (APR) of 591 percent.2 Lenders charge higher prices in Ohio than in any neighboring state.

Distressing signals

- 1 in 10 adults in Ohio—roughly 1 million people—has taken out a payday loan.3

- No payday or auto title lenders are licensed under the Short-Term Loan Act, which passed the Ohio Legislature with bipartisan support in 2008 and was an attempt to curb payday loan rates. The industry then tried to get Ohio voters to repeal the legislative action. When that effort failed, lenders circumvented the law by obtaining licenses to operate as credit service organizations, which are not subject to fee limits.4

- Ohio’s market consists of more than 650 payday loan storefronts in 76 counties, more than 90 percent of which are owned and operated by companies that also do business in other states.5

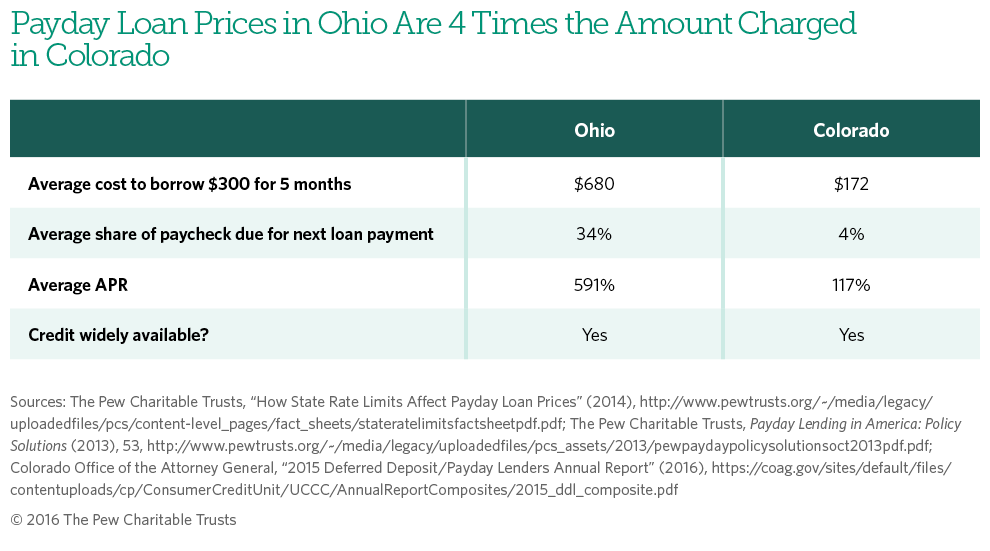

- Payday loans in Ohio have unnecessarily high prices: Borrowers are charged up to four times what their peers pay in other states.6 (See Table 1.)

Ohio can balance affordability and access to credit

- In 2010, Colorado lawmakers replaced conventional two-week payday loans with six-month installment payday loans at lower prices. Each year, borrowers in that state save more than $40 million, which goes back into the state’s economy.7

- After reform, access to credit remains widely available in Colorado.8

- An average loan payment consumes 4 percent of a borrower’s next paycheck.9

- Borrowers have a pathway out of debt, and 75 percent of loans are repaid early.10

- With similarly sensible reforms, Ohio policymakers can reduce costs for their constituents, creating affordability for borrowers and a viable market for lenders.

Federal rules are not enough to protect Ohioans

- Nationally, borrowers overwhelmingly want reform, with 8 in 10 favoring requirements that payments take up only a small amount of a borrower’s paycheck with more time to repay the loan.11

- The federal agency that sets rules for these loans, the Consumer Financial Protection Bureau, has proposed a requirement that lenders review borrowers’ credit reports and evaluate their debt obligations before making loans.12

- Under this requirement, however, the 400 and 500 percent APR payday and auto title loans that are on the market today would still be allowed in Ohio. Further, Ohio’s market has begun shifting to longer-term payday installment loans with similarly high APRs and unaffordable payments.13

- The Ohio General Assembly has the power to license and set reasonable terms for these loans; the federal agency does not.

Endnotes

- The Pew Charitable Trusts, Payday Lending in America: Who Borrows, Where They Borrow, and Why (2012), http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/ pewpaydaylendingreportpdf.pdf.

- The Pew Charitable Trusts, “How State Rate Limits Affect Payday Loan Prices” (2014), http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs/content-level_pages/fact_sheets/stateratelimitsfactsheetpdf.pdf.

- The Pew Charitable Trusts, “State Payday Loan Regulation and Usage Rates” (2014), http://www.pewtrusts.org/en/multimedia/data-visualizations/2014/state-payday-loan-regulation-and-usage-rates.

- Sheryl Harris, “An (Updated) Illustrated History of Payday Lending in Ohio: Plain Dealing,” Cleveland Plain Dealer, March 24, 2015, http://www.cleveland.com/consumeraffairs/index.ssf/2015/03/ an_updated_illustrated_history.html; Ohio Neighborhood Finance Inc. v. Scott, 139 Ohio St. 3d 536, 2014-Ohio-2440 (2014), http://www.supremecourt.ohio.gov/ROD/docs/pdf/0/2014/2014-Ohio-2440.pdf; The Pew Charitable Trusts, “From Payday to Small Installment Loans: Risks, Opportunities, and Policy Proposals for Successful Markets” (2016), http://www.pewtrusts.org/~/media/assets/2016/08/ from_payday_to_small_installment_loans.pdf.

- Ohio Department of Commerce, “Ohio Department of Commerce eLicense Center” (2016), https://elicense2-secure.com.ohio.gov. This store count is generated from the 2016 database of Ohio Small Loan Act and Second Mortgage Loan Act licensees published by the Ohio Division of Financial Institutions. Auto title or payday lenders that operate exclusively under the credit services organization license in Ohio are not included.

- The Pew Charitable Trusts, “How State Rate Limits Affect Payday Loan Prices.”

- The Pew Charitable Trusts, “Trial, Error and Success in Colorado’s Payday Lending Reforms” (2014), http://www.pewtrusts.org/~/media/assets/2014/12/ pew_co_payday_law_comparison_dec2014.pdf.

- The Pew Charitable Trusts, Payday Lending in America: Policy Solutions (2013), 20, http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2013/ pewpaydaypolicysolutionsoct2013pdf.pdf.

- Ibid., 31.

- Ibid., 14; Colorado Office of the Attorney General, “2015 Deferred Deposit/Payday Lenders Annual Report” (2016).

- The Pew Charitable Trusts, Payday Lending in America: Policy Solutions (2013), 22.

- The Pew Charitable Trusts, “The CFPB’s Proposed Payday Loan Regulations Would Leave Consumers Vulnerable” (2016), http://www.pewtrusts.org/en/research-and-analysis/ analysis/2016/09/07/the-cfpbs-proposed-payday-loan-regulations-would-leave-consumers-vulnerable.

- The Pew Charitable Trusts, “From Payday to Small Installment Loans.”

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube