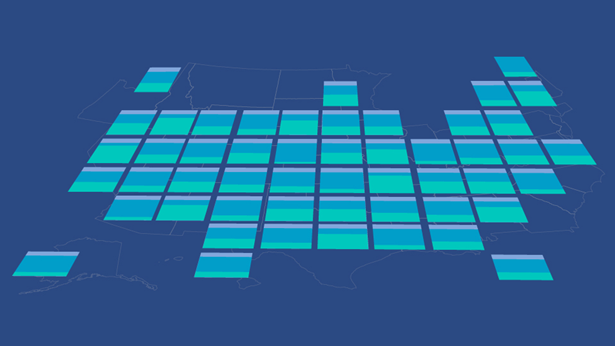

How States Raise Their Tax Dollars

FY 2021

Editor’s note: This article was updated on April 28, 2023, to remove repeated information.

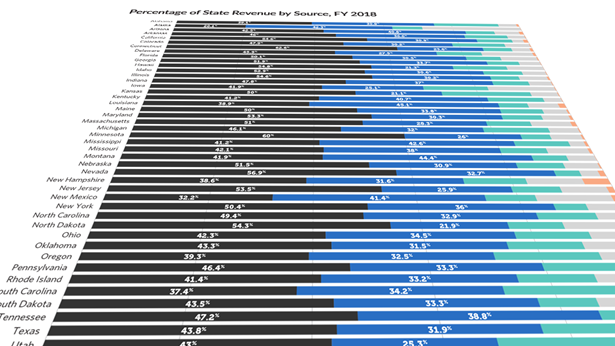

Taxes make up about half of state government revenue, with two-thirds of states’ total tax dollars coming from levies on personal income (39.9%) and general sales of goods and services (29.3%).

Broad-based personal income taxes are the greatest source of tax dollars in 33 of the 41 states that impose them, with the highest share—63.2%—in Oregon. General sales taxes are the largest source in 14 of the 45 states that collect them. Texas is the most reliant on these taxes, at 61.8% . Other sources bring in the most tax revenue in a few states: severance taxes in Alaska and North Dakota, and corporate income taxes in New Hampshire.

This infographic illustrates the sources of each state’s tax revenue.