America Saves Week: The Importance of Building Emergency Savings

Many families need stronger financial footing

Millions of U.S. households are one unexpected expense away from financial distress. America Saves Week, an annual national campaign dedicated to helping solve this and related problems, provides a key opportunity to investigate ways to address families’ financial insecurity. From Feb. 22-27, financial institutions, community groups, and schools will participate in activities to promote healthy savings behavior for households and individuals.

Pew’s research on family finances underscores the precarious state they are in and highlights the things policymakers could do to help:

- Six in 10 households suffered a financial shock in the past year.

- The typical family spent $2,000 on its most expensive shock—half a month’s income.

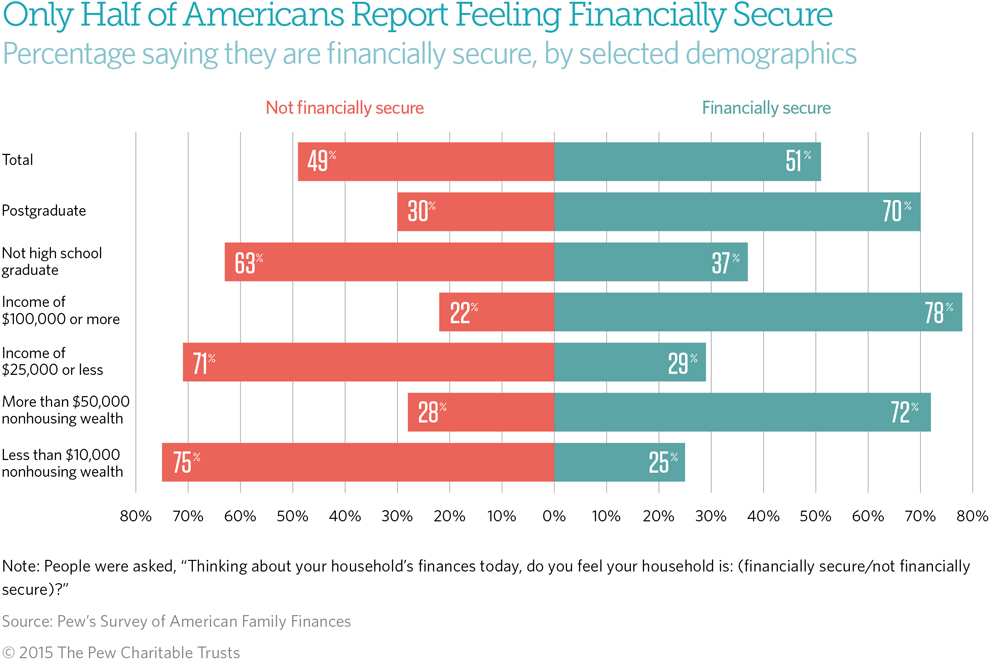

- Although the economy is improving, half of respondents to Pew’s Survey of American Family Finances described their family as financially insecure.

- Only 1 in 5 families said they have a lot of control over their finances.

- 55 percent of households struggled to “make ends meet” after experiencing their most expensive financial shocks.

- 80 percent of families had less in savings than they recommend for people like them.

3 research-based strategies that could help families save more

1. Automatic savings mechanisms

Automatic savings mechanisms can help families accrue savings over time. Although many people have the option to automatically direct money into retirement savings, few have this choice for short-term savings.

Increased opportunity to automatically transfer funds to savings might help families build on the typical family's $3,800 in liquid savings and close the gap between what people have saved and the amount they want to have.

One successful, if unrecognized, automatic savings mechanism is income tax withholding. For the 72 percent of households that receive a tax refund, their paycheck withholding acts as de facto savings, holding a portion of their income in reserve that is later distributed as a lump sum. This tax refund is a significant opportunity to both pay down debt incurred from prior financial shortfalls and prepare for unexpected expenses down the road.

2. Flexibility for savings withdrawals

Some types of savings accounts restrict withdrawals, but Pew’s data clearly show that households need the ability to access their resources in emergencies. Families would benefit from savings programs that provide households with the flexibility to respond to financial shocks as they see fit and to apply all of their resources.

3. Information on when and how to deploy savings

Although building a rainy day fund is crucial, people also need tools to help them know when it is raining and what to do when it is. Many households have ebbs and flows in income and expenses week to week, month to month, and year to year. Helping families recognize when they can afford to save and when it may be advisable to tap into savings or seek out fair and affordable credit is essential to improving their overall financial security. At the end of the day, the peace of mind and resilience that savings gives households matters more than an account balance.

America Saves Week is the perfect time for policymakers, financial institutions, and individuals to take action to help households build savings and to support the stability that Pew’s data show matters most to American families.

Clinton Key is a research officer with the financial security and mobility project at The Pew Charitable Trusts.