Debt Collection Cases Continued to Dominate Civil Dockets During Pandemic

Available state court data shows long-term trend not slowed by COVID-19

Consumer debt collection lawsuits continued to fill state civil court dockets throughout the COVID-19 pandemic, according to a new analysis by The Pew Charitable Trusts. This finding builds on research showing that debt claims have grown to dominate state civil court dockets in recent decades. A previous national analysis showed that these suits rose from an estimated 1 in 9 civil cases in 1993 to 1 in 4 in 2013, and that trend does not appear to have slowed in recent years, according to available data from nine states.

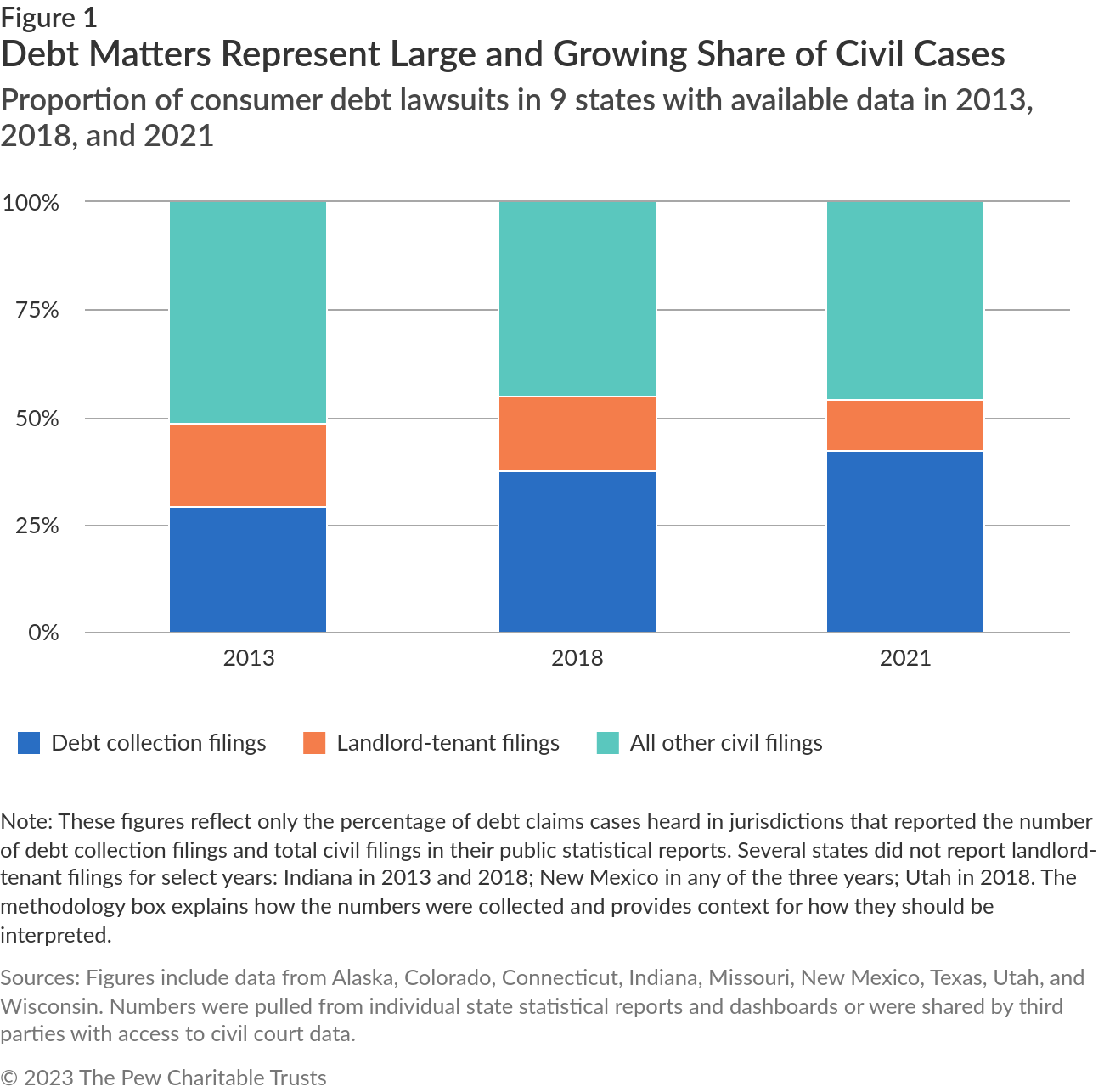

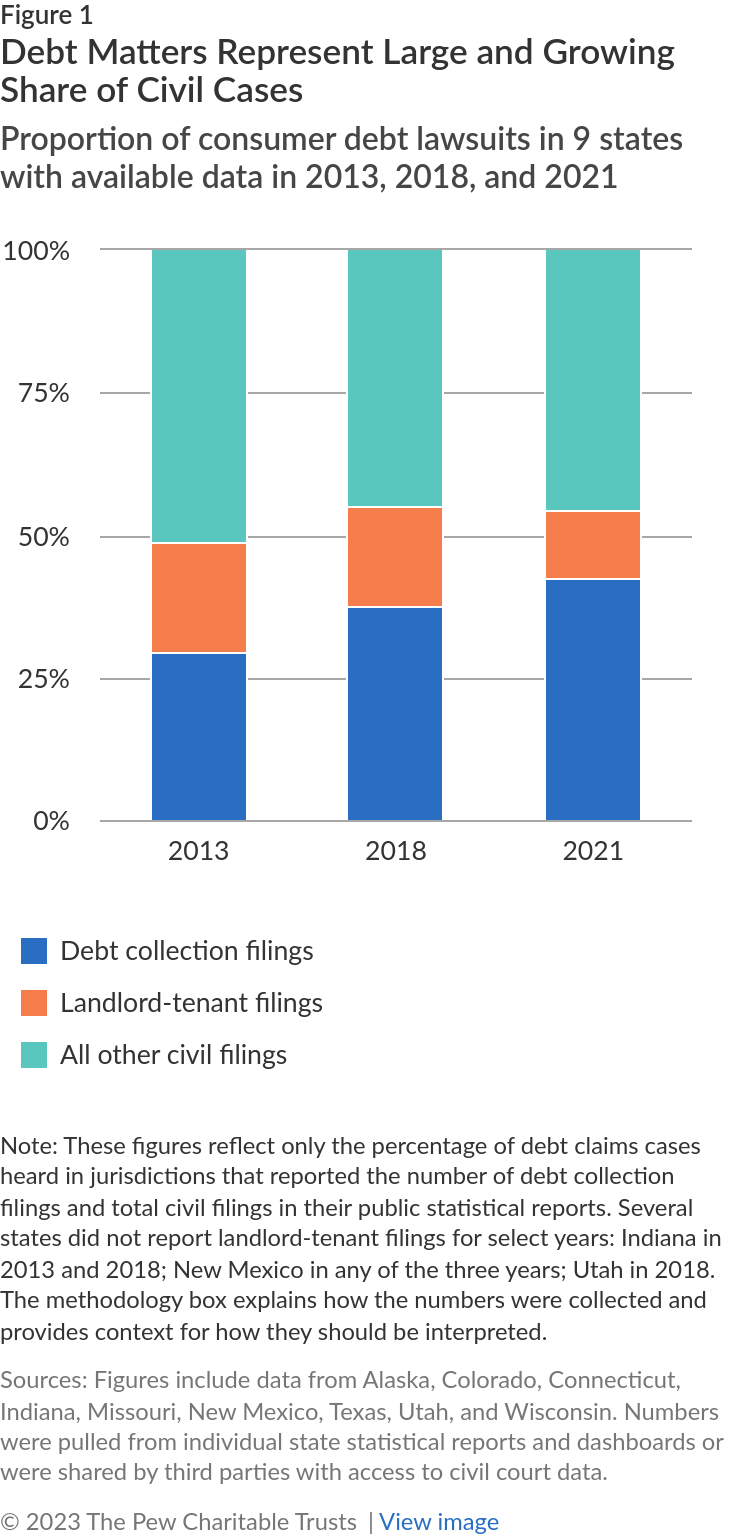

Although the coronavirus public health emergency initially paused filings of certain nonemergency case types, plaintiffs continued to file debt collection lawsuits. Nationwide data is not readily available, but in nine states (Alaska, Colorado, Connecticut, Indiana, Missouri, New Mexico, Texas, Utah, and Wisconsin) where researchers could get access to comparable data for 2013, 2018, and 2021, debt cases made up 42% of civil dockets in 2021—up from 38% in 2018 and 29% in 2013. (See Figure 1.)

Of those nine states, two saw their proportion of debt cases constitute about half of civil dockets in 2021—New Mexico (51%) and Texas (48%). Part of the increase in the proportion of debt cases from 2018 to 2021 was likely caused by decreases in landlord-tenant cases due to pandemic-related state eviction moratoria.

Pew’s analysis found that although the number of cases have fluctuated over time, debt cases have continued to dominate the docket irrespective of broader economic trends. In 2018, when the country’s economic outlook was positive (based on indicators such as unemployment rate and job growth), the proportion of debt filings did not drop from five years earlier. That year, in states with available data, ten out of 12 jurisdictions saw debt collection lawsuits as the most common case type. In 2021, when millions of Americans continued to face uncertainty linked to job loss and illness, the number of debt collection lawsuits filed still took up a large proportion of the cases in the jurisdictions where they were heard.

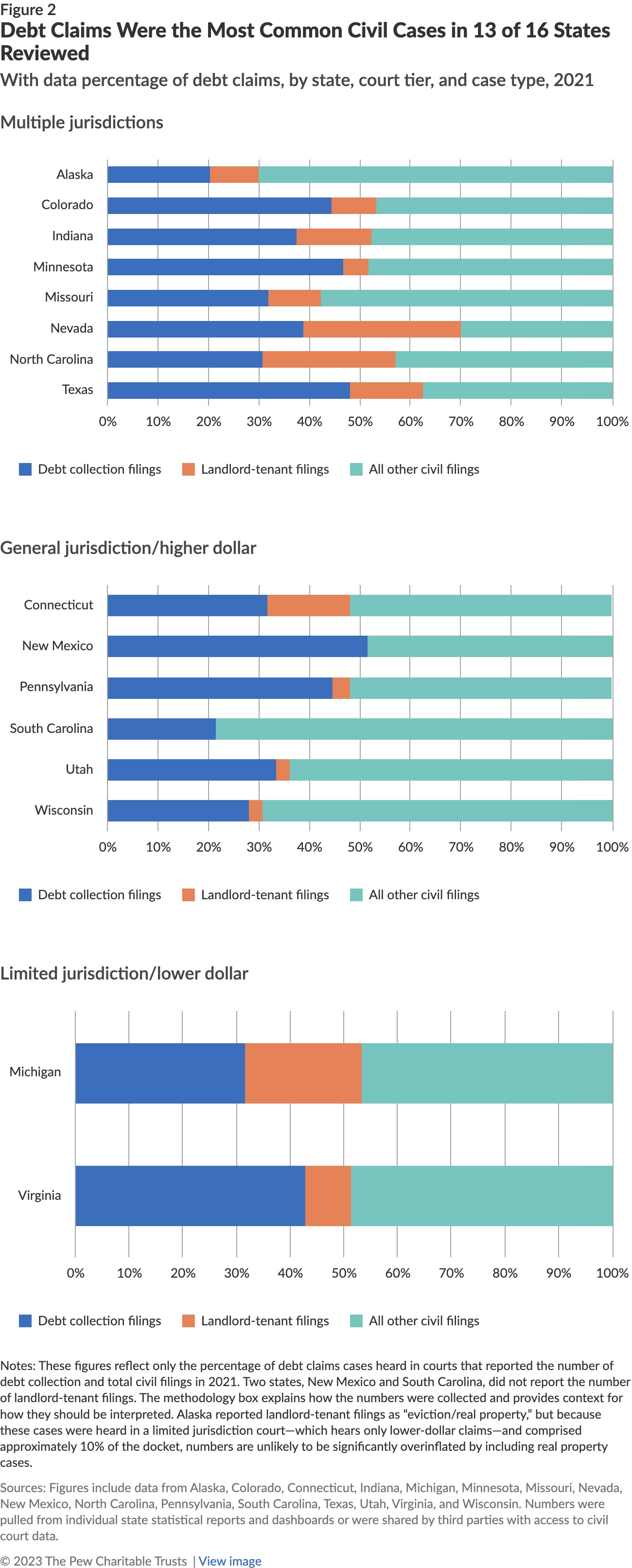

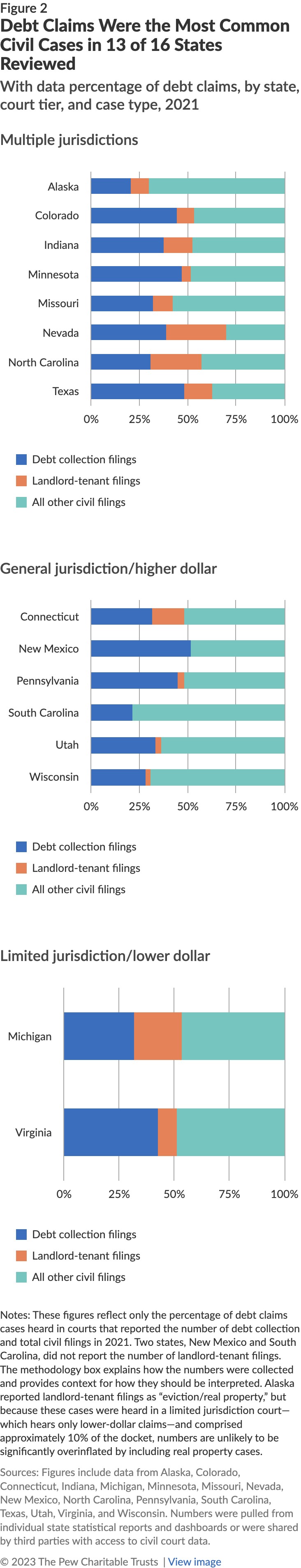

Additionally, Pew found that in the jurisdictions with available data, roughly 1 in 20 adults with a debt in collections were sued in 2021, and these lawsuits remained the most prevalent civil court case type in 13 out of 16 states. (See Figure 2.)

Most debt cases are business-to-consumer suits involving a corporate plaintiff represented by a lawyer and an individual defendant navigating the court system without such help. In jurisdictions with available data, Pew found in a 2020 report that more than 70% of debt suits end in a default judgment —an automatic judgment for the plaintiff that occurs when defendants do not respond to or participate in cases against them. These numbers parallel recent state data that found the percentage of default judgments in Utah's District Court was 71% in 2019 and 63% in Michigan in 2021.

The 2021 data shows no signs of relief for courts overburdened by debt cases—or for defendants facing the significant consequences that such litigation can have. As more states report this data, they will be able to track these trends and further explore what’s happening in their courts, what the problems are, and what potential solutions they can implement.

Better state-level debt litigation data would help court officials and state leaders identify the right policy solutions for their jurisdictions that level the playing field for defendants and ensure that both parties can fully participate in cases. Collecting more and better data also could support courts in taking data-informed steps to rebalance or “right-size” their dockets. Such improvements could help connect defendants with resources, such as legal aid providers. Doing so would allow them to better navigate these matters and make the most of their day in court.

Methodology

Pew captured information from court statistical reports and dashboards in 2013, 2018, 2021, and 2022: which courts heard debt collection lawsuits, whether these courts had limited (smaller dollar) or general (larger dollar) jurisdiction, how debt collection was labelled (e.g., collection of accounts, debt/contract), the number of debt collection filings, how landlord-tenant cases were labelled (e.g., unlawful detainer, eviction), the number of landlord-tenant cases, the number of traffic cases, the number of small claims cases, and the total number of filings in the court where debt cases were heard. As of June 2023, only a handful of states had reported 2022 data; as a result, Pew excluded that year from the analysis.

The figures reflect only the percentage of debt claims cases filed in courts that reported those numbers publicly. Because some states had data for courts of limited and/or general jurisdiction and others had information for just one court, and because some states reported by fiscal year and others by calendar year, these figures should not be understood to represent apples-to-apples comparisons. To help address these limitations, Pew took steps to make these states comparable by removing cases related to probate, family (including abuse-related protective orders), criminal matters, traffic, and administrative cases from the total number of civil cases. While often thought of as a civil matter, Pew excluded family matters from this analysis because it can be difficult to characterize family cases through filings because they can stay open for many years (e.g., a parenting time case may remain open for 18 years) and including these cases can be an inaccurate reflection of the docket. Further, domestic relations cases often follow a separate set of procedures than other civil matters, which usually follow the general rules of civil procedure in a given jurisdiction. Excluding family matters aligns with how the Court Statistics Project, National Open Data Standards, and many state statistical reports present their data. Finally, these figures do not count small claims cases, with the exception of cases in states in which business-to-consumer cases were clearly identified in small claims case counts.

Casey Chiappetta is a principal associate with The Pew Charitable Trusts’ civil legal system modernization project.

This article was previously published on pewtrusts.org and appears in this issue of Trust Magazine.