Philadelphia Business Taxes: Incentives and Exemptions

Like many cities, Philadelphia does not regularly evaluate whether tax breaks achieve their goals

© Getty Images

© Getty ImagesOverview

Philadelphia business tax rates are among the highest of any large city in the nation, and the tax structure is frequently cited as one reason for the city’s relatively weak job-creation record over the past several decades. A key element of that structure is the business income and receipts tax (BIRT), which taxes profits and revenue of businesses located in the city. Only 11 of the nation’s 30 largest cities impose levies on corporate profits or revenue, and only Philadelphia does so on both.

To make these business taxes less onerous, Philadelphia’s leaders have created a large and varied group of tax incentives and exemptions. Known as tax expenditures, they constitute an integral but little-understood aspect of the city’s business tax policy. Supporters view the expenditures—which do not appear in the city’s budget or financial statements—as investments in growing, maintaining, and attracting businesses, thereby enhancing the tax base. Critics see them as drains on public resources that have little accountability, haphazard goals, and scant proof that they pay off in business growth or future tax revenue.

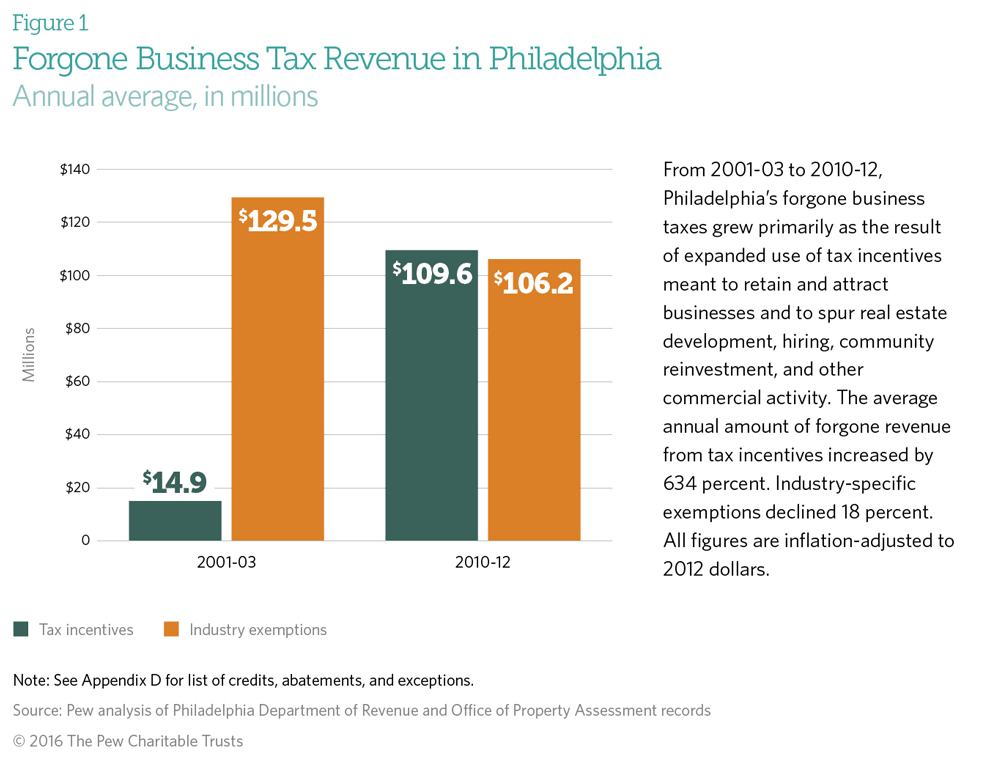

To help policymakers and the public better understand the role that these measures play in Philadelphia’s overall tax policy, The Pew Charitable Trusts sought to quantify the city’s tax expenditures and compare them with those of other major cities. In Philadelphia, the analysis looked at two types of tax expenditures: incentives to spur companies to take specific actions, such as hiring more workers or investing in neighborhoods; and industrywide exemptions to support particular business sectors deemed by policymakers to merit special treatment. The study covered two periods, 2001-03 and 2010-12, in order to show change over time; the 2010-12 data were the most recent for which information was complete.

The research found that Philadelphia has 21 city-approved business tax reduction programs or provisions, the most among the nation’s 30 largest cities. Eight of those reductions took effect after 2012, too late for their impact to be included in this analysis.

The research also found that from 2010 to 2012, the tax incentive programs resulted in an average of $109.6 million per year in forgone revenue for the city and the school district—a 634 percent increase from 2001- 03, when the average annual inflation-adjusted amount was $14.9 million. This report describes revenue as “forgone” rather than “lost,” in part because repealing the tax incentives would not necessarily restore an equivalent amount of money to local coffers; businesses probably would alter their operations to reduce their tax liabilities.

The vast majority of the $109.6 million stemmed from two programs: the 10-year property tax abatement on new construction and building improvements for commercial and industrial property, and the Keystone Opportunity Zone initiative, which exempts businesses within designated areas from state and local business taxation. Like all tax incentives, both of these programs require companies to commit to making new investments in the city and are in effect for limited periods of time.

The other main source of tax expenditures—industrywide exemptions primarily for finance, insurance, utilities, and port-related firms—produced at least $106.2 million in forgone revenue annually from 2010 to 2012. The amount was 18 percent less than in 2001-03, adjusted for inflation. Unlike tax incentives, exceptions are granted to individual companies without any time limits. Companies determine their eligibility in tax filings, which city auditors can challenge. (See Figure 1.)

Whether these tax expenditures have paid off for Philadelphia is hard to say. There is no question that there have been benefits, in terms of jobs created and buildings constructed. The issue is whether those benefits outweigh the costs.

Philadelphia reports on some of its smallest tax-expenditure programs but does not conduct comprehensive analyses of how much all the tax expenditures cost or whether they achieve their purposes—and is not required by law to do so. Only a few cities, including New York and Washington, require that kind of reporting. For those reasons, this report does not compare forgone revenue for the city of Philadelphia and the school district with other jurisdictions.

In 2012, the staff of the Pennsylvania Intergovernmental Cooperation Authority (PICA), a state agency that oversees Philadelphia’s finances, called on the city to clarify and evaluate specific tax expenditures, concluding: “A lack of detailed accounting prevents a systematic process of evaluating whether the costs of these policies are justified in relation to their benefits.”

This study does not attempt to determine whether Philadelphia business tax expenditures have met their goals, but it does look at ways that cities can design programs to include evaluations. According to public finance and policy analysts, measuring the impact of tax benefits and setting clear rules for receiving them are key steps toward an effective and equitable tax system that fosters economic development and generates needed revenue.

Conclusion

For several decades, business leaders and tax experts have called for transformation of the city’s entire tax structure in order to improve Philadelphia’s competitiveness with its suburbs and other large cities. The recent overhaul of the city’s property tax system, the Actual Value Initiative, was viewed as an important first step in laying the groundwork for comprehensive change.

Given the increase in forgone taxes over the past decade, tax expenditures merit a place in Philadelphia’s tax policy discussion. Knowing how much these tax exceptions cost, and whether they are meeting their goals, is a key component of a coherent and equitable city tax policy.