AVI: The Shift in the Tax Burden

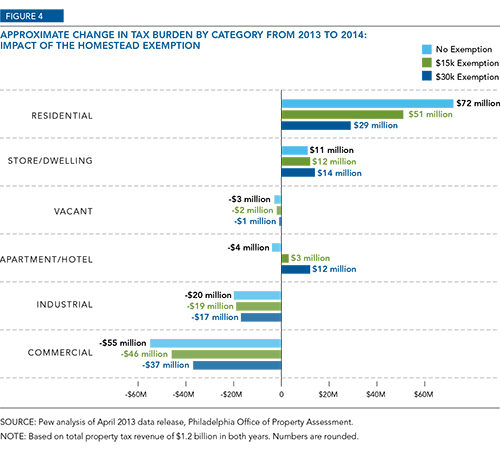

As proposed, the Actual Value Initiative (AVI), Philadelphia's sweeping property tax overhaul, is revenue neutral. The plan is to raise the same amount of revenue through real estate taxes, $1.2 billion, in 2014 as in 2013. The report, AVI: The Shift in the Tax Burden, estimates the potential impact of the Actual Value Initiative on the allocation of the city's tax burden by categories of property. It finds that under AVI, as a result of the citywide reassessment done to correct years of inaccuracy, residential property would account for a greater share of the city's overall property value—and thus the tax burden—and commercial property for less. Several proposals made by Mayor Michael Nutter and members of City Council, including a homestead exemption for all owner-occupied residences, would lessen the magnitude of this shift, perhaps significantly, but likely not eliminate it.

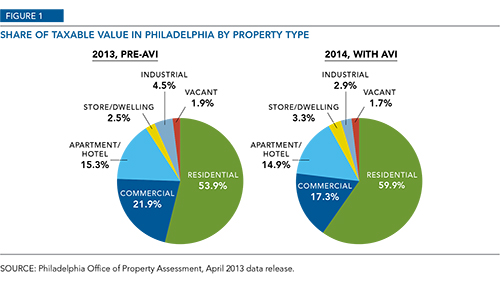

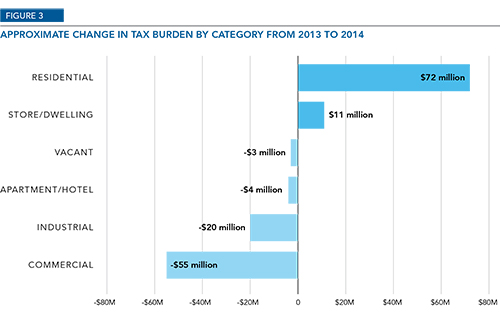

According to the data released by the city's Office of Property Assessment (OPA) in March, residential properties would represent 59.9 percent of the city's total assessed taxable value of nearly $100 billion in 2014. For 2013, that share was 53.9 percent. This difference of 6 percentage points would result in $72 million in additional taxes for homeowners as a group, making AVI not revenue neutral for them.

On the other hand, the commercial sector, which includes shopping centers and Center City office buildings, now represents 17.3 percent of the city's taxable value, down from 21.9 percent a year ago. That change would yield an overall tax reduction of about $55 million for the sector. Industrial properties, a smaller segment of the tax base, would see a drop of $20 million. A third business related sector, apartments and hotels, would experience a decline of $4 million.

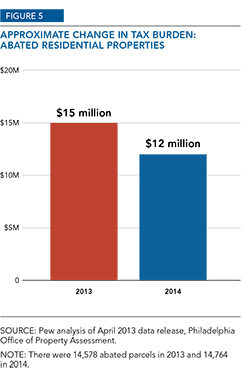

To a much smaller degree, AVI also would reduce the tax burden on residential properties that have 10-year abatements. Owners of abated residential properties stand to pay about $3 million less.

View full report

AVI: The Shift in the Tax Burden (PDF)

Related: The Actual Value Initiative: Overhauling Property Taxes in Philadelphia

Charts from the report