Retirement Security Across Generations

Are Americans Prepared for Their Golden Years?

Overview

|

When the Great Recession hit in 2007, the oldest baby boomers faced the real possibility of downward mobility just as they were entering their golden years.The downturn also heightened concerns about retirement planning—or lack of planning—by younger generations. Many younger Americans were already behind in saving for retirement, and suddenly millions of them were out of work or owned homes worth far less than they had been just a few years earlier. |

This report tracks the wealth of each cohort over the last two decades to assess the recession's impact on each group's financial security.

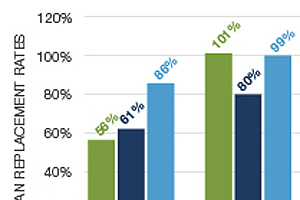

Additionally, the report explores the retirement security of each age group by calculating replacement rates, or the extent to which retirees can use their accumulated wealth and savings to replace preretirement income.

The study revealed:

- Early boomers (born between 1946 and 1955) were approaching retirement in better financial shape than the age groups that came before them. Benefitting from both the dot-com boom and the housing bubble, early boomers had higher overall wealth, financial net worth, and home equity in their 50s and 60s than Depression babies (born between 1926 and 1935) or war babies (born between 1936 and 1945) had at the same ages.

- The picture of wealth accumulation and savings for Americans born after 1955 was more mixed. Gen-Xers (born between 1966 and 1975) had higher net worth than late boomers (born between 1956 and 1965) when both were in their 30s and 40s, but neither group had as much wealth as early boomers had at the same age. Similarly, late boomers had more wealth than early boomers when both were in their 40s and 50s, but neither had as much as did war babies.

- Both cohorts of baby boomers and the Gen-Xers have significantly lower asset-to-debt ratios than do the older groups. Over the last two decades, Depression and war babies have been shedding debt, while boomers and Gen-Xers have been accumulating it. As of 2010, war babies' asset levels were 27 times higher than their debts. In contrast, late boomers' assets were about four times higher than their debts, and Gen-Xers' assets were about double their debts.

- All groups experienced wealth losses in the Great Recession, but Gen-Xers took the hardest hit. Both early and late boomers were negatively affected by the recession at a critical point in their lives, losing 28 and 25 percent of their median net worth, respectively. From 2007 to 2010, however, Gen-Xers lost nearly half (45 percent) of their wealth, an average of about $33,000, reducing their already low levels.

- Replacement rate analysis shows that the youngest cohorts will not have enough assets for a secure retirement. Early boomers may be the last cohort on track to retire with enough savings and assets to maintain their financial security through their golden years. Even after the recession, they had acquired enough savings and wealth to replace 70 to 80 percent of their preretirement income.

Replacement rates have steadily declined across the age groups studied, putting the youngest on shaky financial footing. At the median, Gen-Xers will have enough resources to replace only about half of their preretirement income; late boomers will replace about 60 percent.