Having a Retirement Plan Can Depend on Industry or Hours Worked

Barriers, balances, and opportunities for savings

Overview

Most Americans save for retirement through a workplace retirement plan, such as a 401(k) or 403(b).1 Still, more than one-third of full-time American workers lack access to this kind of plan, and access varies widely depending on a worker’s industry. Access to and participation in a retirement plan often depend on whether an employee is part time or full time, with part-time workers consistently less likely to have the option—or to choose—to join an employer-based program.2 Further, employers in certain industries are more inclined to offer retirement benefits to their employees than are those in other industries. A Bureau of Labor Statistics study shows that workers in “lower hour industries”—where part-time work is more prevalent, such as retail trade; arts, entertainment, and recreation; and hospitality and food service—are less likely to receive health insurance, paid time off, and, notably, access to employer-sponsored retirement plans.3 As for other retirement outcomes—including plan participation, barriers to participation, and plan balances—the data are still incomplete.

This chartbook examines access to and participation in defined benefit, or traditional pension plans, and defined contribution plans, such as 401(k), based on a combination of work status and industry type, specifically focusing on the distinctions between industries that predominately employ full-time versus part-time workers. The analysis uses data from the U.S. Census Bureau’s Survey of Income and Program Participation (SIPP). “Workers” refers to 18-to-64-year-old private-sector full- and part-time employees who were not self-employed, agricultural workers, or in the armed forces at the time of the survey. The chartbook builds on The Pew Charitable Trusts’ previous analysis of SIPP data by looking more closely at industry type.4 The key findings are:

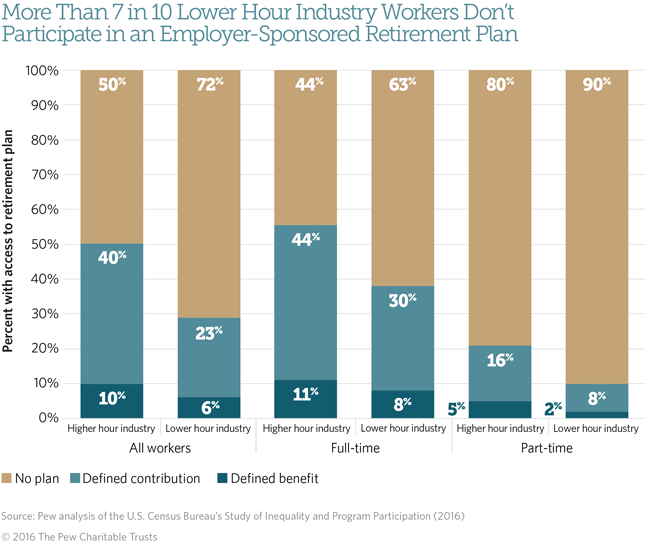

- More than 7 in 10 workers in lower hour industries don’t participate in an employer-sponsored retirement plan due to lack of access and barriers to taking advantage of the plan, or “takeup.”

- Lower hour industry workers report less access to, and are less likely to take up, employer-sponsored retirement plans when offered.

- Lower hour industry workers who do not participate in employer-sponsored plans often cite eligibility rules as a key barrier to participating.

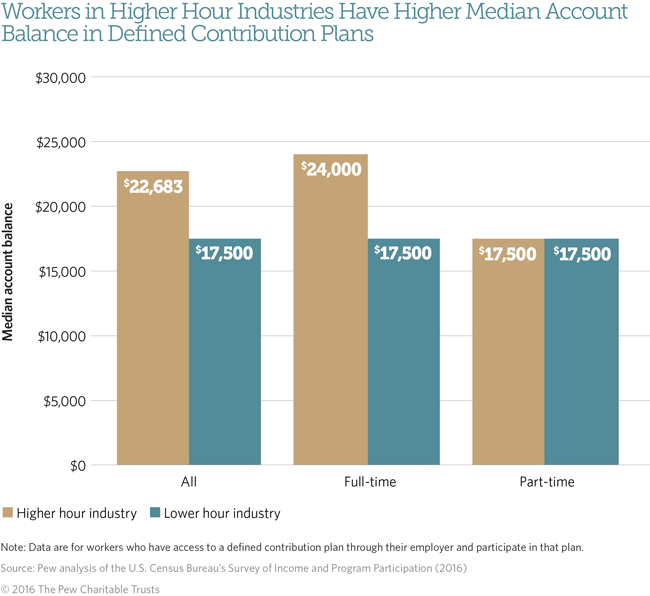

- Lower participation means lower savings. Among all workers, those in higher hour industries have median account balances that are more than $5,000 greater than the median for lower hour industry workers.

- These differences are not confined to part-timers. Full-time employees in lower hour industries have lower participation rates and account balances than their counterparts in higher hour industries, possibly because of plan eligibility rules and less disposable income.

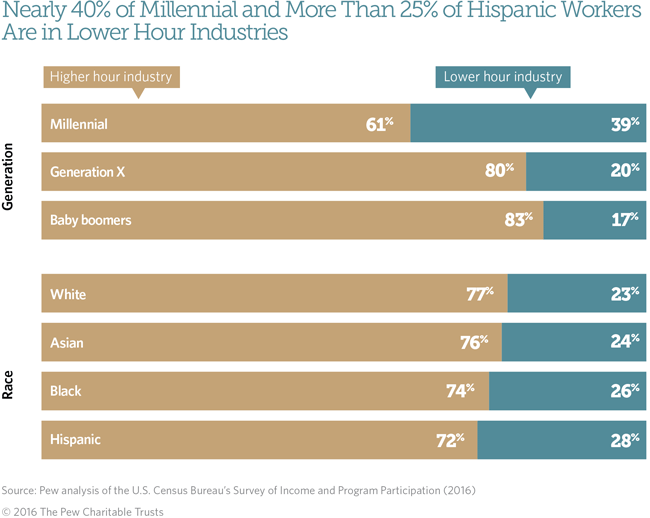

- Examining industry is important because racial minorities and millennials, both of whom tend to work in lower hour industries, are less likely to achieve a secure retirement because access to retirement plans is lower in these industries.

The following charts delve more deeply into these findings. As policymakers address retirement security, this chartbook outlines clear differences among the retirement preparedness of employees working in different types of industries, which can inform policy decisions, and raises additional questions for future research.

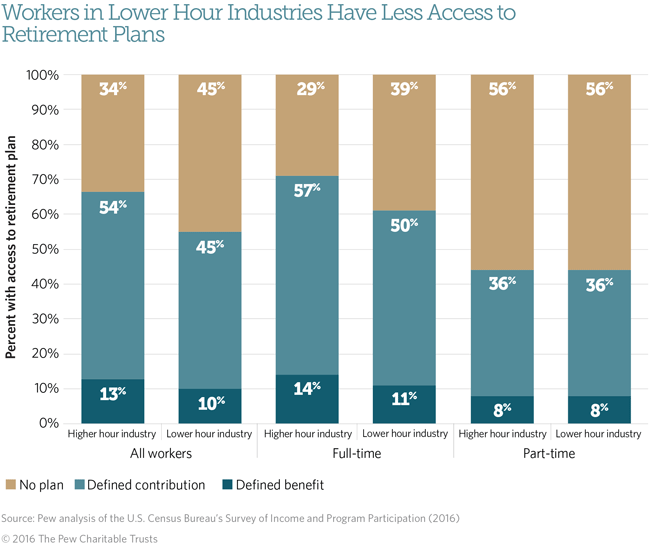

Workers in lower hour industries average lower rates of access to employer-sponsored retirement plans than do those in higher hour industries. This discrepancy may be caused by the greater proportion of part-time workers in lower hour industries.5 However, full-time workers in lower hour industries also have significantly lower access rates than their counterparts in higher hour industries (39 and 29 percent, respectively). In contrast, part-time workers in higher and lower hour industries have nearly identical rates of access.6

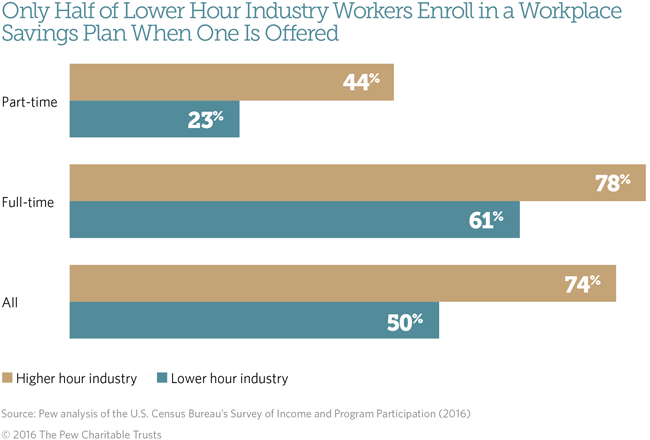

Similar to rates of access, takeup of available employer-sponsored plans varies by industry type. For both full- and part-time workers, lower hour industry workers take up employer-sponsored retirement plans less often. Just over 40 percent of part-time higher hour industry workers take up plans, almost twice the rate of lower hour industry part-time workers. Differences in takeup exist for full-time workers as well. Nearly 80 percent of higher hour industry full-time workers take up plans, compared with 61 percent of lower hour industry workers employed full time.

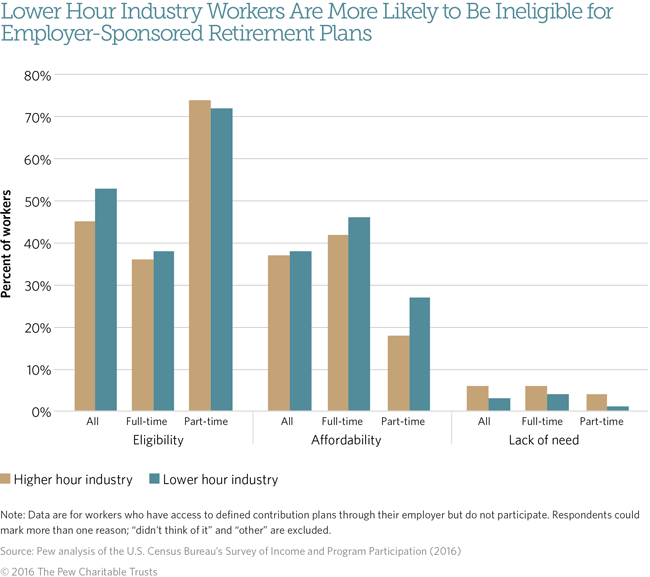

There are several reasons why employees might not participate in a plan: They may be ineligible under employer policies, lack disposable income, or are saving in ways that make joining an employer-sponsored plan unnecessary. Among all workers, 53 percent of those in lower hour industries cite eligibility as their reason for not participating, compared with 45 percent of higher hour industry workers.7 A significant majority of part-timers in both industry groups say eligibility keeps them from participating, while a slightly larger majority of full-time workers cited affordability. Twenty-seven percent of part-time employees in lower hour industries cited affordability as a reason for not participating versus 18 percent for workers in higher hour industries—perhaps because of better wages in higher hour industries. Although a small proportion of workers cited lack of need as their reason for not participating in a plan, higher hour industry workers were twice as likely to offer this as an explanation.8

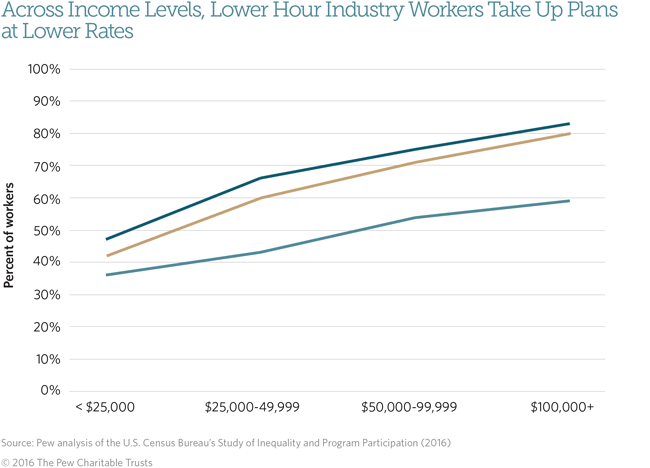

As household income increases, workers are more likely to take up employer-based retirement plans when offered. But lower hour industry workers at all income levels take up retirement plans at rates significantly below those of their higher hour industry counterparts. The proportion of workers taking up an employer-sponsored retirement plan climbs from 40 percent of all workers with household incomes of less than $25,000 to 80 percent for those making $100,000 or more. However, even at the highest income levels, higher hour industry workers are 40 percent more likely to participate than lower hour industry workers.

As a result of the lack of access and barriers to taking part in a plan, less than 30 percent of lower hour industry workers participate in any plan, while half of all workers in higher hour industries participate in either a defined contribution or defined benefit retirement plan through their employer. Among full-time workers, 55 percent participate in higher hour industries compared with 38 percent in lower hour industries. Part-time workers in both industry types have low rates of participation, perhaps due to issues of plan eligibility and less disposable income.9

Among all workers, those in higher hour industries have a median account balance that exceeds that of lower hour industry workforce by more than $5,000. While this difference persists among full-time workers, the data show no difference between part-time workers in higher and lower hour industries. The data also show that full-time workers in lower hour industries have the same median retirement account balance as part-time workers. This might be because lower hour industry workers are less likely to have access to a plan, have lower wages, and participate less than their counterparts in higher hour industries.

Focusing on industry type is especially important given that groups disadvantaged in trying to achieve retirement security are more concentrated in lower hour industries.10 For example, 39 percent of millennials are employed in lower hour industries compared with only 20 percent of older workers.11 White workers are least likely to be employed in lower hour industries, while Hispanics are the most often employed group (23 and 28 percent, respectively). Generational, racial, and ethnic differences in access to employer-sponsored retirement plans may align in part with the industries in which these groups work.

Conclusion

Employer-sponsored retirement plans play an important role in the accumulation of household retirement savings. Still, many workers lack access to such plans or fail to participate when they are offered. This chartbook examines how industry type may shape the opportunity and ability for workers to save for retirement. Workers in industries with a high proportion of part-time employees have lower access and participation rates as well as lower savings.

Part-time workers often face eligibility rules and other barriers to retirement security. As such, their prevalence in lower hour industries may require additional consideration from policymakers. But differences between lower and higher hour industries are not driven solely by the prevalence of part-time workers in lower hour industries. Full-time workers in these same industries often have worse retirement savings outcomes too. Thus, lower hour industries may affect the retirement savings of all workers for several reasons, including the low wages paid in these industries and the fact that many employers in these industries cannot afford to sponsor a retirement plan.

As policymakers consider ways to increase retirement savings, this chartbook outlines the importance of focusing on the characteristics of both employers and workers in lower hour industries. For example, these workers include groups with lower rates of access to employer-sponsored retirement plans, such as millennials and Hispanics. However, even among employees with access to a plan, the participation rate and the median plan balance are smaller for workers in lower hour industries. Further research that examines why workers in these industries do not participate at rates comparable to those in higher hour industries would provide policymakers with valuable information. For example, additional data might demonstrate that part-time and younger workers face steeper economic challenges in saving for retirement. A one-size-fits-all retirement policy that would merely provide private sector workers without an employer-sponsored plan the opportunity to save would not reduce these financial security hurdles. Similarly, creating a marketplace exchange for small businesses to shop for retirement benefit products may not address the particular competitive challenges facing employers in lower hour industries. This chartbook also points to the significance of the eligibility barriers that keep many workers from participating in their employer’s retirement plans.

Methodology

This chartbook uses the most recent available retirement-related data from the U.S. Census Bureau’s Survey of Income and Program Participation (SIPP), a multiple cross-sectional and longitudinal study of various economic topics. Specifically, it relies on data from Wave 11 topical module focused on retirement savings plans conducted in 2012, using participants from the 2008 panel. The sample includes 18-to-64-year-old private sector full-time and part-time employees who were not self-employed, agricultural workers, or in the armed forces at the time of the survey (n = 23,166).12 Pew identifies two main types of employer-sponsored retirement plans: defined benefit plans (in which the employer primarily contributes to the fund) and defined contribution plans (in which the employee primarily contributes to the fund). Because respondents did not explicitly state whether their employer offered either of these categories, we construct these categories based on various characteristics.13

Data were weighted using person-level weights developed by SIPP. Tests of significance were used appropriate for variable type; for example, categorical data were analyzed using chi-square tests, and continuous variables were analyzed using analysis of variance (ANOVA) tests.

Endnotes

- Investment Company Institute, “Quarterly Retirement Market Data,” accessed June 28, 2016, http://www.ici.org/research/stats/retirement. Although assets held in individual retirement accounts (IRAs) are larger than those for defined contribution plans, IRA assets largely come from defined contribution plan rollovers. See also Craig Copeland, “Individual Retirement Account Balances, Contributions, and Rollovers, 2011: The EBRI IRA Database,” Employee Benefit Research Institute, Issue Brief No. 386 (2013): 1, http://www.ebri.org/pdf/briefspdf/EBRI_IB_05-13.No386.IRAs.pdf.

- The Pew Charitable Trusts, “Employer-Sponsored Retirement Plan Access, Uptake, and Savings: Workers Report Barriers and Opportunities” (Sept. 14, 2016), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2016/09/employer-sponsored-retirement-plan-access-uptake-and-savings.

- Higher hour industries include all other industries: mining; construction; manufacturing; wholesale trade; transportation and utilities; information; finance and insurance; real estate and rental and leasing; professional, scientific, and technical services; administrative and support and waste management; educational services; health services; and other services. John L. Bishow, “The Relationship Between Access to Benefits and Weekly Work Hours,” Monthly Labor Review 138 (2015), http://www.bls.gov/opub/mlr/2015/article/pdf/the-relationship-between-access-to-benefits-and-weekly-work-hours.pdf.

- The Pew Charitable Trusts, “Employer-Sponsored Retirement Plan Access.”

- Just 16 percent of workers are employed part time in higher hour industries, while part-time workers make up 36 percent of the lower hour industries workforce.

- A chi-square test was conducted to indicate significant differences in access to employer sponsored retirement savings plans between industry type among all workers and among full-time workers at p < 0.001. There are no significant differences among part-time workers.

- Respondents originally marked one or more of the following answers, which we then collapsed into five categories: eligibility (“No one in my type of job is allowed in the plan,” “Don’t work enough hours, weeks or months per year,” and “Haven’t worked long enough for this employer”), affordability (“Can’t afford to contribute” and “Don’t want to tie up money”), lack of need (“Don’t need it,” “Have an IRA or other pension plan coverage,” and “Spouse has pension plan”), did not think of (“Haven’t thought of”), and other (“Started job too close to retirement date,” “Too young,” “Employer doesn’t contribute or contribute enough,” “Don’t plan to be in job long enough,” and “Some other reason”). We present data only on eligibility and affordability here.

- Among all workers, chi-square tests of significance indicate there are significant differences between higher and lower hour industry workers for eligibility and lack of need at p < 0.001. Among full-time workers, chi-square tests of significance indicate there are significant differences between higher and lower hour industry workers for affordability and lack of need at p < 0.005

- A chi-square test was conducted to indicate significant differences in participation in employer-sponsored retirement savings plans between industry type among all workers, among full-time workers, and among part-time workers at p < 0.001.

- The Pew Charitable Trusts, “Employer-Sponsored Retirement Plan Access.”

- Those born between 1946 and 1964 are considered baby boomers, those born between 1965 and 1980 are considered Generation X, and those born between 1981 and 1997 are considered millennials.

- Full-time/part-time status was determined based on the number of hours reported by respondents; those who said they worked 35 hours or more during the reference period were labeled as full-time workers. Self-employment status was determined based on whether respondents wanted to use their job or their business as a reference point for the topical module.

- Pew determined defined benefit (DB) and defined contribution (DC) categories based on a number of characteristics surrounding respondents’ primary pension plan. As part of the survey, respondents were asked about plan type (“plan based on earning and years on the job” and “cash balance plan” were initially coded as DB plans, and “individual account plan” was coded as a DC plan). Plan type was coded as a DB plan if it was reported that participation in Social Security would affect the worker’s plan benefit. We then coded plan type as a DC plan if the primary plan allowed tax-deferred contributions as well as one of the following: employer’s contributions depended on the worker’s own contributions; participant had ability to choose how money was invested; or the worker had taken or had the ability to take out a loan from his or her plan. We additionally coded a plan type as a DC plan if respondents answered that the plan was like a 401(k). Finally, respondents were additionally asked clarifying questions to determine that they did not actually have access to employer-sponsored plans. We used their responses to these questions of whether the sponsored plan is tax deferred, like a 401(k), to code plan types to DC plans. Because of these two lines of questions, takeup was determined based on whether respondents said they participated in the primary plan and whether they answered the applicable follow-up questions. If answers to the primary and follow-up questions were inconsistent, we used answers to the primary questions. Participation was based on takeup. Stata code available upon request.