The Trillion Dollar Gap: Florida

Underfunded State Retirement Systems and the Roads to Reform

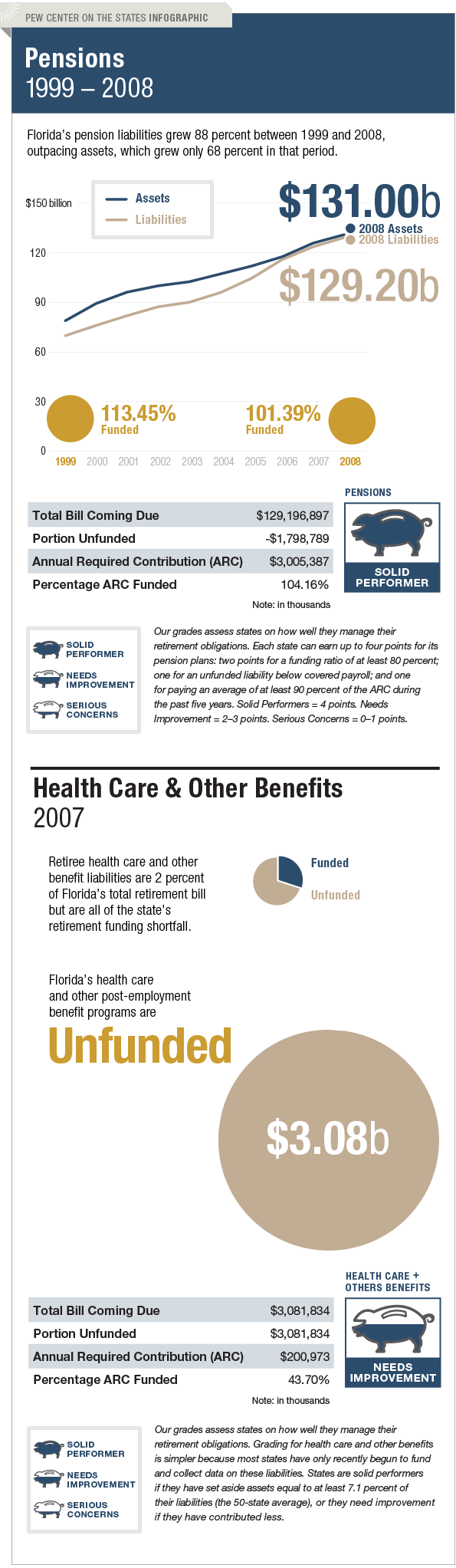

Florida is a top performer when it comes to managing its long-term pension liability, but needs to improve how it handles the bill coming due for retiree health care and other benefits. The Sunshine State is one of only three states (the others are New York and Washington) to have more pension assets than accrued liability—funding 101 percent of its total pension obligation, well above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. Florida has fiscally responsible policies, making at least 90 percent of the annual required contribution each year since 1997 and maintaining an additional reserve to cover unexpected actuarial losses.

However, although Florida has relatively limited long-term liabilities of $3.1 billion for retiree health care and other benefits, the state has not contributed any funds to cover those costs.