The Trillion Dollar Gap: Connecticut

Underfunded State Retirement Systems and the Roads to Reform

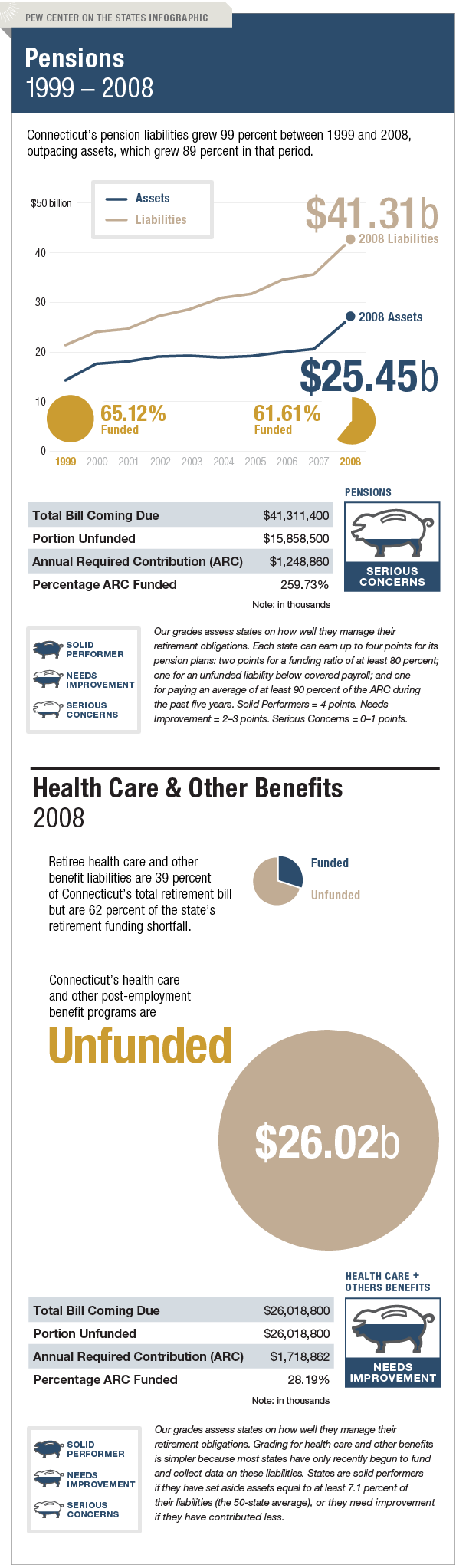

Connecticut's management of its long-term pension liability is cause for serious concern and needs to improve how it handles the bill coming due for retiree health care and other benefits. The state has funded only 62 percent of its total pension bill, well below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. Since 2000, the Constitution State's unfunded pension liability increased by more than $9 billion.

In 2008, Connecticut funded 260 percent of its annual required contribution, in large part by issuing a $2 billion pension obligation bond for the severely underfunded teachers' system. This bond includes a covenant that requires the state to fully fund the teachers' plan on an actuarially sound basis. As of 2008, Connecticut had one of the largest long-term burdens, given the size of its payroll and population, for retiree health care and other non-pension benefits: $26 billion. But the state—like 19 others—has failed to contribute any funds to cover those costs.