Participants’ Limited Engagement in Illinois Retirement Savings Program Could Help Boost Financial Security

Survey shows few routinely check their accounts while saving

Early participants in the Illinois program intended to help private-sector workers save for their retirements have not checked their accounts routinely and many don’t know how much they have saved, according to a survey by The Pew Charitable Trusts.

These findings indicate limited engagement in the years immediately after the 2018 launch of Illinois Secure Choice—a retirement savings program facilitated by the state of Illinois—but the data shows that participants have been doing what policymakers intended: putting money aside for retirement.

The Illinois initiative targets those without access to a workplace retirement plan who work at businesses with a threshold number of employees, now five. Eligible workers are automatically enrolled and contribute a preset percentage of their wages or salaries. They can opt out, change their contribution percentage, or withdraw prior contributions at any time.

To learn more about participants’ experiences, Pew contracted with the Rand Corp. to survey adults eligible to participate in Illinois Secure Choice. Rand conducted the survey in three waves at roughly six-month intervals, with the first round fielded in the spring of 2020, the second in the fall of 2020, and the third in the spring of 2021.

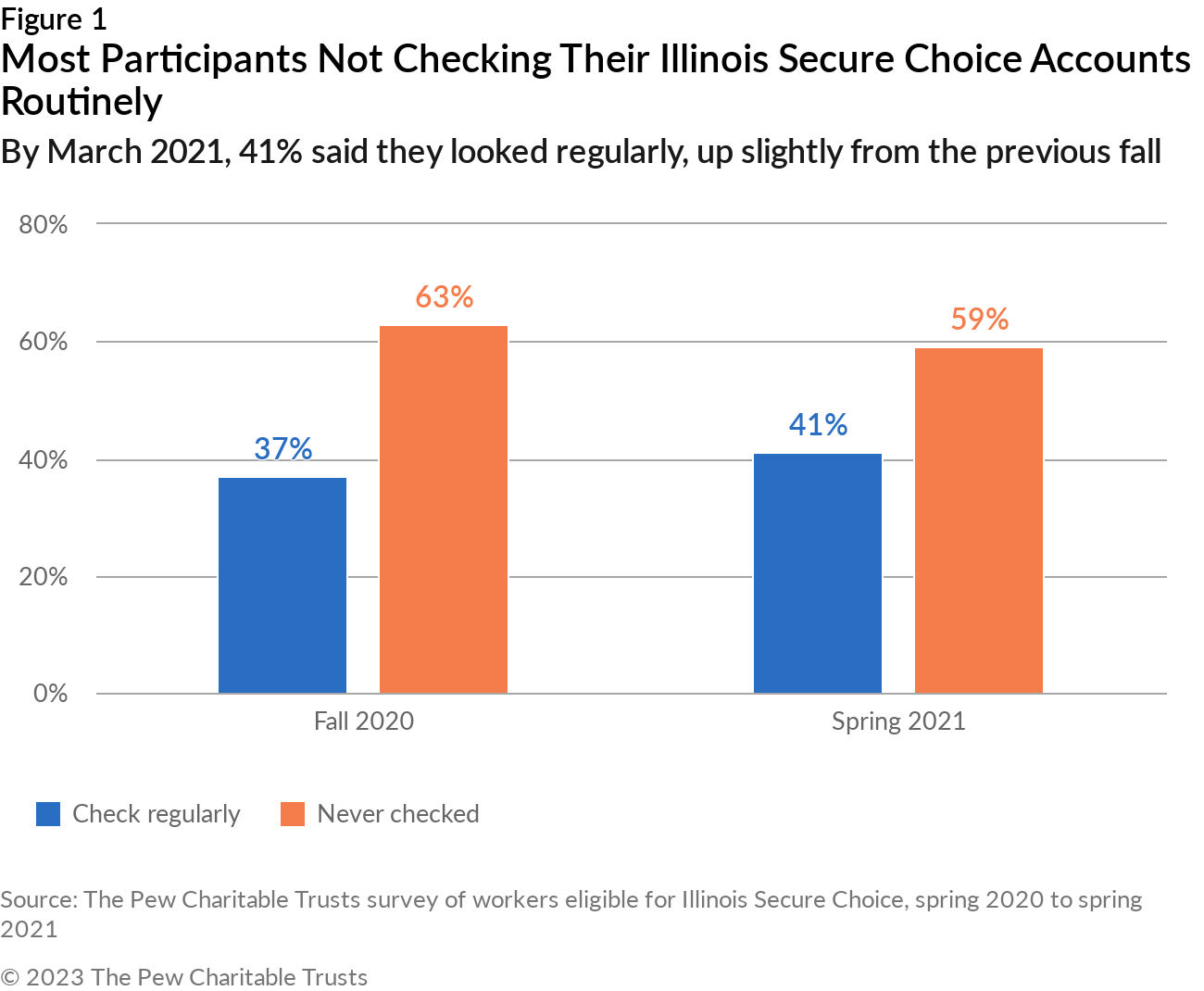

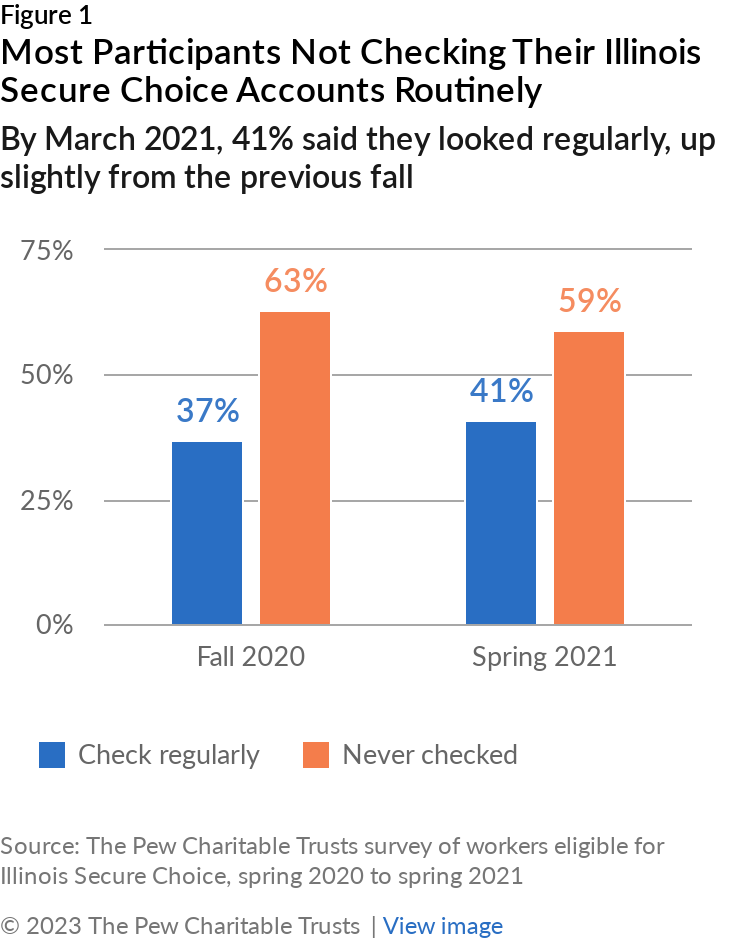

The results show limited routine engagement with the program in its initial years. For example, most participants did not check their accounts regularly, at any rate from daily to quarterly. (See Figure 1.) By spring 2021, the last wave, 41% of participants were checking regularly. That is a small but statistically significant increase from 37% the prior year, but still represents less than half of participants.

Engagement increased with education level: Half of those with a college degree or higher said they checked their accounts. Other demographic characteristics, however, were not associated with checking or not checking accounts.

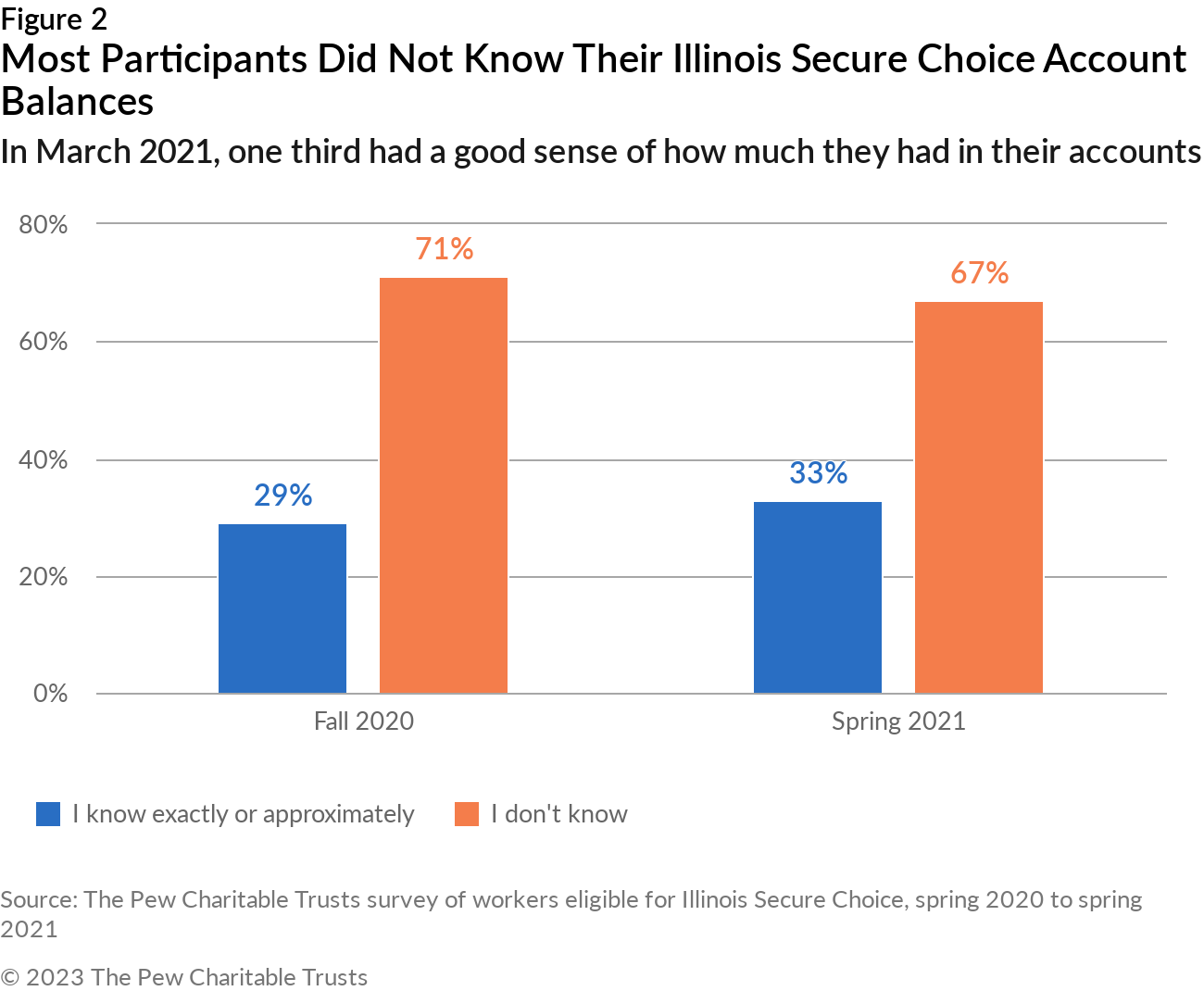

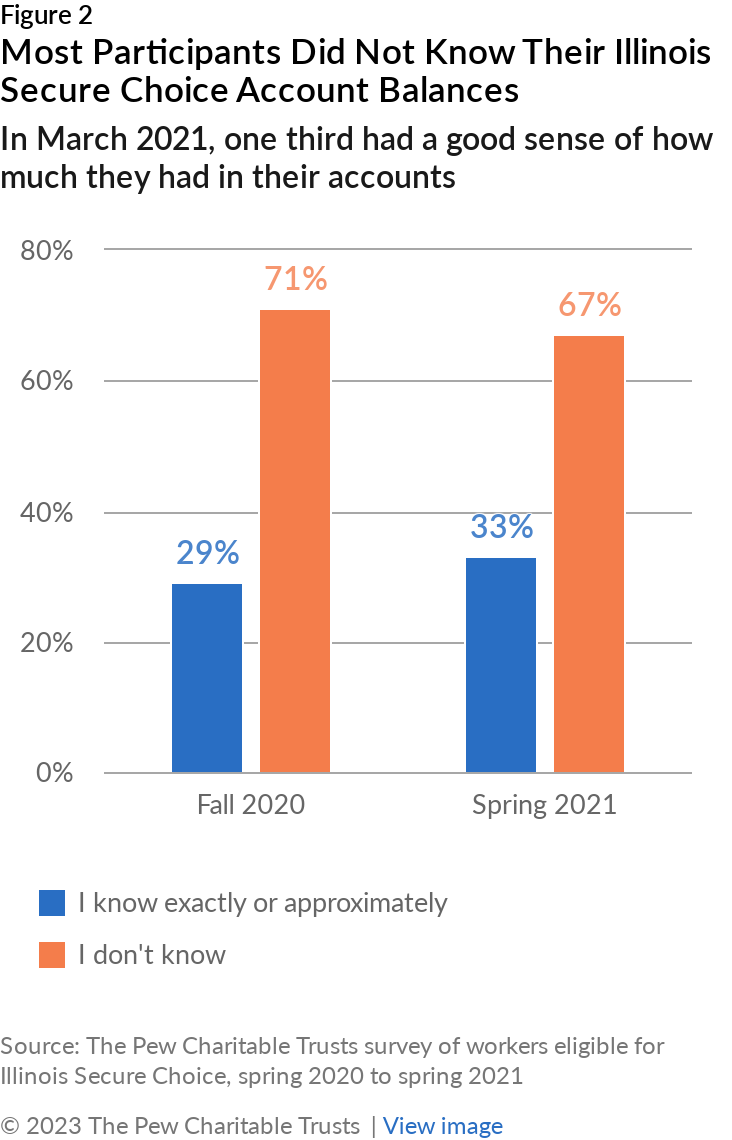

About 3 in 10 account holders (29%) said in the fall of 2020 that they knew approximately or exactly how much savings they had accumulated. (See Figure 2.) By the spring of 2021, that figure had risen slightly to one third, a small but statistically significant increase in knowledge.

Some demographic groups, particularly those closer to retirement age, were more likely to have a sense of their savings. For example, participants over age 45 and those having at least a college degree were more likely than other groups to say they knew their account balances in fall 2020 and spring 2021.

The limited engagement may suggest that paycheck deductions are not a source of concern and are not affecting these workers’ financial pictures. More broadly, people who “set it and forget it” with regards to their Illinois Secure Choice accounts may be more likely to build their savings over time.

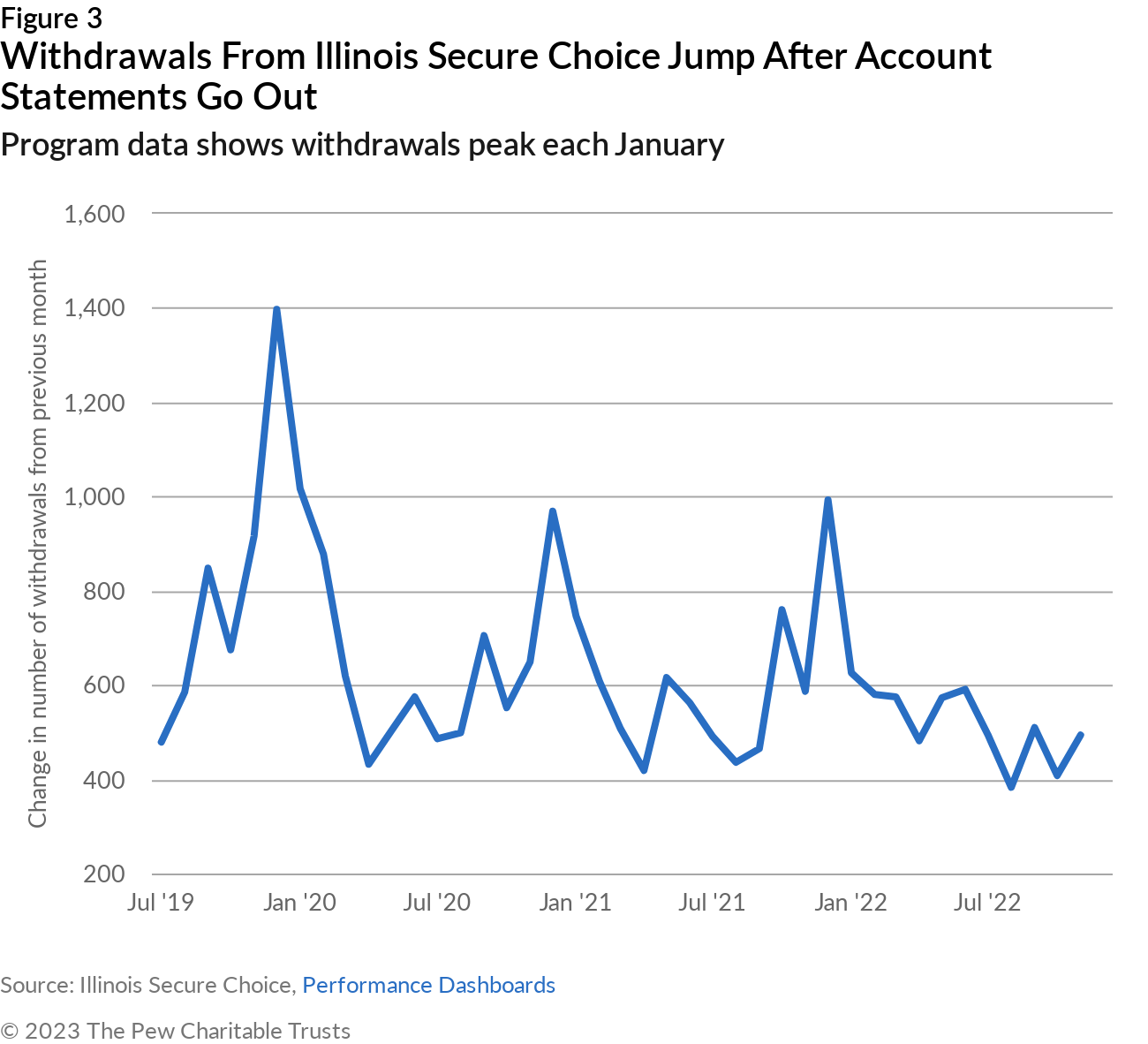

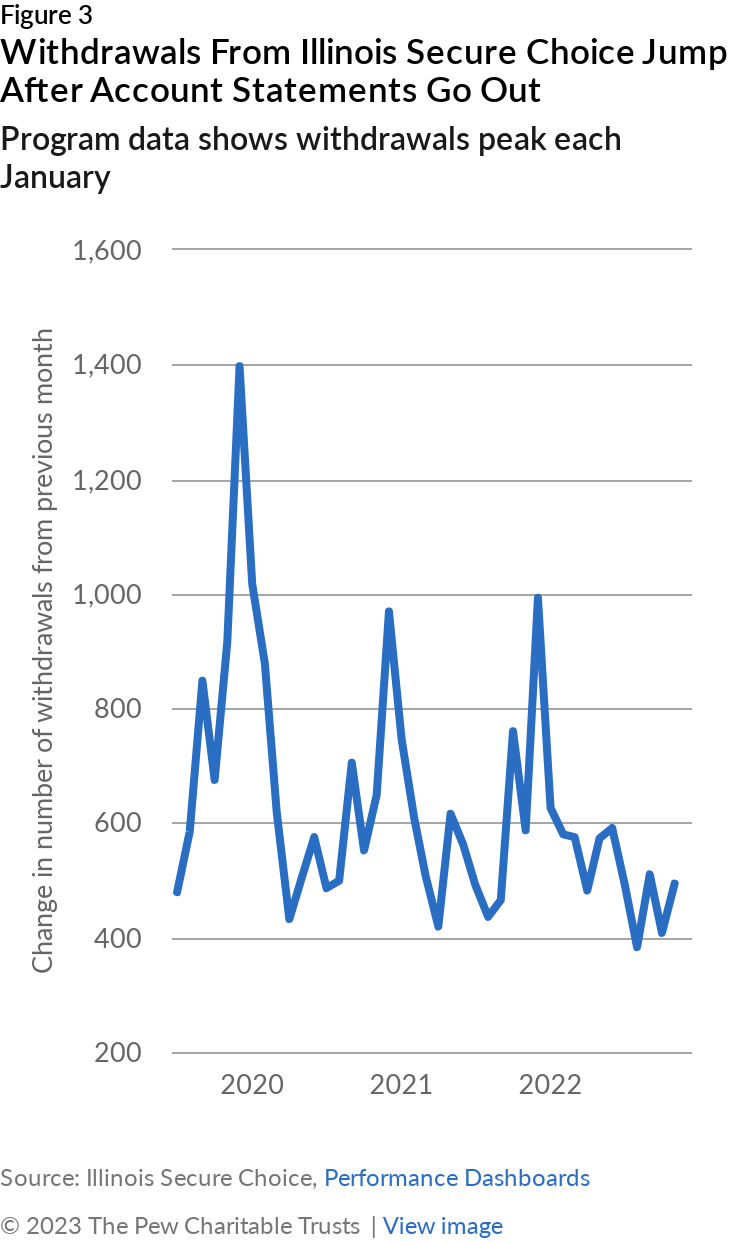

Some financial advisers recommend checking savings account balances no more than once a quarter to avoid ill-considered asset sales or withdrawals based on short-term market movements. And that connection between savers checking their accounts and making withdrawals is underscored by data showing that withdrawals tend to increase when annual statements go out. (See Figure 3.)

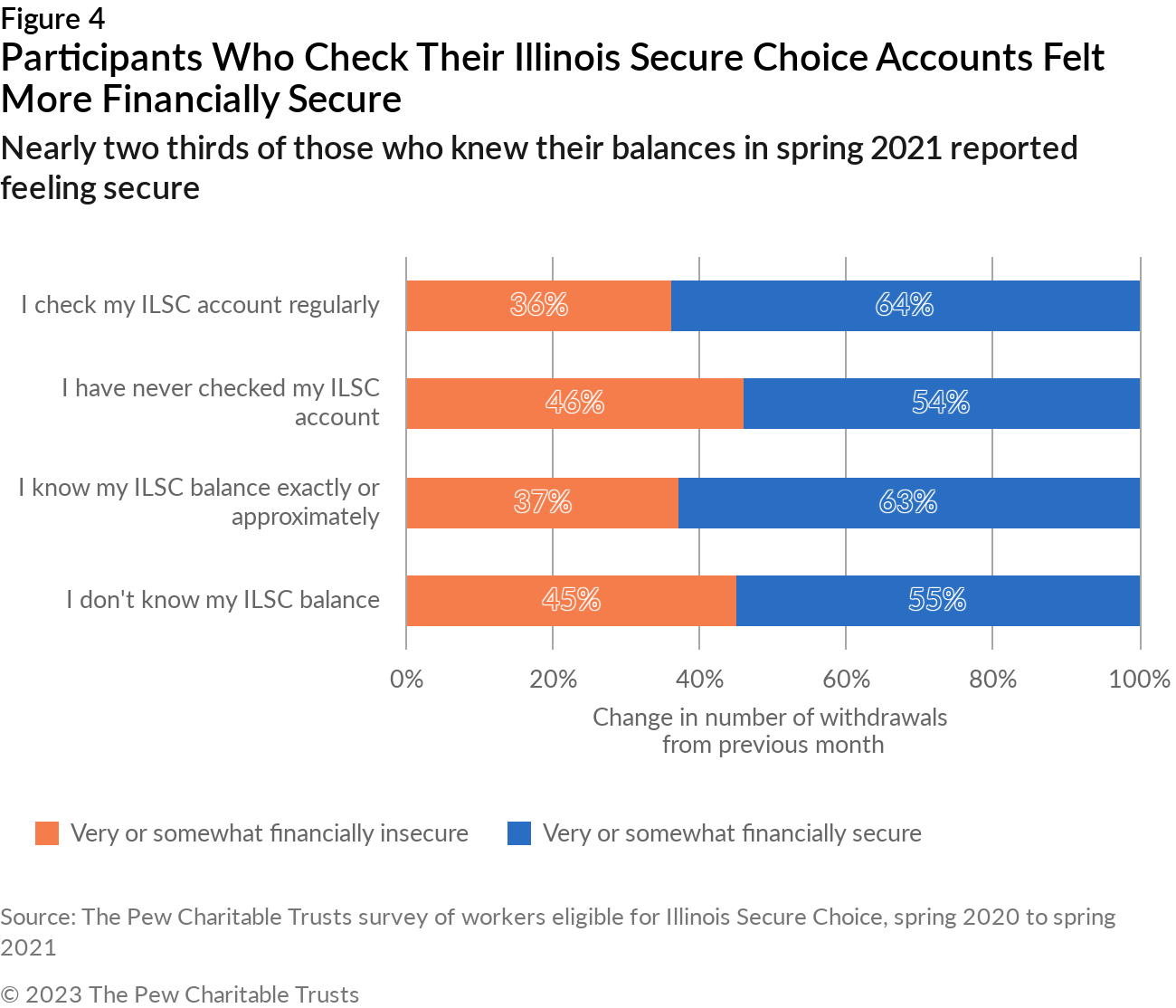

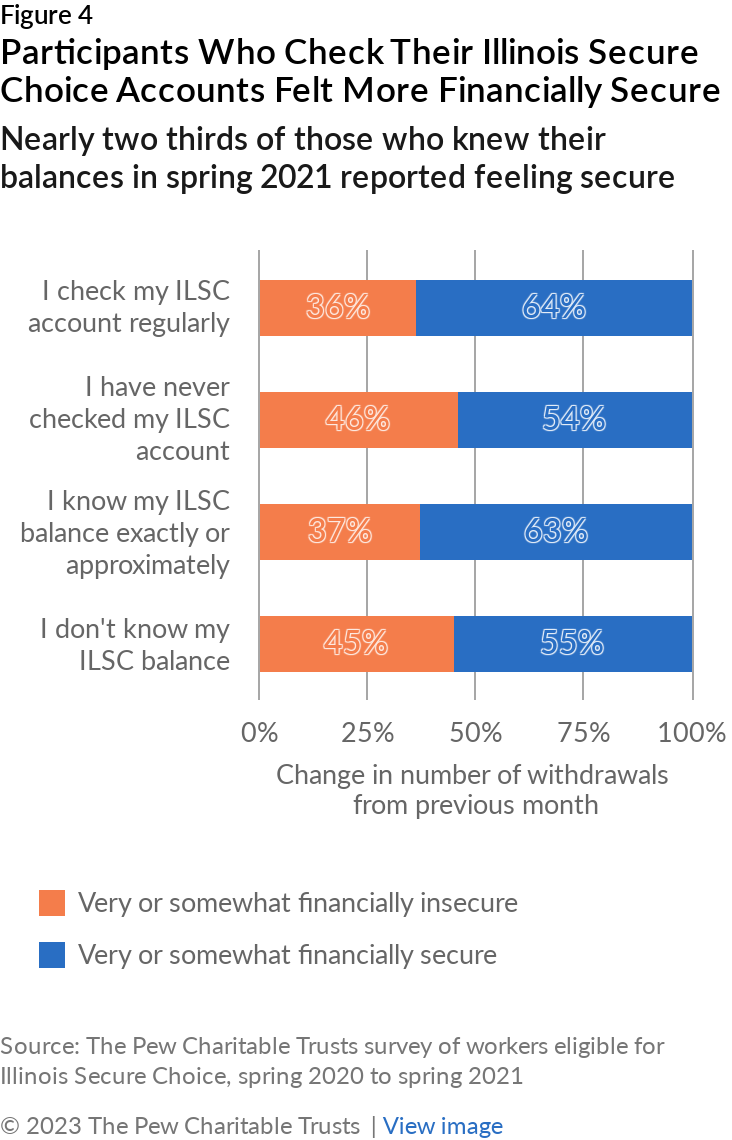

On the other hand, more of those who checked their accounts regularly, or who knew their account balances, felt financially secure than those who didn’t check routinely. (See Figure 4.) By spring 2021, when 41% of participants were checking their accounts regularly, almost two thirds (64%) of that group said they felt financially secure. That figure drops to 54% among participants who said they never checked their accounts. More of those who said they knew their account balances also said they felt financially secure compared with those who did not know their account balances (63% versus 55%, respectively).

The limited engagement early on suggests that participants have not been overly concerned about deductions to their paychecks, and that participating in Illinois Secure Choice has not altered their overall financial situations. On the other hand, participants who did check their accounts, or who knew their balances, felt more financially secure than those who didn’t check, a positive outcome for the new savings initiative.

Alison Shelton is a senior research officer and Mark Hines is a research officer with The Pew Charitable Trusts’ retirement savings project.