President’s 2017 Budget Aims to Expand Retirement Provisions

Funding proposal designed to help more Americans build retirement savings

Shutterstock

ShutterstockMillions of Americans lack access to a workplace retirement plan, but the president’s budget proposal seeks to create new savings opportunities for workers.

President Barack Obama’s fiscal year 2017 federal budget plan includes a number of proposals to improve opportunities for American workers to save for retirement. The budget asks Congress for several billion dollars over the next 10 years to encourage the creation of new retirement plans. Among its provisions, the proposal released Feb. 9 would provide assistance to states seeking to establish state-run retirement plans for private sector employees.

The budget includes tax credits for new plans, language to encourage automatic enrollment for eligible workers, and a proposal to allow “open” multiple employer plans, which would permit small businesses to join together to offer a plan to employees. Currently, these plans tend to include only employers from the same industry or geographic area.

Pew’s retirement savings project examines the challenges in increasing Americans’ retirement savings and how the potential solutions affect employees, employers, and taxpayers.

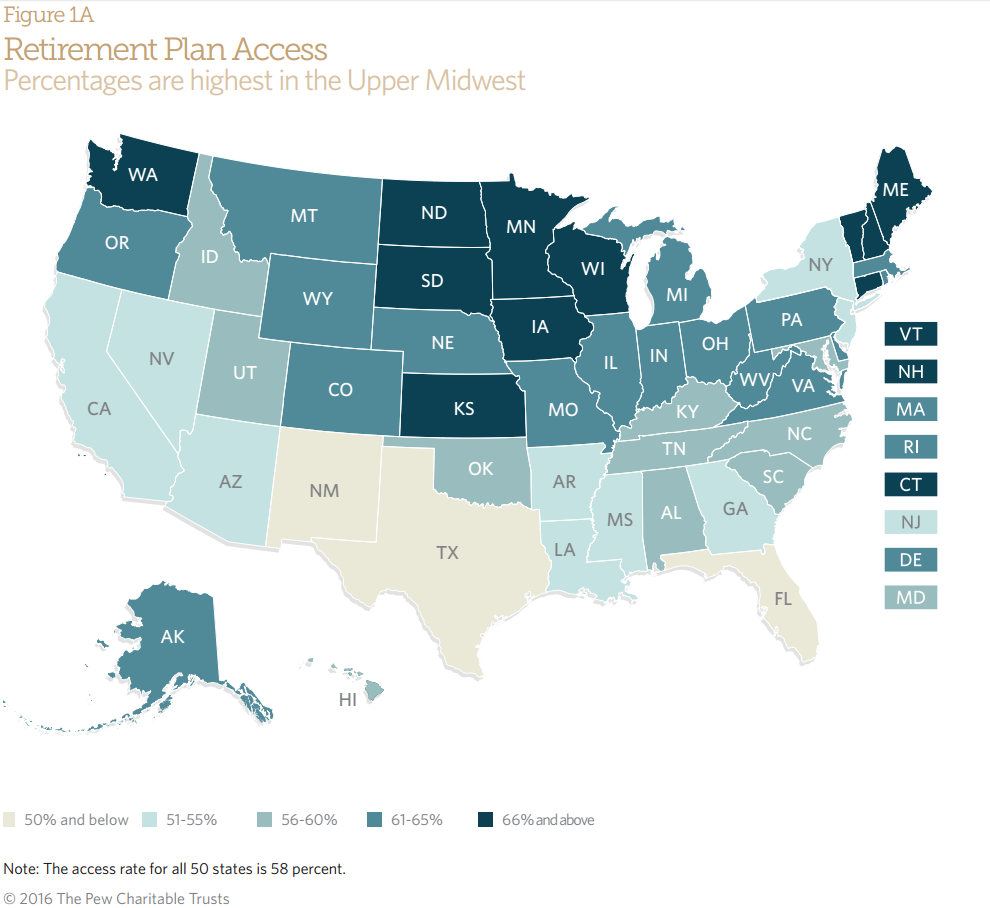

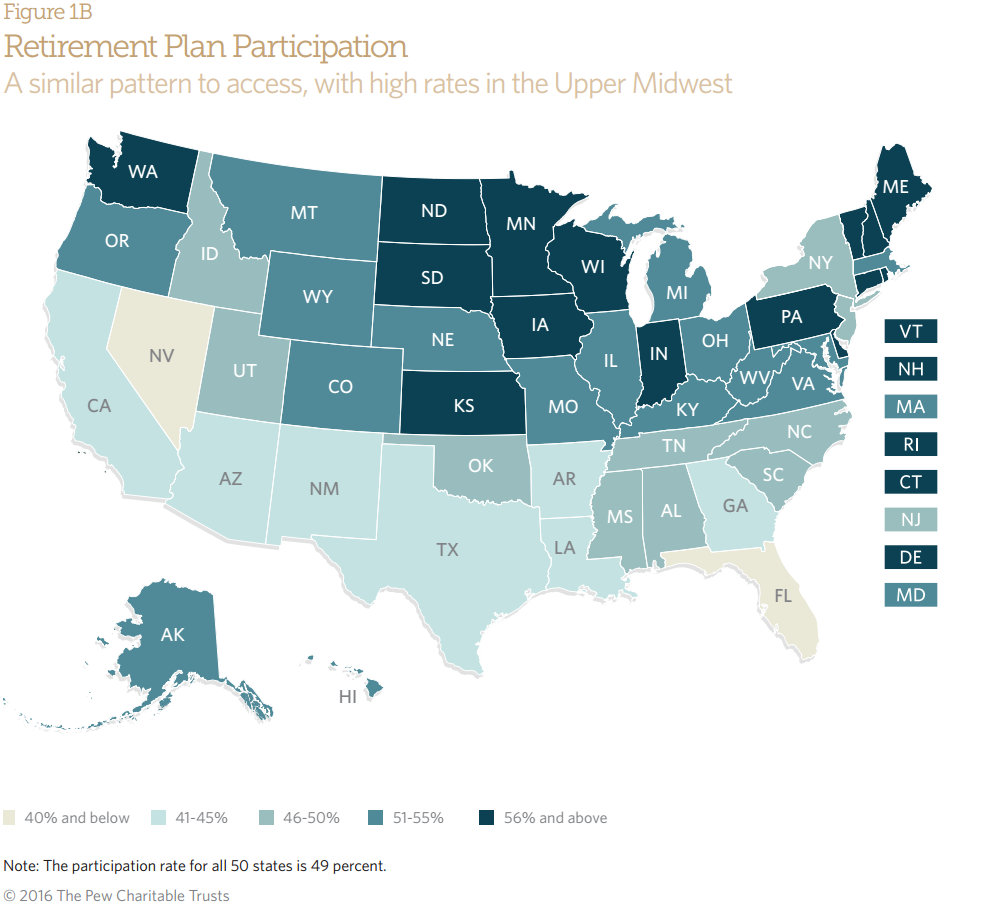

In January 2016, the project released a retirement savings report and an interactive infographic that detail private sector workers’ access to and participation in plans in all 50 states.

Here’s what some of our data show regarding the current state of retirement savings for full-time, year-round private sector workers in the U.S.:

- Some 30 million people do not have access to an employer-sponsored retirement plan—and only half of U.S. workers participate in a workplace retirement plan.

- Larger companies tend to provide more access to retirement plans than very small businesses do: Companies with 500 or more employees have a 74 percent access rate, compared with 22 percent for companies with fewer than 10 employees.

- Who has access to a retirement plan and who participates varies widely by state.

- Wisconsin, Minnesota, and Iowa have the highest participation rates; Florida and Nevada have the lowest.

- Regional differences also were significant, with higher access and participation rates in the Upper Midwest, along with parts of New England and the Pacific Northwest.