State Tax Revenue Up — But Short of Peak

Note: These data have been updated. To see the most recent data and analysis, visit Fiscal 50

To see the most recent analysis for Fiscal 50, please visit our overview page.

Only 14 states’ tax revenue had recovered from the Great Recession by the first quarter of 2013, after adjusting for inflation. Total state tax collections were still 1.6 percent below their peak in the third quarter of 2008. The difference shows how far states still have to go to regain lost tax revenue.

Despite more than three years of growth, state tax revenue has yet to fully recover from its plunge in the Great Recession. For every $1 states collected at their 2008 revenue peak, they took in the equivalent of 98.4 cents in the first quarter of 2013, after adjusting for inflation and seasonal fluctuations.

The difference between the latest quarterly tax revenue and each state’s peak quarterly level—based on four-quarter moving averages—is a gauge of the financial stress still burdening state budgets. It means most states had less purchasing power from their tax dollars while simultaneously coping with a sharp drop in federal stimulus aid, still-high unemployment, and rising demand for costly services such as Medicaid and education.

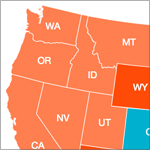

But it matters where you live. As of the first quarter of 2013:

- North Dakota’s tax revenue was 100 percent above its highest point during the recession, thanks to an oil boom that sent severance and sales taxes soaring.

- Thirteen states’ tax revenue remained down 10 percent or more from their peak, in today’s dollars.

- Alaska was furthest from its peak—down nearly 43 percent. Its 2008 peak, however, was the short-lived result of a major state oil tax increase taking effect just as crude prices spiked to an all-time high. The next-largest gaps between current and peak tax revenue were in Wyoming (-28 percent), in Florida (-22 percent), and in Louisiana and New Mexico (-20 percent each).

Without adjusting for inflation, quarterly state tax revenue was 5.1 percent above peak overall and had recovered in 33 states, as of the first quarter of 2013.

Increasing tax revenue does not necessarily signal an economic comeback. Growth can come from tax increases or other policy changes. In the most recent quarter, for example, some increases likely were due to taxpayers accelerating capital gains to avoid a federal tax hike. Even getting back to peak only means that states have their previous purchasing power—with nothing additional to pay for costs associated with population increases, growth in Medicaid enrollment, deferred needs, or accumulated debts.

Adjusting for inflation is just one way to evaluate state tax revenue growth. Different insights would be gained by tracking revenue relative to population growth or state economic output.

Analysis by Barb Rosewicz and Sarah Babbage

Chart Sources: Pew analysis of the U.S. Census Bureau’s Quarterly Summary of State and Local Taxes, as adjusted by the Nelson A. Rockefeller Institute of Government.