Pension Risk Reporting Guidance Updated to Include Inflation Scenario

Recent economic trends show the value of stress testing to manage uncertainty

The number of states that conduct forward-looking assessments of investment risk on funding levels and costs for their state pension systems has grown significantly over the past decade from just seven states in 2012 to 25 today. These risk reporting tools, such as pension stress tests, can help policymakers plan for uncertainty by estimating the impact that a range of economic scenarios can have on plan balance sheets and required contributions.

As the use of these essential tools becomes standard, risk assessments are evolving to reflect relevant economic concerns and emerging risks. Recent experience, for example, has shown the importance of models that can account for the economic impact of prolonged inflation. Reporting guidance from The Pew Charitable Trusts, first published in 2018, has been updated to do that more specifically.

How inflation drives uncertainty for public pensions

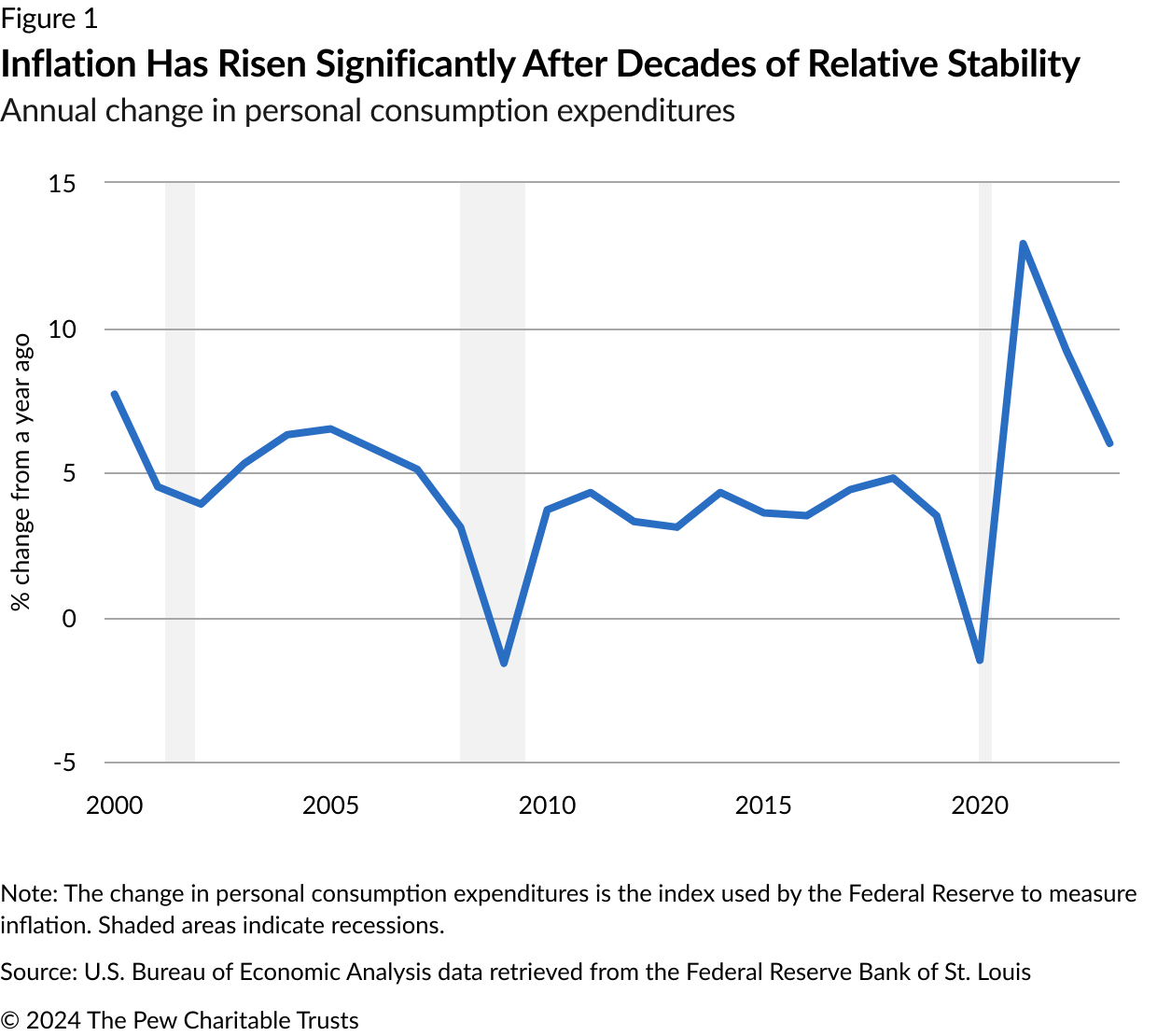

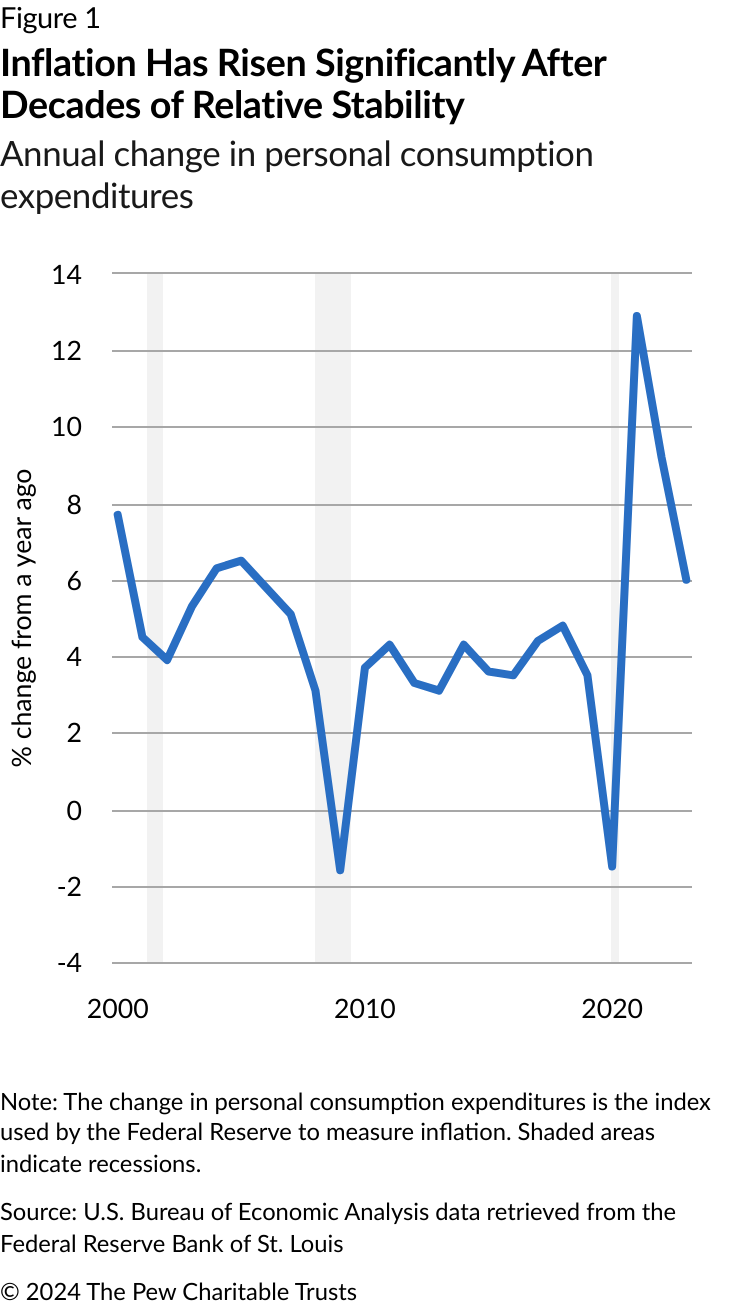

Recent experience—specifically, the high inflation during the economic recovery from the COVID-19 pandemic—demonstrates the importance of risk reporting that includes analyses of a range of relevant economic scenarios. Beginning in 2021, inflation levels rose significantly and remained persistently high through 2022, prompting concerns of a possible economic slowdown or a recession. Although inflation has begun to abate, it remains above the Federal Reserve’s 2% target, prolonging uncertainty about how long inflation will last.

For states and local governments, rising inflation can affect retirement system benefits, funding levels, and costs. In particular, increases in inflation can erode the purchasing power of benefits over time, making it harder for retirees to maintain a given standard of living. For plans that provide cost-of-living adjustments (COLAs), inflation-linked benefit changes can lead to increased costs for retirement systems that do not have variable benefit designs or caps on annual adjustments. Following the 2007-09 Great Recession, many states reduced or eliminated COLAs for public sector retirees to help ensure fiscal sustainability. More recent inflation increases could place pressure on policymakers in those states who are tasked with providing pensioners with a secure retirement while maintaining stable pension plan funding.

Sustained inflation can have broader economic effects that could further affect plan balance sheets and required contributions. If the inflation rate continues to remain above target for a prolonged period, monetary policymakers could take more aggressive measures to bring it down. These measures, in turn, increase the likelihood of an economic recession, which could lead to investment losses and increased liabilities, eroding plans’ funding gains. Retirement system costs could increase as a result, crowding out the share of government budgets available for other critical priorities.

Updating pension risk reporting to account for inflation

To better reflect these potential risks, Pew has updated its “Foundation for Public Pensions Risk Reporting,” guidance that provides a starting point for comprehensive risk assessments targeted to governmental plan sponsors and budgetary decision-makers. The framework, first published in 2018, now includes a “stubborn inflation” scenario in which monetary policies adopted to address persistently high levels of inflation result in a recession. It also has been amended to reflect updated capital market assumptions, 2023 updates to the Federal Reserve’s stress test methodology, and recently adopted actuarial standards of practice.

Several state retirement systems have similarly amended established investment risk assessments to incorporate the potential impact of inflation. Stress tests in California, Connecticut, and Wisconsin have included scenarios analyzing the effects of sustained higher inflation on plan balance sheets, required contributions, and COLAs. Meanwhile, recent analysis in Virginia includes a scenario showing the effects of an inflation-linked economic downturn on the plan’s cashflow needs. Although these assessments vary from state to state, they demonstrate how the adoption of risk reporting practices provides pension fiduciaries and state policymakers with a framework that can be adjusted year to year to incorporate current economic considerations and policy-relevant scenarios.

Pension risk reporting standards and practices continue to evolve and shifts in the national economy will prompt routine updates to scenarios and baseline assumptions. Such steps give policymakers the opportunity to consider more robust assessments that look beyond investment risk to analyze other significant risks, such as the risk that actual contributions will fall short of plan assumptions. And future guidance on risk reporting might address other risks, including demographic changes affecting plan participants, or emerging risks such as climate change. As more states and plans implement pension risk reporting for state retirement systems, policymakers and fiduciaries should update these tools routinely to ensure that they continue to assess relevant risks and communicate useful findings to decision-makers tasked with funding pension promises alongside other critical government services.

Stephanie Connolly is a principal associate and Corryn Hall is a manager with The Pew Charitable Trusts’ state fiscal policy project.