A Widening Gap in Cities

Shortfalls in Funding for Pensions and Retiree Health Care

Executive Summary

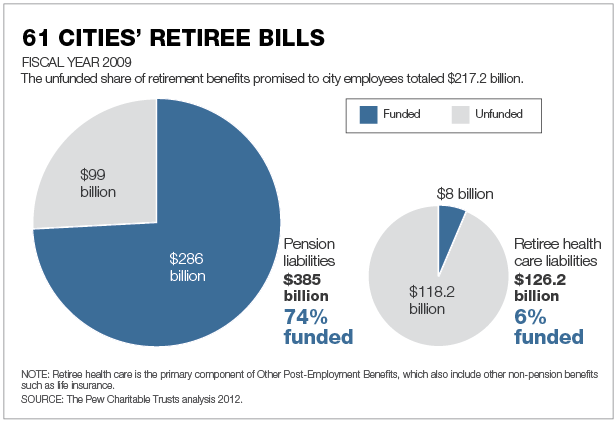

As the Great Recession ended, 61 key cities across America—the most populous one in each state plus all others with more than 500,000 people—emerged with a gap of more than $217 billion between what they had promised their workers in pensions and retiree health care and what they had saved to pay that bill. While states have a much larger shortfall, cities face the same daunting challenges posed by unfunded liabilities for their public sector retirement benefits.[i]

For pensions, these cities had a shortfall of $99 billion in fiscal year 2009, the most recent year with complete data. The gap continued to widen in fiscal year 2010 as reflected by complete data for 40 of the cities, which saw unfunded pension liabilities rise by another 15 percent.[ii]

Besides pensions, many localities also have promised health care, life insurance, and other non-pension benefits to their retirees, but few have started saving to cover these long-term costs. These unfunded liabilities loom even larger than for pensions (see graphic).[iii] As of fiscal year 2009, the cities in this report had promised at least $118 billion more than they had in hand to cover retiree health care benefits.

Wide disparities exist in how prepared cities are to fulfill their pension obligations.

- Milwaukee and Washington, D.C., had surpluses at the end of fiscal year 2009, with enough money to cover 113 percent and 104 percent, respectively, of their liabilities, better than the best-funded state, New York, at 101 percent. [iv]

- In four cities—Charleston; Omaha; Portland, Oregon; and Providence, Rhode Island—pension systems were more poorly funded than those in Illinois, which at 51 percent was the lowest-funded state. [v]

- Charleston trailed all the other cities at 24 percent.[vi]

- Overall, the cities had enough money to cover 74 percent of their pension obligations in fiscal year 2009, compared with 78 percent for states.[vii]

Cities have more in common when it comes to gaps in funding for retiree health care and other non-pension benefits.

- As of fiscal year 2009, overall, cities had set aside enough money to cover just 6 percent of their promises, compared with slightly more than 5 percent in states.[vii]

- Only Los Angeles and Denver had even half of the money needed.

Key Findings: Pensions

- The big picture. Altogether, the 61 cities had enough assets to cover 74 percent of $385 billion in projected pension obligations as of fiscal year 2009, the most recent year with complete data for each city. That left a gap between assets and liabilities of $99 billion. More recent, complete data for 40 cities showed the gap widening in fiscal year 2010.

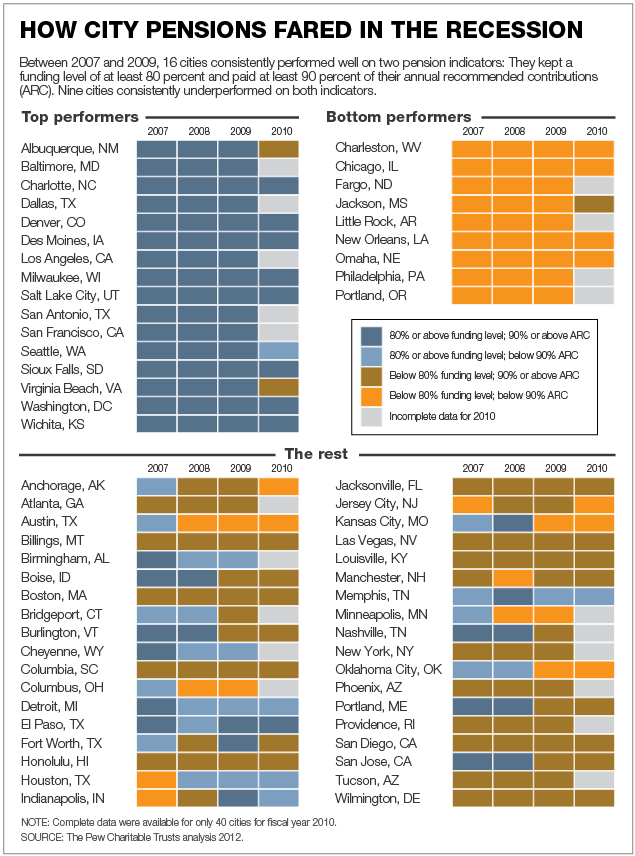

- Performance on two key indicators. Cities were assessed on: (1) their funding level, which is the percentage of projected liabilities covered by assets; and (2) the extent to which they are paying the annual contribution their actuaries recommend to meet their pension obligations, generally over 30 years.[i]

-

Between 2007 and 2009—one of the most volatile financial times in their history —16 cities maintained funding levels above 80 percent and consistently made at least 90 percent of their annual pension payments: Albuquerque; Baltimore; Charlotte; Dallas; Denver; Des Moines; Los Angeles; Milwaukee; Salt Lake City; San Antonio; San Francisco; Seattle; Sioux Falls; Virginia Beach; Washington, D.C.; and Wichita.

-

Nine cities fell below the benchmarks for both funding level and annual pension contributions each year from 2007 to 2009: Charleston; Chicago; Fargo; Jackson; Little Rock; New Orleans; Omaha; Philadelphia; and Portland, Oregon.

- Best- and worst-funded in 2009. Twenty-four cities emerged from the recession with funding levels of 80 percent or higher in fiscal year 2009; 37 cities fell below that mark.[ii] This snapshot captures cities' pension holdings at a low point because of the recession.

- Best and worst at making annual payments. More than half—35—of the 61 cities made at least 90 percent of their annual pension payments each year between 2007 and 2009, including 25 that paid at least 100 percent each year. Six cities regularly shortchanged their pension funds and made less than two-thirds of their annual recommended contributions: Charleston, Chicago, Little Rock, New Orleans, Omaha, and Portland, Oregon.[iii]

- Results in 2010 and beyond. A look at 40 cities that reported results for all of their pension plans for fiscal years 2005 through 2010 showed declines in funding levels beyond the end of the recession. Their aggregate funding levels reached 82 percent in 2007, before dropping to 78 percent in 2008, 73 percent in 2009, and 70 percent in 2010.[iv]

Key Findings: Retiree Health Care

- The big picture. Pension shortfalls grab more headlines, but they are not the biggest retirement bill coming due for the 61 cities. The cities had set aside just 6 percent of $126.2 billion in projected costs for what are known as Other Post-Employment Benefits, primarily retiree health care, leaving $118.2 billion in unfunded liabilities in fiscal year 2009.

Many cities are just beginning to set aside contributions for these benefits, as they routinely do for pensions. Because retiree health promises generally have fewer legal protections than those for pensions, some cities are trimming them to reduce their long-term liabilities.

- Best- and worst-funded. Los Angeles led the 61 cities with 55 percent of its retiree health care promises pre-funded in fiscal year 2009. Next were Denver (51 percent); Washington, D.C. (49 percent); Louisville (40 percent); Sioux Falls (37 percent); and San Antonio (31 percent).

While 27 cities had set aside some assets to offset their liabilities, 33 had not and were paying for their retirees' health care out of their treasuries on a pay-as-you-go basis. One city—Portland, Maine—had no liabilities because it offers no retiree health care.

- Best at making annual payments. Some cities have begun tackling their retiree health care liabilities by pre-funding a portion of their expenses. Of the 27 cities with some assets set aside, five contributed more than 90 percent of the annual sums recommended by their actuaries in both fiscal years 2009 and 2010: Anchorage, Charlotte, Los Angeles, Sioux Falls, and Virginia Beach. Eight contributed more than half of their full annual payments in both years, and 14 contributed less than half.

- Bigger unpaid bills for retiree health care than for pensions. In total dollars, the 61 cities had promised three times more in pension benefits than in retiree health benefits.[i] Yet more than a third of the cities faced bigger unpaid bills for retiree health care than for pensions.[ii] That is primarily because cities have saved for pensions for years, so a greater portion of those liabilities were covered.

Lessons From the Recession

The Great Recession had a significant impact on local pension plans across the country. Overall, the aggregate funding level of the 61 cities studied declined five percentage points—from 79 percent in fiscal year 2007 to 74 percent in fiscal year 2009. Half of the cities saw drops of eight percentage points or more. But the downturn was not the decisive factor that separated cities with the best-funded pension systems from those with poorly funded ones.

Whether a city was fiscally disciplined made a big difference in how it fared. Cities with pension plans that kept up with their payments—consistently making the “annual recommended contribution” calculated by their actuaries—weathered the financial downturn better than their counterparts.[i] Between 2007 and 2009, 35 cities paid at least 90 percent of each year's annual recommended sum. The funding level of their pension plans fell at half the rate as those in cities that did not consistently make the bulk of their payments.[ii]

Cities began to reform their public sector retirement systems before 2007, but changes have accelerated rapidly in the wake of the Great Recession. Many of the 61 cities in this analysis—even those with relatively well-funded systems—have made adjustments to address funding shortfalls or unsustainable growth in costs for pensions or retiree health care.

In general, reforms for both pensions and retiree health fall into four categories: (1) plan design; (2) funding; (3) benefits; and (4) organization and management.

The changes most commonly affect new hires but also current retirees and employees in some cases.

Pension and Retiree Health Care Funding in 61 Cities, FY 2007-2010