Avoiding Blank Checks

Creating Fiscally Sound State Tax Incentives

QUICK SUMMARY

Reliable cost estimates and annual cost controls for tax incentives have helped states promote job creation and economic growth while avoiding unexpected budget challenges But Pew's analysis shows that policy makers often create tax credits, deductions, and exemptions without these tools, raising the risk of budget shortfalls and unplanned spending cuts or tax increases to close them

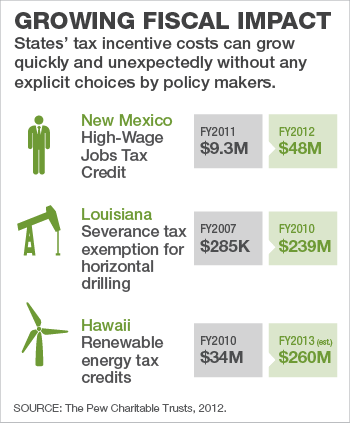

In several states, tax incentive costs have grown quickly and unexpectedly, throwing budgets out of balance. These fiscal problems can be prevented, however.

States have had the most success managing their tax incentive costs when they act up front using two key tools: reliable cost estimates and annual cost controls. These tools have been paired together across a range of incentive programs, from those aimed at job creation to others meant to grow specific industries or types of investment.

When policy makers do not have a reliable cost estimate, they have a harder time determining whether the state can afford a proposed incentive and whether the economic return will be worth the price. Similarly, by creating tax incentives without a limit on their annual costs, lawmakers leave the state vulnerable to budget challenges that are entirely avoidable.

Tools to Avoid Blank Checks Not Used Consistently

States often have omitted cost estimates and cost controls, even when facing the significant budget pressures of recent years.

Pew reviewed 16 tax incentive bills that passed between 2007 and 2011 with the potential to be among the costliest nationwide. Our analysis focused on whether reliable cost estimates and annual spending limits were used.

- In only four cases, both tools were used.

- Five of the bills were enacted with neither of these fiscal safeguards.

- In seven cases, the legislation lacked one or the other.

How Cost Estimates and Controls Help

Cost estimates provide lawmakers with important projections of an incentive's effect on state revenue. These detailed analyses help policy makers make better decisions about the incentive's design, size, and scope.

Annual spending limits protect the state budget from cost spikes caused by unforeseen changes in the economy and other factors that even the best estimates may not anticipate. These limits give policy makers certainty that incentives will not throw the budget out of balance. Yet, they also allow for flexibility. Lawmakers can choose to increase a cap if they have evidence that a bigger program would generate greater economic returns, or they can lower the limit if the incentive is costing too much.