Do States Benefit From Restricting Safety-Net Eligibility Based on Wealth?

A review of 3 analyses of public assistance program asset limit tests

Opponents argue that thresholds discourage low-income households from pursuing self-sufficiency through savings.

© iStock

Overview

The United States provides financial support to low-income families through more than a dozen programs, including Temporary Assistance for Needy Families (TANF) and the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps). States receive federal grants to administer SNAP and TANF services. The states also set eligibility requirements, which are typically limits on household income and the dollar value of liquid holdings such as cash, savings, and some types of material property, such as cars. For instance, the Urban Institute reports that to qualify for TANF in California in 2015, a household could have no more than $2,250 in assets when applying for assistance. These limits and what holdings count toward them vary by state, program, and applicant characteristics, including age, number of adults in the household, whether an applicant is new or a renewal, and other factors.

However, experts, advocates, and policymakers have long debated the effectiveness and merits of asset limits, also called thresholds. Opponents argue that these limits discourage low-income households from pursuing self-sufficiency through savings, while supporters stress the importance of strict guidelines for efficient allocation of government resources.1 In recent years, many states have considered and enacted changes to their thresholds, including raising them, altering allowable assets, and even eliminating them. Central to this debate is whether, and how, relaxing or removing asset thresholds would affect caseloads, program recipients’ participation and asset accumulation, and states’ costs.

This brief examines the findings of three studies—one from The Pew Charitable Trusts and two commissioned by Pew with support from the W.K. Kellogg Foundation—that looked at the effect of asset limits on family finances and state and program costs and obligations:

- “Do Limits on Family Assets Affect Participation in, Costs of TANF?,” a July 2016 Pew report, analyzed data that states provided to the federal government to gauge the impact of changes to asset limits on program participation and state costs.2

- “TANF and SNAP Asset Limits and the Financial Behavior of Low-Income Households,” from May 2017, examined results from the U.S. Census Bureau’s Survey of Income and Program Participation to explore how TANF and SNAP asset rules affect participation and household finances. The study compares households in states that relaxed asset limits with those in states that did not and looks for differences in financial behaviors and outcomes over time.3

- “Asset Limits in Public Assistance and Savings Behavior Among Low-Income Families,” completed in March 2017, used data from the University of Michigan’s Panel Study of Income Dynamics to test the impact of changes to TANF asset limits on low-income families’ financial well-being. The paper used families with higher incomes that would not qualify for TANF, and so would not be subject to asset limits, as a comparison group to test whether and to what extent threshold policies influence the savings behavior of low-income households.4

All conclusions and data discussed in this brief are from these papers unless otherwise noted. Key findings include the following:

- The July 2016 report found that changes in asset limit policy do not lead to increased state administrative costs or caseload growth.

- The 2017 studies identified only slight differences in household financial well-being between residents of states with and without thresholds.

- Both 2017 papers found that relaxing asset limit dollar amounts had an insubstantial effect on savings levels. The May 2017 report found that in states with asset limits, benefit-eligible households were slightly less likely to have checking or savings accounts.

- The May 2017 report also found that eliminating or relaxing vehicle limits boosted by 5 to 10 percent the probability that a household would own a vehicle and increased both the number of vehicles owned and the likelihood that a family’s liquid and semiliquid assets would exceed $500.

Taken together, these analyses indicate that enforcing asset limits returns no clear benefits to states, because relaxing or eliminating them does not increase program enrollment or participation. However, although removing limits does not meaningfully affect households’ asset holding and accumulation, it may reduce barriers to family financial well-being as measured by bank account and vehicle ownership.

A brief history of asset limits

Asset thresholds are generally at the discretion of each state. For TANF, states have full authority to impose a limit and determine which assets count toward it, while for SNAP the federal government sets a liquid asset limit—$3,250 for households with an elderly or disabled resident and $2,250 for others in 2017—that states can opt to relax or eliminate. As a result, tests vary widely, with many states exempting certain assets, such as vehicles, retirement accounts, or individual development accounts, a federally sponsored savings program that encourages low-income families to save for specific purposes.

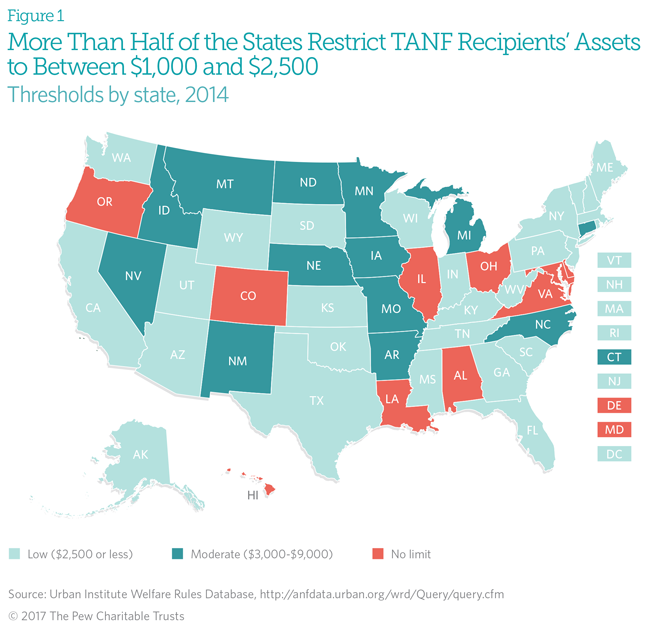

For TANF, states’ asset thresholds range from $1,000 to $10,000. (See Figure 1.) Twenty-seven states and the District of Columbia have a limit of $2,500 or less, which is defined as low; 10 do not have a threshold for TANF; and the remaining states have moderate limits between $3,000 and $9,000. Between 2000 and 2014, Texas was alone in lowering its threshold, which declined from $2,000 to $1,000.

Asset rules for TANF and SNAP have changed dramatically in the past decade and a half: Ten states haveeliminated or relaxed their overall asset limits for TANF, and 37 have done the same for SNAP. Twelve states have eased or removed vehicle-specific thresholds for TANF, and all states and the District have done so for SNAP. For instance, Illinois in 2013 eliminated its TANF asset limit of $3,000.

These actions have created an opportunity for researchers and advocates to study the effect of such policy changes on program participation, savings and accumulation of wealth, and states’ caseloads and costs.

Does relaxing liquid asset limits increase program participation?

The findings of the three studies reviewed in this brief indicate that easing asset limits makes TANF and SNAP more accessible and allows more families to qualify for assistance, which in turn could imply an increase in enrollment in the two programs and associated administrative costs. And, since 2000, while TANF enrollment has significantly declined, independent of asset thresholds, SNAP caseloads increased in about 35 states that eliminated asset limits.

But the 2016 analysis found that after controlling for factors such as the Great Recession and unemployment, asset limits had a weak effect on caseloads. Specifically, states that removed their SNAP asset limits had an average of 407 more recipients per 100,000 residents than states that retained their thresholds. By comparison, a 1 percentage point rise in the unemployment rate resulted in an average of 2,325 additional SNAP recipients per 100,000 residents. The difference between the impact of the policy change and that of unemployment suggests that a family’s decision to enroll in an assistance program is driven more by its financial condition than by the characteristics or requirements of the program.

The May 2017 study confirmed this finding by comparing households in the states that eliminated or relaxed their TANF and SNAP asset thresholds with those in states that did not. The data show that reducing or eliminating an asset limit had no detectable effect on program participation during the preceding 12 months. In fact, the researchers found suggestive evidence that eliminating or relaxing the thresholds for SNAP actually reduced the probability that a household had participated in the program in the previous month.

The findings on removing vehicle limits are more conclusive. The July 2016 study estimated that states that exclude vehicles from their asset tests have 172 fewer TANF recipients per 100,000 residents on average than those that do not. The May 2017 paper mirrors this, with evidence showing that exempting vehicles from asset tests reduces participation by 2 to 8 percent in the case of TANF and about 5 percent for SNAP. The study suggests that higher rates of vehicle ownership in states with relaxed limits may bolster families’ ability to find adequate employment and thereby avoid continued program participation.

Does relaxing asset limits have significant effects on family wealth?

The effect of asset limit policies on the financial health of eligible households’ financial security is another crucial concern. Previous Pew research shows that families that meet income requirements for TANF or SNAP typically have very low levels of savings.5 Consequently, a limit on assets might not meaningfully affect their savings. However, a low threshold could work against families accumulating such savings by encouraging them to spend down resources before applying for assistance or discouraging them from starting to save for fear of losing benefits.

Further, under a low asset limit policy, households that leave a program may not have adequate resources to weather unexpected expenses and may have an elevated risk of re-enrolling, a process known as churn, which is associated with higher administrative costs for states. Similarly, some eligible families may choose not to

apply for needed benefits because they worry about having to document their holdings or because they believe, incorrectly, that certain assets make them ineligible for assistance.6

The May 2017 paper studied households before and after changes in asset thresholds to estimate the effect of SNAP asset limits on families’ asset holdings. After considering checking and savings accounts and semiliquid assets—such as investment and retirement accounts, vehicles, homes, and rental equity—as well as net worth, the researchers found that although eliminating or relaxing asset thresholds for SNAP had no noticeable effect on a household’s likelihood to own those assets, removing the thresholds for TANF increased the probability that a family would have a checking or savings account.

The March 2017 study found that raising asset thresholds had no significant impact on household assets for TANF recipients, in the near term or over time. Rather, the analysis found that income was a more important predictor of family savings than the asset limit and that, conversely, age and family size were the primary factors

when asset levels declined.

The May 2017 study showed some increases in financial well-being after asset limits were relaxed. The researchers found no noticeable effects on the value of liquid assets or home or vehicle equity, but they did uncover a small amount of evidence that easing limits may boost TANF recipients’ use of checking and savings

accounts and increase their total wealth. The analysis could not, however, discern whether those gains were the result of differing financial behaviors among program participants depending on the presence and severity of asset limits, or of possible enrollment by higher-wealth households in states without thresholds. It further found that, although changes to overall thresholds have minimal impact on savings or asset ownership, eliminating or relaxing vehicle limits increased the probability that a household would own a vehicle by 5 to 10 percent; the number of vehicles owned; and the likelihood that the value of a family’s liquid and semiliquid assets would exceed $500. Not only did the analysis find no noticeable effects on rental or vehicle equity, but it also found no effect on total wealth or net worth, which the researchers attributed to the use of auto loans to acquire vehicles.

Not surprisingly, both 2017 studies found that, even among the low-income populations they examined, families with higher average incomes or incomes that increased over time tended to accumulate and hold more assets, regardless of program limits. This seems to indicate that asset accumulation and saving by low-income families is more closely linked to household financial conditions than to policy changes.

Conclusion

Since 2000, some states have revised their TANF and SNAP asset requirements, usually relaxing or eliminating the thresholds, but many states continue to expend considerable resources to verify the compliance of benefits recipients with various asset limit policies. However, in most cases, states have undertaken these changes and related enforcement efforts with scant evidence of the effect on households or state budgets. The three papers reviewed in this brief offer important insights for policymakers considering modifications to their states’ asset limit policies.

Overall, the research provides only limited support for the standard arguments for and against asset limits. The three papers show that relaxing or removing asset limits neither results in exploding caseloads nor significantly improves savings or wealth accumulation among benefit-eligible households.

Together, these findings suggest that asset limits return no advantage to the states that use them and expend resources to administer them, and that enforcement of these rules may have small negative effects on families’ bank account or vehicle ownership. Further research is needed to understand how asset limits are implemented in various jurisdictions and how benefit-eligible households manage their financial lives in the presence of asset restrictions.

Endnotes

- See, for example, Corporation for Enterprise Development, “Lifting Asset Limits Helps Families Save,” updated February 2014, https://www.prosperitynow.org/files/resources/Policy_Brief_Asset_Limits.pdf; and Maine Department of Health and Human Services, “Maine DHHS Announces Asset Test for Food Stamps,” news release, September 16, 2015, http://www.maine.gov/dhhs/archivednews_autosearch.shtml?id=657252.

- The Pew Charitable Trusts, “Do Limits on Family Assets Affect Participation in, Costs of TANF?” (2016), http://www.pewtrusts.org/en/

research-and-analysis/issue-briefs/2016/07/do-limits-on-family-assets-affect-participation-in-costs-of-tanf. - Maureen Pirog, Edwin Gerrish, and Lindsey Bullinger, “TANF and SNAP Asset Limits and the Financial Behavior of Low-Income Households” (May 2017),

http://www.pewtrusts.org/~/media/Assets/2017/09/ TANF_and_SNAP_Asset_Limits_and_the_Financial_Behavior_of_Low_Income_Households.pdf. The Survey of Income and Program Participation is a longitudinal study that tracks a nationally representative sample of U.S. households for approximately four years. The data are collected by the Census Bureau. More information on the SIPP is available at https://www.census.gov/programs-surveys/sipp/about.html. - Leah Hamilton, “Asset Limits in Public Assistance and Savings Behavior Among Low-Income Families” (March 2017). http://www.pewtrusts.org/~/media/Assets/2017/09/ Asset_Limits_in_Public_Assistance_and_Savings_Behavior_Among_Low_Income_Families.pdf.

The Panel Study of Income Dynamics is a longitudinal, nationally representative household survey that began in 1968 and is conducted by

the University of Michigan. More information on the PSID is available at https://psidonline.isr.umich.edu. - The Pew Charitable Trusts, “What Resources Do Families Have for Financial Emergencies?” (2015), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/11/emergency-savings-what-resources-do-families-have-for-financial-emergencies.

- Rourke O’Brien, “Ineligible to Save? Asset Limits and the Saving Behavior of Welfare Recipients,” Journal of Community Practice 16, no. 2

(2008): 183–99, http://dx.doi.org/10.1080/10705420801998003.

Do Public Assistance Asset Limits Influence Program Costs and Family Financial Security

Do Limits on Family Assets Affect TANF?

Restricting holdings has minimal impact on program caseloads, expenses