Investment Options for Public Sector Defined Contribution Plans

Governments face key choices when setting up plans to help workers boost retirement savings

Overview

Most state and local public workers are members of a traditional defined benefit (DB) plan, but many today also have access to what are known as defined contribution (DC) plans, similar to private sector 401(k)s.

Workers may participate in hybrid plans that provide them with both a DB and a DC plan, in supplemental DC options offered in addition to a pension, or as an alternate approach for university or other public employees. After they retire, most public workers depend at least in part on savings from these accounts rather than solely on guaranteed lifetime payments from employer-based pensions and Social Security.

Workers with DC accounts must decide how to invest their money, but many Americans have only limited knowledge about how to build retirement savings.1 Government plan sponsors can help workers maximize these savings by providing well-designed investment options. For example, research shows that when DC or hybrid plan members are offered a limited number of low-fee investment options with appropriate asset allocations, they typically see the best outcomes.2 Specifically, index and target date funds effectively limit fees, offer appropriate asset allocations, and help simplify investment decisions.

This brief examines the elements of a defined contribution plan that sponsors should consider, including the type of fund, corresponding fee levels, number of choices offered, and the default option. It also discusses the workings of retirement systems that manage DC assets internally alongside pension fund investments, effectively removing the need for workers to make investment decisions.

Investment options

Two types of funds—index and target date—typically have low fees and relatively straightforward designs, making them well-suited for DC plans. Index funds are passively managed, meaning they track the performance of a specific index, such as the Standard & Poor’s 500 Index. In contrast, actively managed funds have a manager or team of managers that makes investment decisions on buying, holding, and selling.

Target date funds, also known as life-cycle funds, have diversified portfolios that adjust automatically as members near retirement, helping them invest easily with appropriate asset allocations. Target date portfolios are constructed with a mix of stocks and bonds, with the level of risk linked to an employee’s age and assumed retirement date. Portfolios are then rebalanced over time, reducing the percentage of funds in stocks and increasing the percentage of bonds. That can limit risk exposure as members age. For example, the Rhode Island Employee Retirement System offers 12 target funds based on likely retirement year in five-year increments—from 2010-60.3 The fund for those expected to retire in 2060 is about 90 percent invested in stocks, compared with around 30 percent for those that had been expected to retire by 2010.4

Target date and index funds have become increasingly common5 in plans for both public and private sector workers. For example, in a 2014 analysis of Vanguard’s private sector plans, the share offering target date funds grew from 28 percent in 2005 to 88 percent in 2014. About three-quarters (76 percent) of individuals who joined plans in 2014 invested in a target date fund.6 Separately, a 2013 survey of public DC plans found that over 80 percent reported offering target date funds.7 The use of index funds is similarly widespread; 84 percent of DC plans for public sector workers offer index funds.8

Fees

Fees can have a significant impact on members’ total retirement savings.9 Because of the way index funds are structured, they typically offer lower fees than actively managed funds and often provide a better return after expenses.10

Target date funds also can be designed with low fees on par with those provided by DB plans. Public DB pension plans are estimated to have, on average, fee levels of about 0.43 percent, including administrative and investment fees.11 Similarly low levels are found in public sector DC plans. A 2015 study found similar levels for DC plans, with fees ranging from 0.3 to 0.57 percent.12 According to the Pew analysis, some report slightly lower fees.13 For example, the Massachusetts Deferred Compensation Save Money and Retire Tomorrow (SMART) Plan has investment management fee levels of 0.2 to 0.3 percent. Adding in administrative and other types of fees, the total cost is kept below 0.5 percent.14

Number of funds

Limiting the number of fund options may help members make better investment decisions. That’s because offering too many choices can increase complexity and confusion for many participants.15

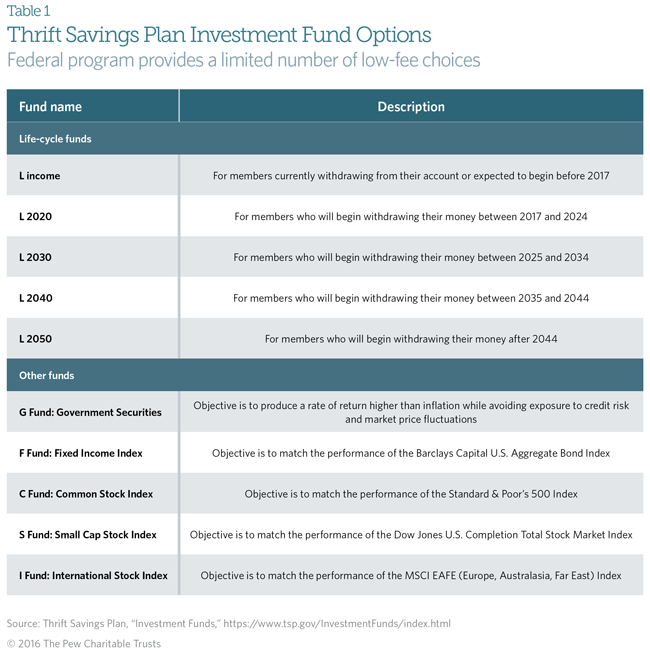

The Thrift Savings Plan (TSP) for federal civil service employees provides a good example of a DC plan with limited investment choices. Employees choose among 10 funds: five target date or life-cycle funds and five low-fee index funds.

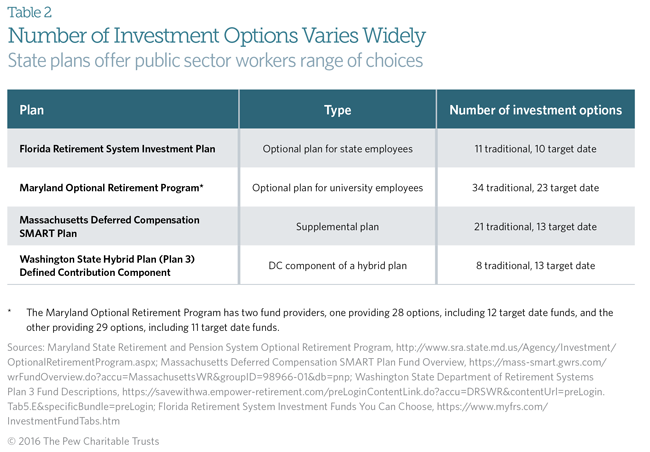

In contrast, many state DC plans offer many more investment options. A review of optional DC plans and hybrid plans shows that most have about 20 choices, double the number in the Thrift Savings Plan approach. Target date funds by definition offer multiple options based on retirement date, resulting in at least half of the fund choices offered through state retirement DC plans being target date options.

Default option

Plan managers may want to provide well-designed default fund options for members who do not make active investment choices. Because members often follow default options, plans can help workers choose options that should boost their retirement security. Individuals with lower than average financial literacy are especially likely to opt for and stay with the default option.16 The evidence also indicates that DC plan members who default into well-designed funds fare better than those who are encouraged to actively select their own investments.17

In the public sector, target date funds are commonly the default, as is the case in the Tennessee and Washington hybrid plans and the Colorado, Florida, and Indiana optional DC plans.18 This is also true in the private sector, where most companies that automatically enroll members in a DC plan adopt target date funds as the default. The analysis of Vanguard private DC plans, for example, shows that more than 80 percent had a target date or balance fund plan as the default option.19

In other instances, plan sponsors might default members into an investment option with low risk and a “safe” or guaranteed return instead of a target fund. For example, the federal Thrift Savings Plan initially set a default for new members into the Government Securities Investment Fund (G Fund). That was the most stable investment option offered under the plan but also unlikely to provide returns as high as other funds. The Federal Retirement Thrift Investment Board, which administers the TSP, found that new government hires younger than 29 had too much money invested in the G Fund, probably because the fund was the default option.20 In response, the board asked Congress to change the default for new employees into the appropriate target date fund. In 2014, Congress approved legislation to do so.21

State managed funds

Although most state investment options for DC accounts are managed externally, members can in some instances invest DC accounts in state-managed funds. For example, the Indiana Public Retirement System allows employees to invest with a fund managed by the Board of Trustees that provides a guaranteed annual return rate.22 The Washington hybrid plan offers a range of externally managed funds as well as a state-managed investment option. Under Oregon’s hybrid plan, all DC funds are invested with the state’s Public Employees Retirement System and managed by the state Treasury.23

State-managed funds can take advantage of economies of scale that often lead to fees lower than available to those in the private market. They also can provide members with expert management of assets, which is especially beneficial to those without solid financial literacy. At the same time, the asset allocation of a state-managed trust fund is typically designed for a long time horizon that may not be the appropriate risk level for members at some points in their careers. Externally managed options that focus on appropriate allocations also can reduce costs by placing members in low-fee target date funds.

Conclusion

When designing or reforming defined contribution plans, policymakers should carefully consider the types of funds to offer, the corresponding fee levels, the number of choices, the default, and whether to offer a state-managed option. There is no one-size-fits-all approach to best meet the needs of employers and workers. Still, the research indicates that offering a limited number of low-fee investment options with asset allocations that suit a range of retirement dates and risk preferences leads to the best outcomes.

Endnotes

- Several studies have found that low financial literacy is widespread among Americans. In research during the last decade, many individuals have made financial mistakes when saving for retirement and managing retirement accounts, including failing to take fees into account. Justine S. Hastings, Brigitte C. Madrian, and William L. Skimmyhorn, Financial Literacy, Financial Education, and Economic Outcomes, National Bureau of Economic Research (September 2012), http://dx.doi.org/10.3386/w18412; Annamaria Lusardi and Olivia S. Mitchell, Financial Literacy and Retirement Planning: New Evidence From the Rand American Life Panel, Dartmouth College (October 2007), http://www.dartmouth.edu/~alusardi/Papers/American_Life_Panel.pdf; James J. Choi, David Laibson, and Brigitte C. Madrian, “$100 Bills on the Sidewalk: Suboptimal Investment in 401(k) Plans,” The Review of Economics and Statistics 93, no. 3 (2011): 748–63, http://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00100#.V-1jyfkrLbY; James J. Choi, David Laibson, and Brigitte C. Madrian, “Why Does the Law of One Price Fail? An Experiment on Index Mutual Funds,” The Review of Financial Studies 23, no. 4 (2010): 1405–32, http://dx.doi.org/10.1093/rfs/hhp097; Shlomo Benartzi and Richard H. Thaler, “Naive Diversification Strategies in Defined Contribution Saving Plans,” The American Economic Review 91, no. 1 (2001): 79–98), https://www.aeaweb.org/articles?id=10.1257/aer.91.1.79; and Julie R. Agnew, “Inefficient Choices in 401(k) Plans: Evidence From Individual Level Data” (doctoral dissertation, College of William and Mary, 2001), http://media.terry.uga.edu/documents/finance/1111.pdf.

- Roderick B. Crane, Michael Heller, and Paul Yakoboski, Defined Contribution Pension Plans in the Public Sector: A Best Practice Benchmark Analysis, TIAA-CREF Institute (2008), https://www.tiaainstitute.org/public/pdf/institute/pdf/DCPlansinPublicSectorCraneHellerandYako.pdf; and Paula Sanford and Joshua M. Franzel, The Evolving Role of Defined Contribution Plans in the Public Sector, Arthur N. Caple Foundation and the National Association of Government Defined Contribution Administrators (2012), http://www.nagdca.org/portals/45/ANC_NAGDCA_SLGE_The_Evolving_Role_of_Defined_Contribution_Plans_in_the_Public_Sector2.pdf.

- State of Rhode Island, “Your Retirement Benefits,” http://www1.tiaa-cref.org/tcm/ri/plans/plan1/investment-choices/index.htm.

- Vanguard Group Inc., “Vanguard Target Retirement 2060 Trust II,” fact sheet, Sept. 30, 2016, https://institutional.vanguard.com/iippdf/pdfs/FS1693.pdf; and Vanguard Group Inc., “Vanguard Target Retirement 2010 Trust II,” fact sheet, Sept. 30, 2016, https://institutional.vanguard.com/iippdf/pdfs/FS1472.pdf.

- Aon Hewitt, “2012 Universe Benchmarks Highlights: Measuring Employee Savings and Investing Behavior in Defined Contribution Plans” (2012), http://www.aon.com/attachments/human-capital-consulting/2012_Universe_Benchmarks_Highlights.pdf; Josh B. McGee, Defined-Contribution Pensions Are Cost-Effective, Manhattan Institute (2015), http://www.manhattan-institute.org/pdf/cr_100.pdf; Jeffrey R. Brown and Scott J. Weisbenner, “Defined Contribution Plans as a Foundation for Retirement Security,” The Journal of Retirement 1, no. 4 (2014): 22–45, http://www.iijournals.com/doi/abs/10.3905/jor.2014.1.4.022?journalCode=jor; and Jack VanDerhei et al., “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2013,” Employee Benefit Research Institute (2014), https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Documents/EBRI_IB_408_Dec14.401_28k_29-update.pdf.

- Vanguard, “Target-Date Fund Adoption in 2014,” (2015), https://institutional.vanguard.com/VGApp/iip/site/institutional/researchcommentary/article/InvResTDFundAdoption2014; and Brown and Weisbenner, “Defined Contribution Plans.”

- National Association of Government Defined Contribution Administrators Inc., “Target Date Funds” (2014), http://www.nagdca.org/dnn/Portals/45/Publications/Issues/NAGDCA_2014%20Target%20Date%20Funds.pdf.

- McGee, Defined-Contribution Pensions.

- U.S. Securities and Exchange Commission, “Investor Bulletin: How Fees and Expenses Affect Your Investment Portfolio,” accessed June 8, 2016, https://www.sec.gov/investor/alerts/ib_fees_expenses.pdf.

- Alex Frino and David R. Gallagher, “Tracking S&P 500 Index Funds,” Journal of Portfolio Management 28, no. 1: (2001): 44–55, http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.199.4563&rep=rep1&type=pdf; Donald R. Lichtenstein, Patrick Kaufmann, and Sanjai Bhagat, “Why Consumers Choose Managed Mutual Funds Over Index Funds: Hypotheses From Consumer Behavior,” The Journal of Consumer Affairs 33, no. 1 (1999): 187–205, https://www.jstor.org/stable/23859904?seq=1#page_scan_tab_contents; Christopher B. Philips et al., “The Case for Index-Fund Investing,” Vanguard Group Inc. (April 2014), https://pressroom.vanguard.com/nonindexed/Updated_The_Case_for_Index_Fund_Investing_4.9.2014.pdf; and Richard A. Ferri, and Alex C. Benke, A Case for Index Fund Portfolios: Investors Holding Only Index Funds Have a Better Chance for Success (2013), https://d9l6g2vjiqrcr.cloudfront.net/documents/BMT-PS_Whitepaper.pdf.

- McGee, Defined-Contribution Pensions.

- Ibid.

- Washington State Department of Retirement Systems, “Plan 3 Fund Descriptions,” accessed May 9, 2016, https://savewithwa.empower-retirement.com/preLoginContentLink.do?accu=DRSWR&contentUrl=preLogin.Tab5.E&specificBundle=preLogin.

- Massachusetts Deferred Compensation SMART Plan, “Fund Overview: Target Date,” accessed May 11, 2016, https://mass-smart.gwrs.com/wrFundOverview.do?accu=MassachusettsWR&groupID=98966-01&db=pnp.

- Crane, Heller, and Yakoboski, Defined Contribution Pension Plans; and Sheena S. Iyengar, Wei Jiang, and Gur Huberman, “How Much Choice Is Too Much? Contributions to 401(k) Retirement Plans,” in Pension Design and Structure, eds. Olivia Mitchell and Stephen Utkus (Oxford, U.K.: Oxford University Press, 2004).

- James Choi et al., “Defined Contribution Pensions: Plan Rules, Participant Choices, and the Path of Least Resistance,” in Tax Policy and the Economy, Volume 16, ed. James M. Poterba (Cambridge, MA: MIT Press, 2002); James Choi et al., “For Better or for Worse: Default Effects and 401(k) Savings Behavior,” in Perspectives on the Economics of Aging, ed. David A. Wise (Chicago: University of Chicago Press, 2001), http://www.nber.org/chapters/c10341.pdf; Julie Agnew and Lisa R. Szykman, Asset Allocation and Information Overload: The Influence of Information Display, Asset Choice, and Investor Experience, Center for Retirement Research, Boston College (2004), http://crr.bc.edu/wp-content/uploads/2004/05/wp_2004-151.pdf.

- Hendrik Cronqvist and Richard H. Thaler, “Design Choices in Privatized Social Security Systems: Learning From the Swedish Experience,” American Economic Review 94 no. 2 (2004): 424–8, http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.174.3079&rep=rep1&type=pdf.

- Washington State Department of Retirement Systems, “Frequently Asked Questions,” accessed May 9, 2016, https://savewithwa.empower-retirement.com/preLoginContentLink.do?accu=DRSWR&contentUrl=preLogin.Tab2.A&specificBundle=preLogin#QA03; Tennessee Department of Treasury, “Hybrid Plan,” accessed May 23, 2016, http://treasury.tn.gov/tcrs; Colorado Public Employees’ Retirement Association, “Your PERA Benefits” (July 2015), https://www.copera.org/sites/default/files/documents/5-113.pdf; Florida Retirement System, “Investment Funds You Can Choose,” accessed May 24, 2016, https://www.myfrs.com/InvestmentFundTabs.htm; and Indiana Public Retirement System, “My Choice: Retirement Savings Plan,” accessed May 26, 2016, http://www.in.gov/inprs/2764.htm.

- Vanguard Group Inc., “Target-Date Fund Adoption in 2014” (2015), http://institutionalinvestor.com/images/416/TDFAD_032015.pdf.

- Thrift Savings Plan, “G Fund: Government Securities Investment Fund,” accessed May 10, 2016, https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_G.html; Kellie Lunney, “Congress Approves Changing TSP Default Settings to More Lucrative Funds,” Government Executive, Dec. 11, 2014, http://www.govexec.com/pay-benefits/2014/12/congress-approves-changing-tsp-default-settings-more-lucrative-funds/101049.

- Ibid.; and Federal Retirement Thrift Investment Board, “TSP Bulletin for Agency TSP Representatives: Bulletin 15-2,” https://www.tsp.gov/PDF/bulletins/15-02.html.

- Indiana Public Retirement System, “Guaranteed Fund,” accessed Oct. 20, 2016, http://www.in.gov/inprs/files/INPRSGuaranteedFund.pdf.

- Oregon Public Employees Retirement System, “Tell Me About My PERS Benefits,” accessed May 13, 2016, http://www.oregon.gov/pers/mem/docs/new_member%20_brochure.pdf.