Paths to Balancing Flexibility and Guaranteed Income for Retired Public Employees

Policymakers should carefully consider the role distribution options play in retirement security

© Getty Images

© Getty ImagesBy providing simple, constructive guidance and education, plan sponsors can help workers make sound decisions for managing income after retirement.

Overview

Most state and local public workers are members of defined benefit (DB) pension plans, but many also have access to defined contribution (DC) plans, similar to private sector 401(k) accounts. These defined contribution accounts can be components of hybrid retirement plans that provide workers both a defined benefit and a defined contribution plan; supplemental plans offered in addition to defined benefit pensions; or alternatives to traditional defined benefit plans for university employees and other public workers.1 When millions of public employees retire, they rely, in part, on savings from these individual defined contribution savings accounts, rather than solely on Social Security and lifetime payments from defined benefit employer-based pensions.

Workers with individual savings accounts must decide how to invest their money and then, once they retire, how to draw down their savings. Policymakers and government plan sponsors can help employees by offering investment options that maximize savings during the working years and by providing distribution options that support secure retirements. The distribution options that sponsors can consider are the focus of this brief.

Annuitization and systematic withdrawal plans (SWPs), also referred to as “safe withdrawal rate plans,” provide two methods to balance the need for flexibility and guaranteed income after retirement. Plan sponsors, such as states, can simplify the task of converting an employee’s savings into retirement income by offering these options and giving workers resources to help them understand the costs and benefits of each approach.

Key Terms and Definitions

Annuity: A contract between an individual (an annuitant) and a financial institution (such as an insurance company or pension fund), under which the individual pays a lump sum or makes a series of payments in return for a stream of income to begin immediately or at some future date. The regular payments are guaranteed for life (single life)—or, in exchange for a slightly lower income stream, the life of the annuitant and a spouse or another designated beneficiary (joint life).2 The payout may be a fixed, specified amount or may include an annual cost-of-living adjustment (COLA).

Annuity conversion factor: A factor used to convert a lump sum balance into a fixed stream of income (annuity payment or payout). The annuity conversion factor depends on a range of elements, including assumptions on mortality rates, and is sensitive to expected interest rates on funds prior to distribution.

Defined benefit (DB) plan: A plan in which the employer promises a specific amount of monthly retirement income based on a formula that typically takes into account the employee’s salary, years of service, and age.

Defined contribution (DC) plan: A plan in which retirement savings are based on accumulated employer and employee contributions and the investment returns on those contributions. Annual investment returns are generally based on actual asset returns.3 DC plans can provide workers with access to annuities upon retirement.

Longevity risk: The risk of an individual outliving accumulated retirement savings.

Partial annuitization: A retirement income strategy in which a portion of savings is used to purchase an annuity and the remaining assets are invested.

Rider: One of several optional features that are sometimes added to an annuity contract for additional fees. Common riders include COLAs, death benefits, or guaranteed minimum income benefits.

Systematic withdrawal plan: A retirement income strategy, sometimes referred to as a “safe withdrawal rate plan,” that can help determine the amount of retirement savings to be withdrawn annually to minimize the risk of outliving assets. The withdrawal rate is typically expressed as a percentage of initial portfolio value and will vary depending on portfolio asset allocation, the retirement savings balance, and life expectancy. Designed to ensure a predictable stream of income in retirement, systematic withdrawal rate strategies provide greater flexibility than annuities in allowing access to additional funds if needed, but they do not guarantee lifetime income. Distribution levels can vary over time, depending on the market performance of the invested balance.

Why employers offer annuities and systematic withdrawal rate plans

Annuitization and systematic withdrawal rate distribution plans provide alternatives to workers besides lump sum withdrawals at retirement. Workers who opt for these lump sum payments may find managing these sometimes significant assets difficult. Each option has its advantages for workers, and the best distribution strategy typically depends on the type of retirement plan and individual circumstances.4 By offering employees education and support, plan sponsors can help workers make informed choices about how much should be allocated to either option.

Annuities provide workers with guaranteed lifetime income throughout retirement. By offering annuities as part of a state or local retirement system, employers can help workers attain a higher annuity payout or price quote—the stream of payments an annuity provider promises to deliver in exchange for a lump sum payment—than employees could receive in the individual annuity market. That helps to ensure they have enough income after their working years.5 Furthermore, by providing annuities through the plan, employers can reduce the chance for errors or mistakes by retirees and help protect employee assets from fraud.6 When the primary retirement plan is a defined contribution account instead of a defined benefit pension, sponsors can consider making an annuity or partial annuity the default option at retirement. That can give workers access to lifetime benefits and help ensure guaranteed income for basic living expenses.

Systematic withdrawal rate plans can provide guidelines to workers unsure of how much to withdraw each year, but with greater access to savings than annuities. For retirement plans that already provide a substantial amount of guaranteed income, such as a hybrid plan paired with a Social Security benefit, plan sponsors may consider establishing the safe withdrawal rate option as the default distribution strategy because it provides workers with a payment stream to cover discretionary expenses and access to their money in case of emergency.7 In fact, recent research on behavioral economics indicates that for workers with two sources of annuity income—such as Social Security and a defined benefit plan—maintaining some flexibility for discretionary spending from defined contribution savings can be advantageous.8

How do annuities work?

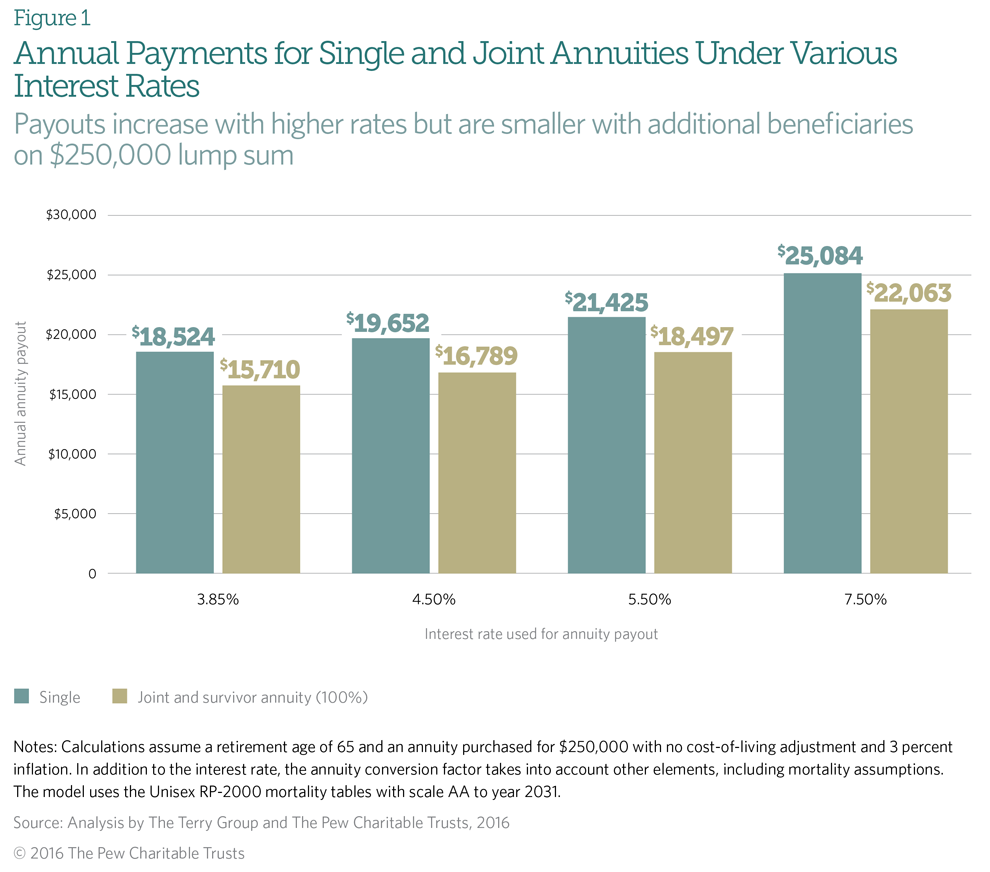

Annuities are designed to provide an individual, and sometimes also a selected beneficiary, with a guaranteed lifetime stream of secure income. An annuity conversion factor—the rate used to convert a lump sum into annuity payments—determines how large those payments will be based on interest rates, the type of annuity, and life expectancy.9 So, for example, retirees receive a smaller benefit if they purchase an annuity that starts paying out earlier in life; if providers expect the interest rate earned on the funds to be low; or if the annuitant selects a beneficiary, such as a spouse, to continue to receive benefits after death. The following figure illustrates how the assumed interest rate used in the annuity conversion factor affects annuity payments for single and joint/survivor annuities for a 65-year-old retiree with a lump sum retirement savings of $250,000.

Annuities come in multiple variations but are usually structured around two factors: payment start date and number of beneficiaries.

Under an immediate annuity, monthly payments begin right away. With a deferred annuity, monthly payments start at a specified future time, often because the employee is still working when the annuity is purchased. In other instances, payments begin when the beneficiary reaches a specified age, such as 75 or 85. In nearly all cases, delaying the start of payments yields a higher annuity payout for a given lump sum payment.

The annual payment size also depends on whether benefits last for one lifetime (single life) or two (joint life).

Retirees can get a guaranteed lifetime income stream with an annuity, but research shows that many remain hesitant because of concerns about limited access to their retirement savings, even in cases where annuities would suit their retirement needs.10 In general, individuals cannot access money invested in an annuity for emergencies or major expenses without paying significant fees. Annuities can also limit options for bequeathing assets.11 For these reasons, people are often more open to partial annuitization, or combining an annuity with another distribution option instead of choosing a single approach.12 Effective education by plan sponsors can help workers select the mix that best suits their needs.

State universities, Washington, and Rhode Island provide various examples of annuity programs

Plan sponsors can offer annuities administered either directly by a state retirement system or through an external insurance or financial services company. Most state university defined contribution plans, as well as hybrid plans for state workers in Rhode Island and Washington, illustrate several possible arrangements.

Almost all states have a DC plan option for state university employees that includes access to annuities. Teachers Insurance and Annuity Association of America (TIAA) is the market leader in administering these plans and typically offers members two ways to get an annuity: They can contribute to one while working, or they can convert other assets into an annuity at retirement. The option to contribute to an annuity while working may appeal to some workers because the annuity won’t decline in value, while it also provides diversification and stability to an investment portfolio of stocks and bonds.

In 2011, Rhode Island adopted a hybrid plan for state workers and teachers that included a defined contribution component, which the state selected TIAA to administer. As with the TIAA-administered plans for universities, employees can use their defined contribution account at retirement to purchase an annuity at a group rate.13 As of 2015, interest rates were between 3 and 4 percent.14

The Washington State Department of Retirement Systems allows workers to purchase annuities administered either through the plan or through a third-party insurance company. By offering annuities directly from the retirement system, the state can provide employees above-market annuity conversion factors.15 Workers can choose single life or joint life annuity contracts; both come with an automatic annual cost-of-living adjustment of 3 percent for payments.

How do systematic withdrawal plans work?

A systematic withdrawal plan helps workers determine how much they can spend each year after retirement to reduce the risk that they will outlive their savings.16 In contrast to an annuity, a safe withdrawal rate plan does not guarantee a lifetime income stream; it provides a plan for drawing down assets during the expected lifespan of the retiree and any beneficiary. If workers already have significant lifetime income—through Social Security and a defined benefit pension or the DB component of a hybrid plan, for example—a safe withdrawal rate plan for the additional defined contribution account can help balance longevity risk with spending flexibility.

Systematic withdrawal rate plans vary to accommodate differing time horizons with employee risk tolerances and spending needs. One common approach, known as the “4 percent rule,” allows retirees to withdraw 4 percent of the initial value of their retirement savings the first year and then continue withdrawing the original amount in subsequent years plus a compounded inflation adjustment.17 Other methods include starting withdrawals at a certain percentage and increasing or decreasing that rate based on market performance, following the IRS required minimum distribution rules for tax-deferred retirement accounts, or investing savings in a mutual fund designed to manage the payout of retirement assets.18

These plans offer employees a disciplined way to spend down retirement savings while providing flexibility and the ability to adjust as their preferences or circumstances change. Individuals can access these savings for emergency costs or larger expenditures. Furthermore, to help protect against inflation, many plans often invest a portion of the retirement portfolio in stocks.19 Still, unlike an annuity, the income stream is not guaranteed, and individuals may need to reduce their spending if markets perform poorly over long periods. In addition, individuals may have difficulty adhering to their plans if the value of assets declines in downward economic cycles.20

Conclusion

There is no one-size-fits-all approach when considering combinations of annuities and safe withdrawal plans. Plan sponsors can select the strategies that best suit their participants’ needs. The value of any pension system depends on its ability to offer workers retirement security. Well-designed distribution options provide retirees with the tools needed to responsibly draw down their assets.

By providing simple, constructive guidance and education, plan sponsors can help workers make sound decisions for managing income after retirement. As more workers enroll in hybrid and defined contribution plans, annuities and safe withdrawal rate plans can help them spend down their savings in a reasonable and prudent manner.

Endnotes

- U.S. Bureau of Labor Statistics, “Program Perspectives: State and Local Government Benefits,” accessed Feb. 9, 2016, http://www.bls.gov/opub/btn/archive/program-perspectives-on-state-and-local-government-benefits-pdf.pdf.

- Annuity payments can also be set to pay out over a definite period of time, such as 10 or 20 years; but in this brief, annuities refer only to lifetime income.

- Defined contribution plans can be designed in a fund that guarantees a fixed rate of return. Teachers’ Retirement System of the City of New York, “TDA Program Summary: Tax-Deferred Annuity Program.” https://www.trsnyc.org/ASPENMemberPro/WebContent/publications/ tdaBook.pdf.

- Steve Vernon, Wade Pfau, and Joe Tomlinson, “Optimizing Retirement Income Solutions in DC Retirement Plans—Phase 1: Baseline, Interim Results, and Commentary,” Stanford Center on Longevity (2015), http://longevity3.stanford.edu/wp-content/uploads/2015/12/Optimal-ret-solutions-Phase-1-final-interim-July-SCL-logo.pdf. Research from the Stanford Center on Longevity generally recommends a portfolio income approach, which involves building a floor of guaranteed lifetime income from annuities, pensions, and Social Security, with the remainder invested mainly in stocks with a safe withdrawal rate plan.

- Michael J. Brien and Constantijn W.A. Panis, “Annuities in the Context of Defined Contribution Plans,” U.S. Department of Labor, Employee Benefits Security Administration (2011), https://www.dol.gov/ebsa/pdf/deloitte2011.pdf. While workers can also purchase an annuity independently, public employers can typically arrange lower-cost annuities, either by offering annuities directly or by providing a negotiated group rate with a provider. On the private market, annuities often have high administrative costs due in part to adverse selection or the tendency of people buying annuities to have longer-than-average life expectancies.

- Steve Vernon, “The Next Evolution in Defined Contribution Retirement Plan Design: A Guide for DC Plan Sponsors to Implementing Retirement Income Programs,” Stanford Center on Longevity (2013), http://longevity3.stanford.edu/wp-content/uploads/2015/12/SOA1.pdf.

- John Beshears et al., “Defined Contribution Savings Plans in the Public Sector: Lessons From Behavioral Economics,” National Bureau of Economic Research (2010), http://scholar.harvard.edu/files/laibson/files/defined_contribution_savings_ plans_in_the_public_sector_lessons_from_behavioral_economics.pdf?m=1360042598; Paula Sanford and Joshua M. Franzel, “The Evolving Role of Defined Contribution Plans in the Public Sector,” Arthur N. Caple Foundation and the National Association of Government Defined Contribution Administrators (2012), http://www.nagdca.org/dnn/Portals/45/ANC_NAGDCA_SLGE_The_Evolving _Role_of_Defined_Contribution_Plans_in_the_Public_Sector2.pdf.

- John Beshears et al., “Liquidity in Retirement Savings Systems: An International Comparison,” American Economic Review 105, no. 5 (2015): 420–25, https://www.aeaweb.org/articles?id=10.1257/aer.p20151004.

- To provide inflation protection, annuity providers sometimes offer a lower initial payout that annually adjusts at a rate designed to track increases in the cost of living, usually between 2 and 3 percent.

- J. Mark Iwry and John A. Turner, “Automatic Annuitization: New Behavioral Strategies for Expanding Lifetime Income in 401(k)s,” The Retirement Security Project (2009), http://www.brookings.edu/~/media/research/files/papers/2010/1/07-annuitization-iwry/07_annuitization_iwry.pdf.

- Christopher Farrell, “Annuities as an Alternative to Shaky Markets? Not So Fast,” The New York Times, Jan. 29, 2016, http://www.nytimes.com/2016/01/30/your-money/annuities-as-an-alternative-to-shaky-markets-not-so-fast.html?_r=0.

- John Beshears et al., “What Makes Annuitization More Appealing?” Journal of Public Economics 116 (2014): 2–16. Survey of individuals ages 50-75 found that respondents were more open to annuitizing a portion of their wealth relative to situations where annuitization was framed as an “all or nothing” decision.

- TIAA-CREF, “State of Rhode Island Defined Contribution Retirement Plan,” accessed Feb. 9, 2016, http://www.tiaa-cref.org/ucm/groups/content/@ap_ucm_p_mcr_auth/documents/document/ tiaa04044648.pdf.

- TIAA-CREF, “Mutual Funds and In-Plan Annuities,” accessed March 23, 2016, https://www.tiaa-cref.org/public/tcfpi/InvestResearch.

- Annuity payments for Washington public workers are determined by an annuity factor that is based on age and plan type. The annuity factors the Washington State Department of Retirement Services uses generally result in a higher monthly benefit than what people receive on the individual market. For example, at a cost of $100,000 for a single life annuity with a 3 percent annual cost-of-living adjustment, a 65-year-old female Washington state employee would receive a monthly payment of $698. At the same cost with the same features, this same person would receive a benefit ranging from $335 to $387 on the individual market in January 2016. Washington State Department of Retirement Systems, “PSC Actuarial,” accessed Feb. 9, 2016, http://www.drs.wa.gov/publications/member/multisystem/ pscactuarial.htm; Annuity Shopper, “Annuity Shopper Buyer’s Guide,” accessed March 23, 2016, https://www.immediateannuities.com/pdfs/as/annuity-shopper-2016-01.pdf.

- Generally, a withdrawal rate is considered sustainable if the strategy does not greatly risk depleting retirement assets for at least 30 years, but individuals retiring later in life may use a shorter time horizon.

- William P. Bengen, “Determining Withdrawal Rates Using Historical Data,” Journal of Financial Planning 17, no. 3 (1994). The strategy also requires an allocation to stock index funds between 50 and 75 percent.

- Wade D. Pfau, “Making Sense Out of Variable Spending Strategies for Retirees,” Journal of Financial Planning 28, no. 10 (2015): 42–51.

- For example, under the Vanguard Managed Payout Fund, an example of an SWP, the asset allocation includes 61 percent stocks. Vanguard, “Vanguard Managed Payout Fund,” last modified May 31, 2016, https://personal.vanguard.com/us/funds/snapshot?FundId=1498&FundIntExt=INT#tab=2.

- Ravindra Jain, Prachi Jain, and Cherry Jain, “Behavioral Biases in the Decision-Making of Individual Investors,” IUP Journal of Management Research 14, no. 3 (2015): 2–27.