State Strategies for Detecting Fiscal Distress in Local Governments

Study shows how states monitor the fiscal health of localities

© Getty Images

© Getty ImagesState policymakers have a critical stake in ensuring the fiscal health of local governments.

This fact sheet was updated in September 2016 to clarify Tennessee’s classification as an “early warning” state.

As local governments across the country struggle to resolve budgetary challenges, some states are exploring ways to help their counties, cities, towns, and villages avoid defaulting on loans or filing for bankruptcy.

Local governments are grappling with growing liabilities, including pensions and other post-employment benefits,1 as well as costly infrastructure needs2 and reduced state and federal aid.3 In many communities, revenue and spending have not returned to the levels seen just before the Great Recession began in 2007. In fact, as of 2015, only 7 percent of U.S. counties had recovered to pre-recession levels based on indicators analyzed by the National Association of Counties: jobs, unemployment rates, economic output, and median home prices.4 Even as the recovery has proved sluggish and uneven, the reality of the next downturn is beginning to loom. Although economists are divided on when that may occur,5 some local governments are beginning to plan for the next recession.

State policymakers have a critical stake in ensuring the fiscal health of local governments so that they can maintain essential services to residents and protect the vitality of their economies, which generate revenue for governments at all levels. County and municipal governments are ultimately the responsibilities of states. James Spiotto, an expert on municipal distress who has testified before Congress on the topic, said that although states do not necessarily take on the financial liabilities of local governments, they are ultimately responsible for the disposition of failed municipalities. In other words, Spiotto said: “The state is always going to be responsible if the local government fails. They’re the parent.”6

Despite this responsibility, many states historically have done little to track the budgetary well-being of local governments. The Pew Charitable Trusts’ report, “State Strategies to Detect Local Fiscal Distress,” looks at how states attempt to detect fiscal distress in local governments, or more generally assess the fiscal condition of localities. This fact sheet lays out the report’s basic findings and highlights common challenges and potential solutions.

Most states routinely collect documents such as audits, financial reports, and budgets from local governments, but less than half analyze this information to try to detect signs of fiscal distress or, more generally, take the fiscal pulse of localities. The reasons for this vary: Some states view these tasks as beyond their responsibility, some say they lack the money and staff, and others say they don’t have the legal authority to intervene even when distress is evident.

As many states have learned, however, taking a hands-off approach to local government fiscal health can lead to costly surprises. Several localities have gained nationwide attention after seeking bankruptcy protection in recent years, including Detroit; Jefferson County, Alabama; Stockton, California; and Central Falls, Rhode Island. In addition, the threat of default and possible bankruptcy is looming in Atlantic City, New Jersey. In the case of Detroit, the state of Michigan spent $195 million from its rainy day fund to help the city exit bankruptcy.

In general, however, insolvencies remain relatively rare: Over the past 60 years, only 64 counties, cities, towns, and villages have filed for bankruptcy, according to Spiotto.7 That is in part by design: 21 states do not allow local governments to file for bankruptcy, while several others place conditions on these filings.8

Although local government bankruptcies are not a widespread problem, many localities struggle to meet the needs of their residents. There are myriad examples of municipalities and counties in serious enough fiscal distress to erode critical services and hamper the community’s ability to thrive.

States can do more than just wait to react to the next fiscal emergency; they can work proactively to detect local distress. In 2013, Pew explored how and when states intervene in local governments in “The State Role in Local Government Financial Distress.”9 The report described the stages of municipal difficulty, from distress to crisis to bankruptcy; the reasons for state intervention; and various approaches states can take, including refusing to become involved even when local governments ask for help, intervening on a case-by-case basis, and repeatedly exercising their authority to make decisions for local governments. The report recommended that states monitor the fiscal conditions of local governments with an eye toward helping them avoid full-blown crises, if possible.

Pew has studied the range of policies and practices that states have in place to assess and track fiscal conditions at the local level, with a focus on whether and how states try to detect signs of local fiscal distress. To operate a “fiscal monitoring system” for purposes of this research, a state must actively and regularly review the finances of its general purpose local governments to monitor fiscal conditions or detect problems.10 Researchers interviewed officials in every state and analyzed relevant statutes. To learn about the issue from the perspective of local governments, researchers also talked with officials from municipal leagues across the country. These efforts add up to the most comprehensive study of fiscal monitoring across the country to date.

Pew’s research found:

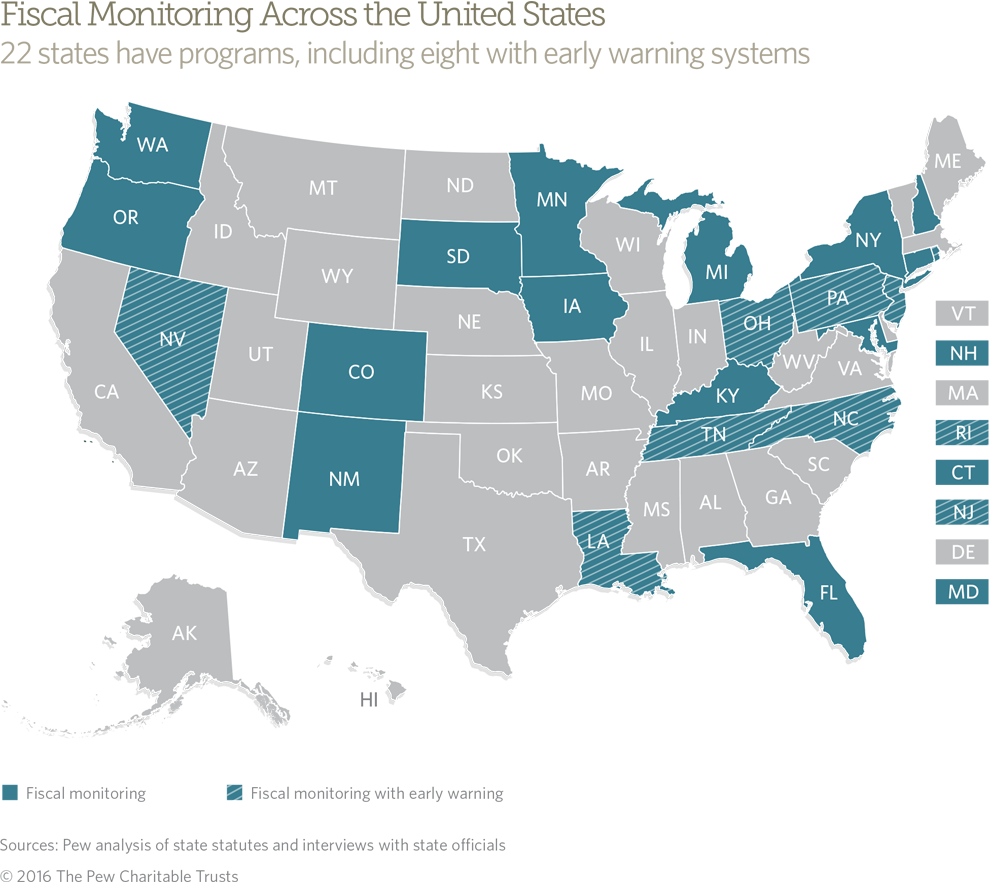

- Twenty-two states11 make some effort to monitor the fiscal health of local governments, meaning that they actively and regularly review financial information from local governments with the aim of trying to detect fiscal distress or, more generally, assessing the fiscal condition.

- Of the 22, eight can be classified as “early warning” states, meaning that they have laws defining when local governments are in fiscal distress and systems to identify signs that a locality is declining toward such a condition.12

- State efforts to monitor local government fiscal health vary widely in terms of scope, frequency, responsibility for the work, and options available to deal with fiscal distress, among other factors.

Some state officials may feel that they have little reason to worry about the fiscal health of their local governments: A number of them said municipal distress is not an issue in their state, citing fiscally conservative cultures or mechanisms in place to ensure local fiscal health, such as limits on taxes, expenditures, and borrowing. The reality, however, is that a record of fiscally healthy local governments cannot guarantee what will happen in the future. One Rhode Island official said the Central Falls bankruptcy “was certainly a wake-up call, too, for everyone. … Before, no one really envisioned a municipality going bankrupt.”13

Just as governments at all levels learned from previous crises, states have an opportunity to re-examine their roles in helping local governments avoid or grapple with fiscal distress. That would follow the model set when the Great Depression prompted New Jersey and North Carolina to adopt rigorous local oversight systems in the 1930s, and the financial crises of the 1970s and 1980s in cities such as Cleveland, New York, and Philadelphia spurred initiatives in multiple states.

As many local governments struggle to adjust to the reality of decreased revenue and increased costs, several states—including New York, Rhode Island, and Tennessee—have either adopted fiscal monitoring systems or strengthened existing ones in recent years. Ohio and Colorado are considering strengthening their systems to detect and deal with fiscal distress. For states that want to figure out how local governments are faring and whether any may be headed for fiscal crisis, Pew’s upcoming report will describe the fiscal monitoring landscape across the country.

Challenges and solutions

The 22 states take various approaches to detect fiscal distress in local governments, depending on their contexts and needs. Pew identified promising responses to the challenges of local fiscal distress for states to consider when developing new fiscal monitoring systems or strengthening existing ones.

Challenge: Learning about fiscal distress too late.

States that try to detect fiscal distress by reviewing audits once a year will inevitably learn about problems after they have developed, rather than as they are emerging.

Solution: States check in with local governments on a frequent and regular basis to try to detect distress earlier. Reviewing budgets prospectively, along with recent financial statements, can help states stay ahead of the curve.

The earlier that states learn of fiscal distress, the sooner they can help—and the less they may need to become involved in the long run. Several states analyze local government budgets for signs of fiscal distress, giving them a sense of what may be ahead instead of what has already occurred. Detecting problems early also reduces the risk of a budget surprise when state officials determine that they must provide direct aid to a local government or ensure that a debt payment is made on time.

Challenge: Inconsistent monitoring when procedures are informal and not codified in statute.

In some states, fiscal monitoring occurs solely because of the initiative of individuals interested in staying ahead of the problems caused by local distress. Procedures for detecting such distress can rely heavily on the experience of those charged with examining the financial health of local governments.

Solution: Formalize monitoring policies and procedures to promote consistency, transparency, and predictability for local government officials and the public.

Codifying fiscal monitoring in statute can help ensure that a state remains committed to both detecting fiscal distress and helping local governments, regardless of administration changes or tight budgets. That said, monitoring systems should remain flexible to adapt to the changing needs of states and local governments. Establishing specific indicators for state review can help ensure that fiscal monitoring happens consistently year after year and across all municipalities.

Challenge: Tensions between state and local government officials.

State efforts to monitor local governments for fiscal distress can lead to tensions between state and local officials. In some instances, local governments may resist fiscal monitoring because they fear or do not want state oversight.

Solution: States can establish good working relationships with local governments.

Although state oversight can naturally lead to tensions, some states have succeeded in working with local governments cooperatively so that the jurisdictions view the state as a partner, not an enforcer. Among the effective strategies are:

- Hire personnel from local governments to staff state divisions dealing with counties and municipalities to help establish credibility for the state operation.

- Allow local governments a formal role in the monitoring process. In some states, municipal officials serve as members of commissions or boards that provide input to the state on monitoring processes or to other local governments in need of financial help.

- Emphasize training local government personnel to help prevent problems from occurring, instead of enforcement.

- Create frequent opportunities for state and local government officials to interact and have meaningful discussions about fiscal health to keep lines of communication open throughout the year, not just at audit time.

Challenge: Seeing intervention as the only response.

States that intervene in local fiscal crises but have few or no intermediate steps to help local governments may lack sufficient options.

Solution: Identify smaller steps to help local governments that stop short of intervention.

States can develop a range of options to help local governments at all levels of fiscal distress, from early warning signs to crisis. Providing technical assistance, working with local officials on their budgets, and training are common tools.

Conclusion

Pew’s study shows that states take a broad variety of approaches to monitoring and intervening in the fiscal health of local governments. Some tend not to step in even when cities are struggling to survive, while others are intimately aware of the fiscal activities of local entities. Fiscal monitoring systems vary according to the goals and contexts of each state, but a number of promising approaches can be applied broadly.

Although some local fiscal crises are truly unpredictable, states can play a critical role in ensuring that local governments remain as fiscally healthy as possible and that states know early when signs of fiscal distress emerge. As state and local governments prepare for the inevitable next downturn, lawmakers may want to consider adopting monitoring systems or strengthening existing ones so that they are less likely to be unpleasantly surprised when a local government struggles to pay its bills.

Endnotes

- The Pew Charitable Trusts, A Widening Gap in Cities: Shortfalls in Funding for Pensions and Retiree Health Care (2013), http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2013/ pewcitypensionsreportpdf.pdf.

- Andrew Flowers, “Why We Still Can’t Afford to Fix America’s Broken Infrastructure,” June 3, 2014, FiveThirtyEight, http://fivethirtyeight.com/features/why-we-still-cant-afford-to-fix-americas-broken-infrastructure/.

- Christiana McFarland and Michael A. Pagano, “City Fiscal Conditions 2015,” National League of Cities, http://www.nlc.org/Documents/Find%20City%20Solutions/Research Innovation/Finance/CSAR%20City%20Fiscal%20Conditions%202015 FINAL.pdf.

- Emilia Istrate and Brian Knudsen, “County Economics 2015: Opportunities and Challenges,” National Association of Counties (January 2016), http://www.naco.org/resources/county-economies-opportunities-challenges.

- Victoria Stilwell and Catarina Saraiva, “Here’s When Economists Expect to See the Next U.S. Recession,” Bloomberg, Sept. 11, 2015, http://www.bloomberg.com/news/articles/2015-09-11/here-s-when-economists-expect-to-see-the-next-u-s-recession.

- The Pew Charitable Trusts, interview with James Spiotto, Feb. 29, 2016.

- James Spiotto, “Is Chapter 9 Bankruptcy the Ultimate Remedy for Financially Distressed Territories and Sovereigns Such as Puerto Rico: Are There Better Resolution Mechanisms?,” statement to Senate Judiciary Committee, Dec. 1, 2015, http://www.chapmanstrategicadvisors.com/insights-publications-18.html.

- The Pew Charitable Trusts, The State Role in Local Government Financial Distress (July 2013), http://www.pewtrusts.org/en/research-and-analysis/reports/2013/07/23/the-state-role-in-local-government-financial-distress.

- Ibid.

- For this study, we excluded special purpose districts such as fire districts, as well as school districts, to narrow the scope of the work.

- The states are Colorado, Connecticut, Florida, Iowa, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, and Washington.

- The states are Louisiana, Nevada, New Jersey, North Carolina, Ohio, Pennsylvania, Rhode Island, and Tennessee.

- The Pew Charitable Trusts, interview with Susanne Greschner, chief of the Rhode Island Division of Municipal Finance, Sept. 17, 2015.

The State Role in Local Government Financial Distress

As cities confront financial challenges, states weigh whether to help them pull through

State Strategies to Detect Local Fiscal Distress

How states assess and monitor the financial health of local governments