The Trillion Dollar Gap: Wisconsin

Underfunded State Retirement Systems and the Roads to Reform

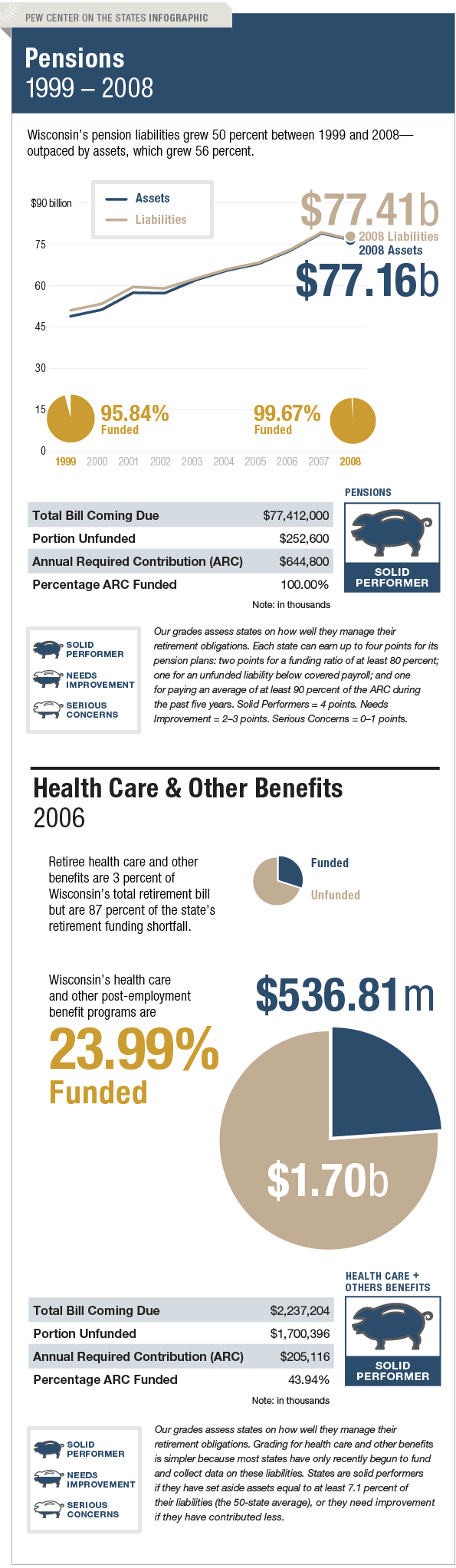

Wisconsin is a national leader in managing its long-term liabilities for both pensions and retiree health care and other benefits. It has funded nearly 100 percent of its total pension bill—well beyond the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—by consistently meeting its actuarially required contributions.

Wisconsin has developed a creative way to share some of the risk of investment volatility with employees, substituting a dividend process in lieu of standard cost-of-living increases. If the investment returns are positive in a year, the system can declare a dividend that is paid to retirees. But this is not guaranteed. If a good year is followed by one with poor investment returns, retirees can see their pensions reduced. In addition, Wisconsin has a relatively limited long-term liability of $2.2 billion for retiree health care and other benefits. It has set aside $536.8 million to cover that bill coming due.