The Trillion Dollar Gap: Utah

Underfunded State Retirement Systems and the Roads to Reform

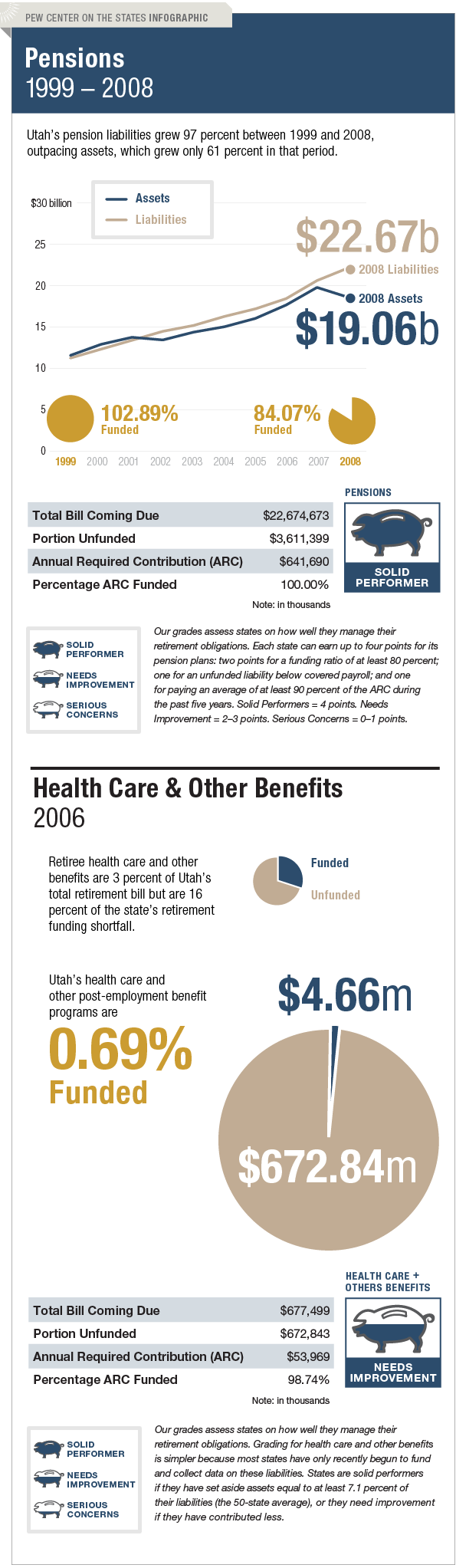

Utah is managing its long-term pension liability well, but it needs to improve how it handles the bill coming due for its retiree health care and other benefits. The state has funded 84 percent of its total pension bill—above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—and has consistently met its actuarially required contributions in recent years.

Because Utah conducts its actuarial valuations on December 31, the state's latest data reflect more of the impact of the financial crisis on pension fund investments than do states with actuarial valuations on June 30. Utah is one of several states to change its assumption of returns on its investments. In 2008, the state shifted from an 8 percent interest rate assumption to 7.75 percent.

Meanwhile, Utah has relatively limited long-term liabilities for retiree health care and other benefits—$677.5 million—but as of 2006 had set aside only $4.7 million to cover that bill coming due.