The Trillion Dollar Gap: Tennessee

Underfunded State Retirement Systems and the Roads to Reform

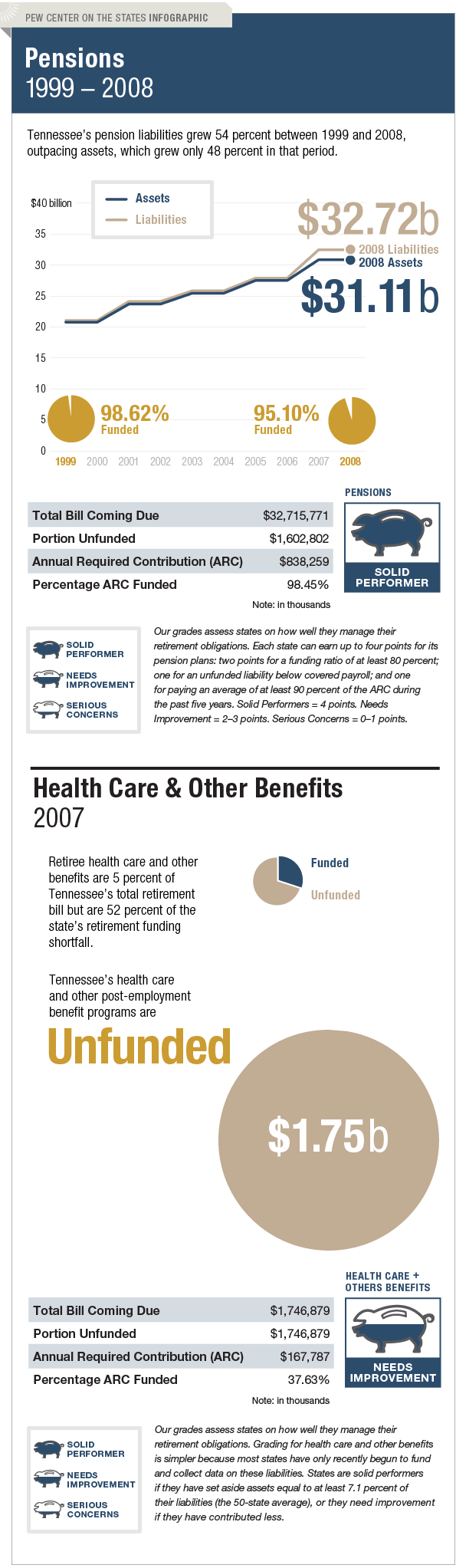

Tennessee is managing its long-term pension liability well, but needs to improve how it handles the bill coming due for retiree health care and other benefits. Tennessee consistently has been able to pay its actuarially required contribution and, as a result, it has funded 95 percent of its total pension bill—well beyond the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. This is due, in part, to its statutory obligation to meet actuarial contribution requirements.

Meanwhile, Tennessee has relatively limited long-term liabilities for retiree health care and other nonpension benefits—$1.7 billion—but the state has not set aside any funds to cover these costs.