The Trillion Dollar Gap: South Dakota

Underfunded State Retirement Systems and the Roads to Reform

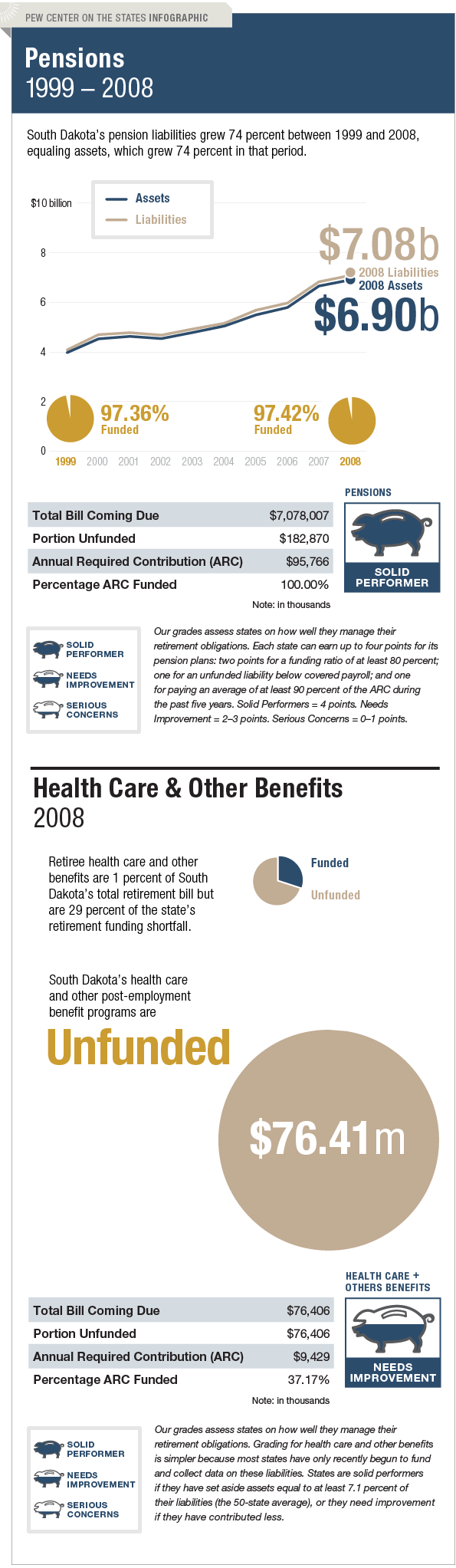

South Dakota is managing its long-term pension liability well, but needs to improve how it handles the bill coming due for retiree health care and other benefits. In fiscal year 2008, the Mount Rushmore State had the sixth-best funded pension system in the country: 97 percent of its liabilities were matched by assets, well beyond the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. Part of the reason is that the state has consistently met its actuarially required contribution levels. In 2006, South Dakota's legislature created a “level payment option” for employees who retire before they are eligible for Social Security. This allows for a steady income that provides more state money in the early years and less once Social Security kicks in. Meanwhile, South Dakota has very limited long-term liabilities for retiree health care and other benefits—$76.4 million. Still, it has set aside no assets to cover these costs.