The Trillion Dollar Gap: Pennsylvania

Underfunded State Retirement Systems and the Roads to Reform

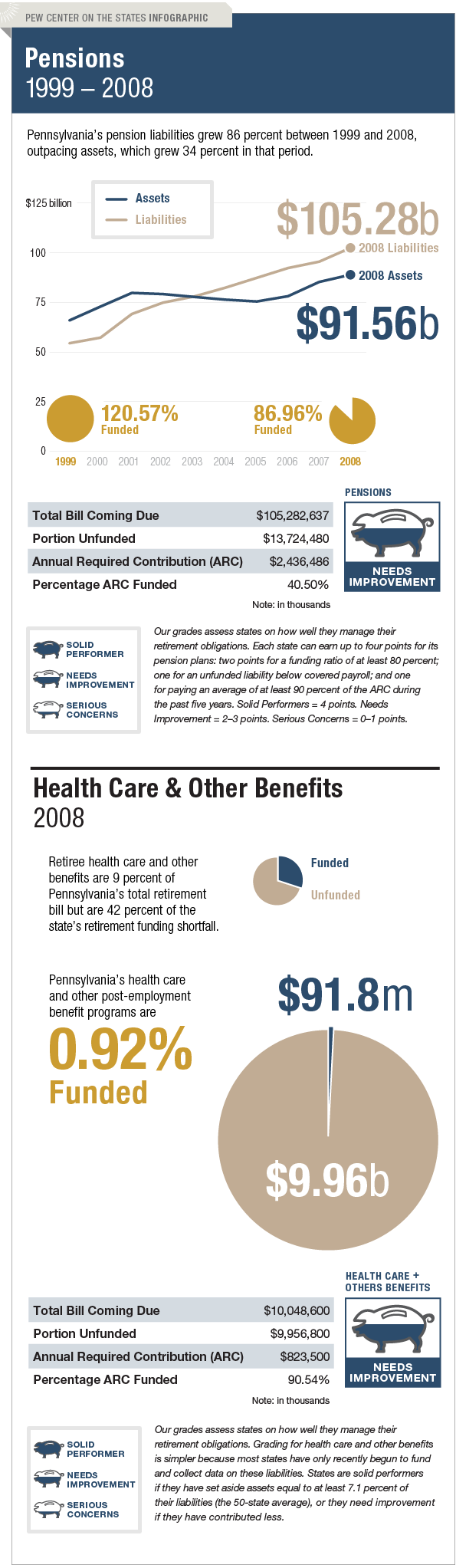

Pennsylvania needs to improve how it manages its long-term liabilities for both pensions and retiree health care and other benefits. The state has 87 percent of the funds needed to pay for its pension obligation—above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. But Pennsylvania has contributed less than half of its required contribution during the past four years, and the overall funding level has decreased significantly since 2000, when the Keystone State had 127 percent of what it needed to cover this bill coming due. In 2009, the Pennsylvania State Employees' Retirement System lowered its investment return assumption from 8.5 percent to 8 percent to be more realistic about its long-term funding needs. Meanwhile, Pennsylvania is one of 29 states with any assets set aside to cover its liability for retiree health care and other benefits, but only $91.8 million—less than 1 percent—of the total $10 billion bill coming due has been funded.