The Trillion Dollar Gap: North Carolina

Underfunded State Retirement Systems and the Roads to Reform

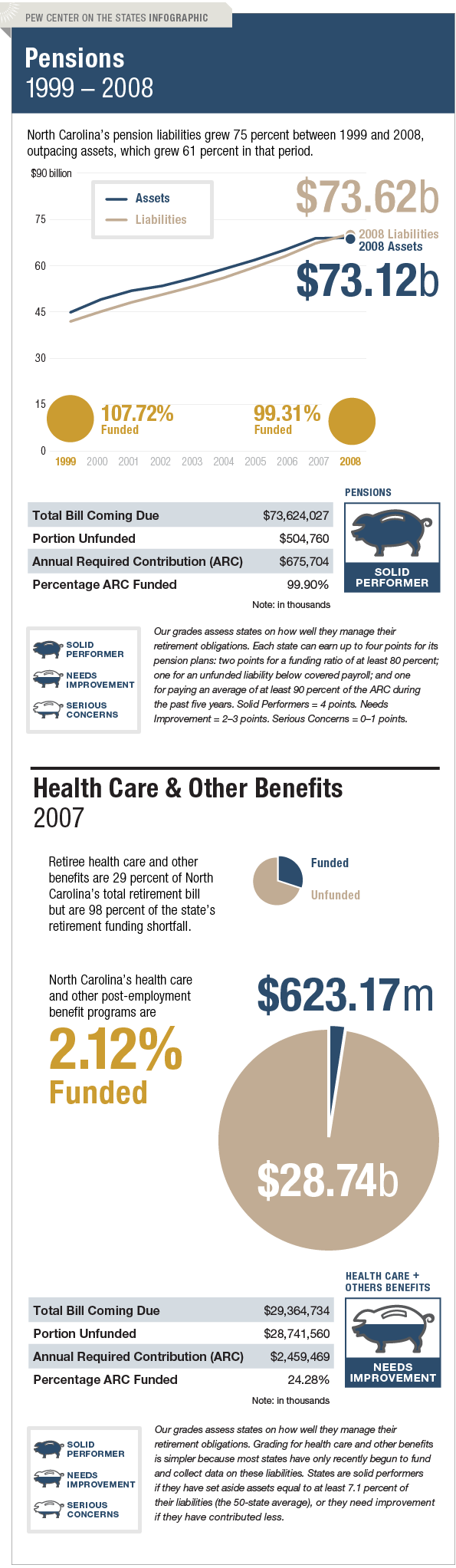

North Carolina is managing its long-term pension liability well, but the Tar Heel State needs to improve how it handles the bill coming due for retiree health care and other benefits. The state has more than 99 percent of its pension liabilities funded—well above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—and has consistently met or surpassed its actuarially required contribution levels during the past 12 years. North Carolina also has taken steps to prevent unaffordable benefit increases by requiring that every retirement-related bill contain actuarial notes from both the General Assembly's actuary and the North Carolina Retirement System. The state is one of 29 with any assets set aside to cover liabilities for retiree health care and other benefits, although it has socked away just 2 percent, or $623 million, of the total $29.4 billion long-term bill coming due.