The Trillion Dollar Gap: New York

Underfunded State Retirement Systems and the Roads to Reform

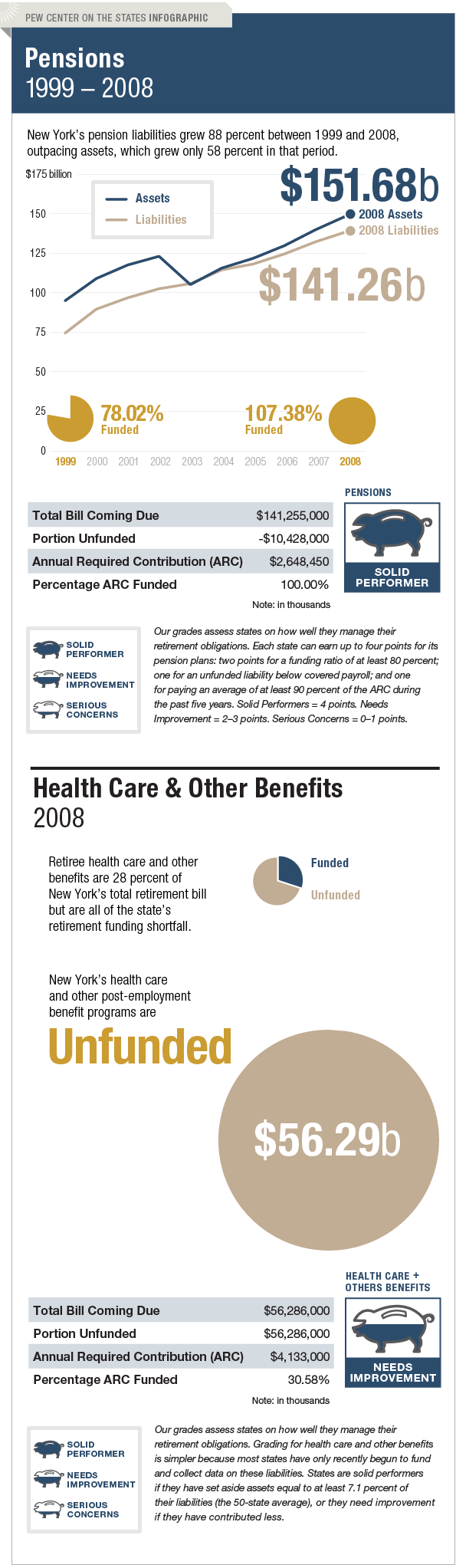

New York is a national leader in managing its long-term pension liability, but needs to improve how it handles the bill coming due for retiree health care and other benefits. The state has successfully met its actuarially required contribution level at least as far back as 1997. As a result, New York has the bestfunded pension system in the country at 107 percent. In 2009, New York enacted policy reforms, raising the retirement age of many new government workers to 62 from 55 and increasing employee contribution levels. Meanwhile, however, New York has failed to set aside any funds to cover a bill coming due of $56.3 billion over the long term for retiree health care and other non-pension benefits.