The Trillion Dollar Gap: New Jersey

Underfunded State Retirement Systems and the Roads to Reform

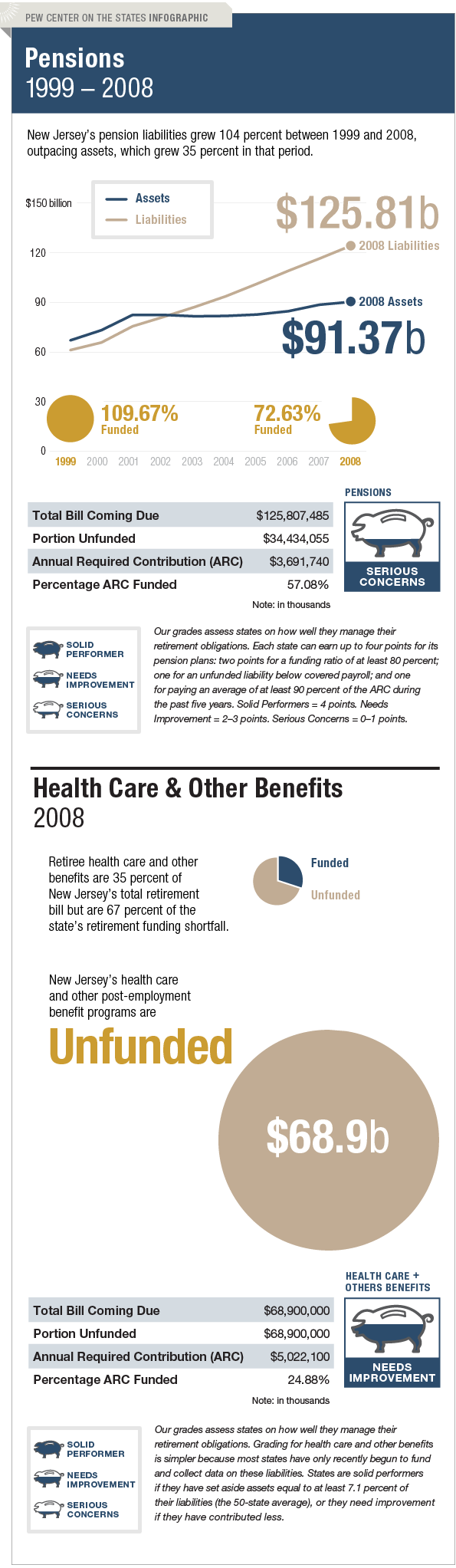

New Jersey's management of its long-term pension liability is cause for serious concern and the state needs to improve how it handles its retiree health care and other benefit obligations. New Jersey had a $7.5 billion pension surplus in 2000, but years of failing to fully meet the actuarially required contribution led to an unfunded liability of $34 billion in 2008. This has left the state's pension plans with only 73 percent of the assets needed, below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. In 2008, the legislature increased both the minimum eligibility age for retirement benefits and the salary threshold at which new hires can join the public employees and teachers' retirement systems. Meanwhile, New Jersey faces a $68.9 billion long-term liability for retiree health care and other benefits—one of the largest of any state—but has not set aside any assets to cover that obligation. In 2008, New Jersey took some initial steps to address this bill coming due by tightening the eligibility requirements.