The Trillion Dollar Gap: Minnesota

Underfunded State Retirement Systems and the Roads to Reform

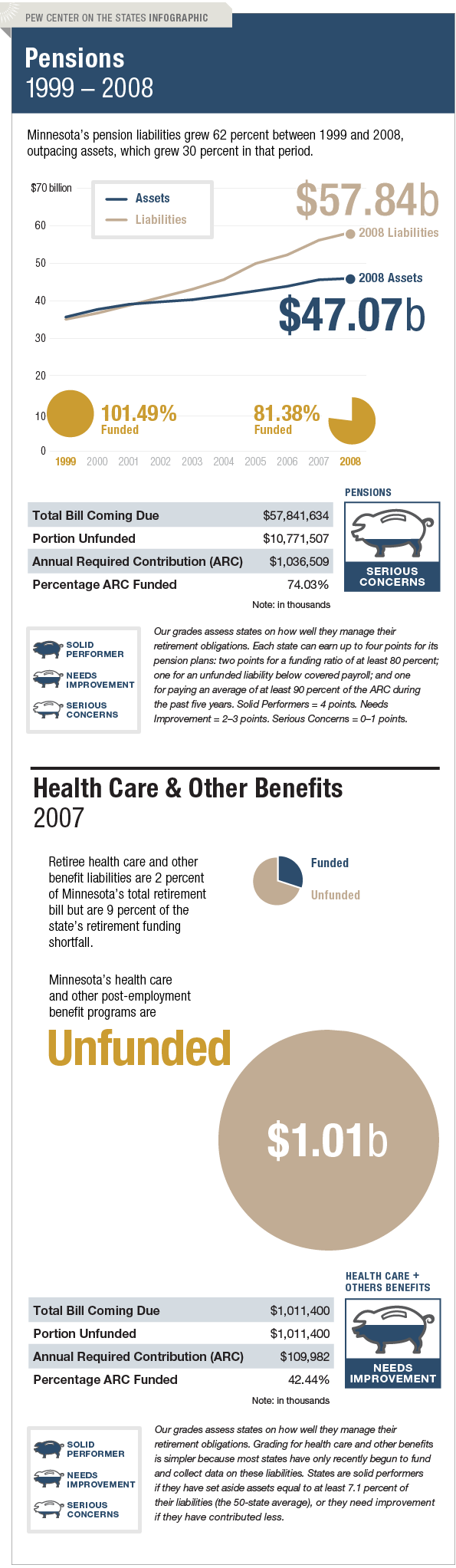

Minnesota needs to improve how it manages its long-term liabilities for both pensions and retiree health care and other benefits. Failure to fully pay the annual required contribution since 2004 has left the state with 81 percent of its total pension liability funded—just above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—and five of the 10 plans run by the state were less than 80 percent funded as of the end of fiscal year 2008.

In 2006, Minnesota passed legislation increasing employer and employee contributions for members of several of the state's retirement plans. That same year, it also capped cost-of-living and investment-based adjustments at 5 percent of benefits.

While Minnesota has relatively limited long-term liabilities for retiree health care and other benefits—$1 billion as of 2007—it, like 19 other states, has failed to set aside any assets to cover its obligations.