The Trillion Dollar Gap: Massachusetts

Underfunded State Retirement Systems and the Roads to Reform

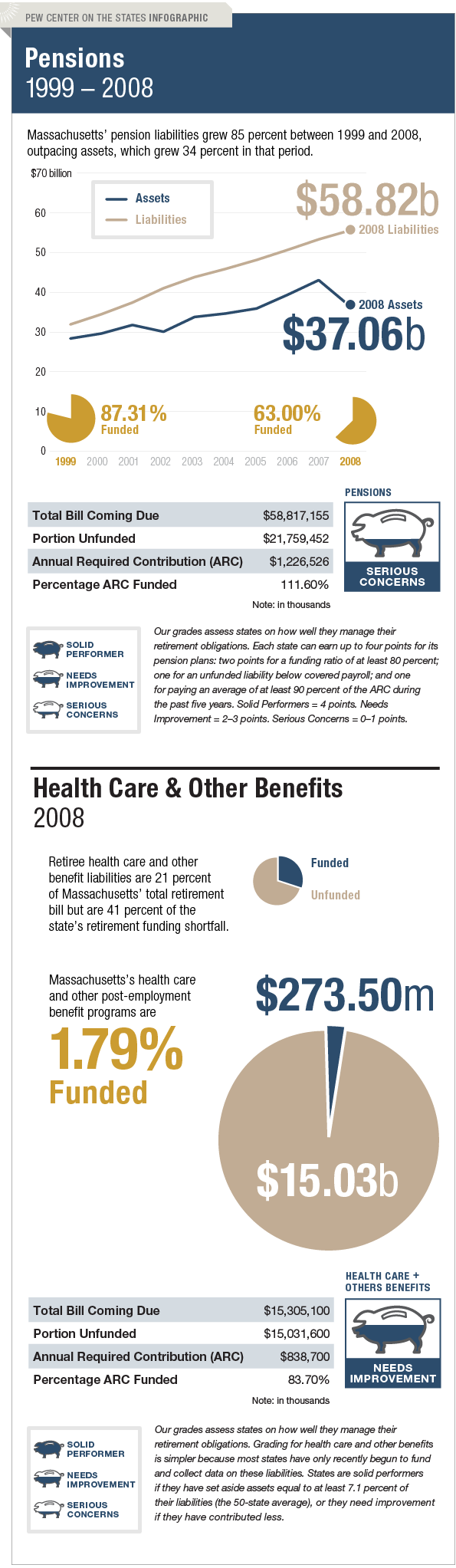

Massachusetts' management of its long-term pension liability is cause for serious concern and needs to improve how it handles its retiree health care and other benefit obligations.

It has funded only 63 percent of its pension bill—well below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—and faces an unfunded liability of $21.8 billion, more than twice the payroll of members of the state-run pension plans. Massachusetts' plans conduct their actuarial valuations on December 31, rather than on June 30. This means that the state's data include a greater share of the investment losses from the financial crisis than do states with valuations on June 30. In 2009, Massachusetts passed a law limiting annual salary increases and other means to inflate benefits.

Meanwhile, the state is one of 29 with any assets set aside to cover long-term liabilities for retiree health care and other benefits, although just 1.8 percent of the $15.3 billion bill coming due has been funded.