The Trillion Dollar Gap: Louisiana

Underfunded State Retirement Systems and the Roads to Reform

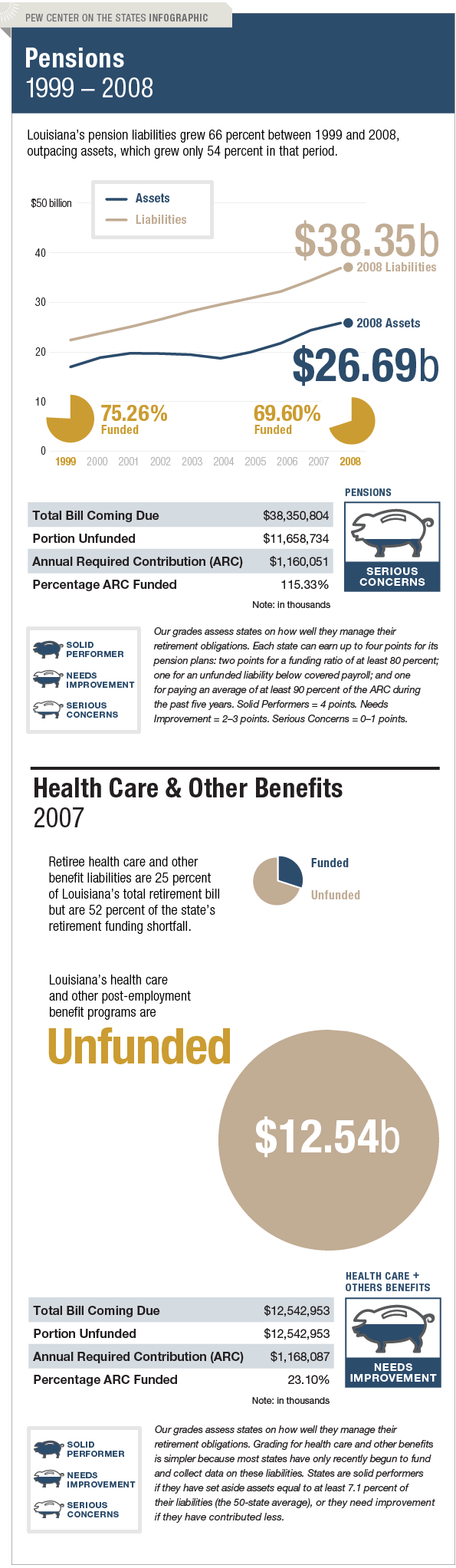

Louisiana's management of its long-term pension liability is cause for serious concern and needs to improve how it handles its retiree health care and other benefit obligations. Although the state has contributed more than 90 percent of the actuarially required contribution each year since 1997, it has funded only 70 percent of its total pension bill—below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. The total unfunded liability—$11.7 billion—is almost twice the payroll for members of the state-run pension plans. In 2009, Louisiana passed a law that limited cost-of-living adjustments to help minimize future benefit increases. Meanwhile, in 2007, Louisiana had a $12.5 billion bill coming due for retiree health care and other benefits—and, like 19 other states, it had failed to set aside any assets to cover these costs.