The Trillion Dollar Gap: Delaware

Underfunded State Retirement Systems and the Roads to Reform

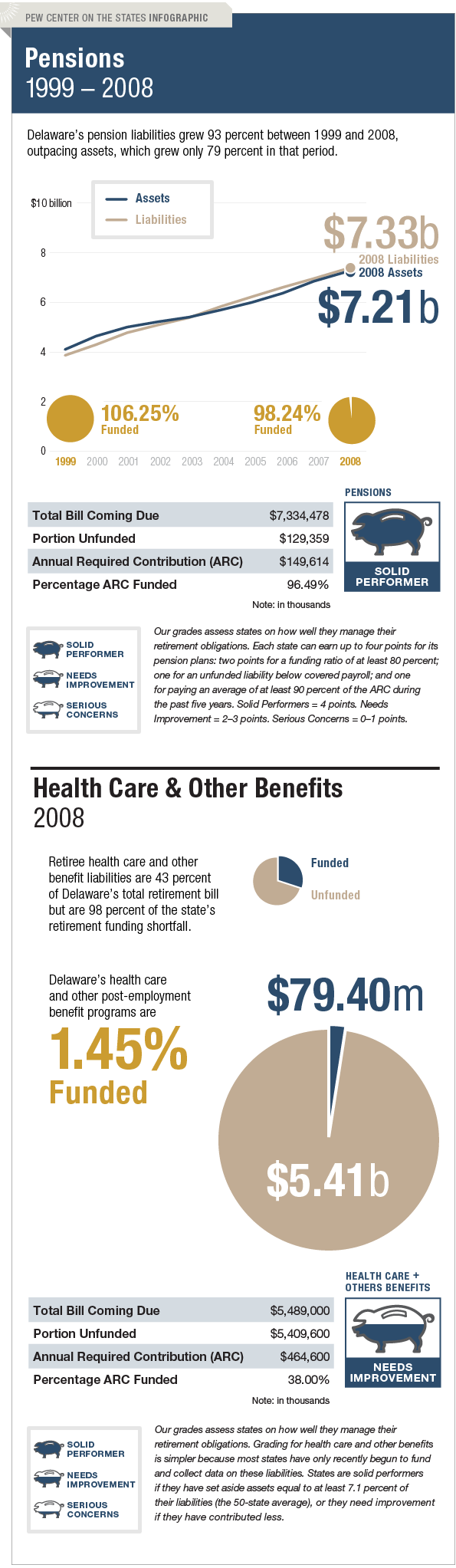

Delaware is a top performer when it comes to managing its long-term liability for pensions, but it needs to improve how it handles the bill coming due for retiree health care and other benefits. Since 2001, the state has steadily increased its annual funding of the actuarially required contribution, and in 2002 it enacted legislation aimed at restricting annual salary increases to inflate benefits.

As of fiscal year 2008, the First State had funded 98 percent of its total pension bill, well above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. Most of Delaware's unfunded liability is associated with the closed State Police Retirement System. Meanwhile, Delaware has set aside about $79 million to cover a total long-term liability of $5.4 billion for retiree health care and other benefits, a funding level of about 1.5 percent.