The Trillion Dollar Gap: Alaska

Underfunded State Retirement Systems and the Roads to Reform

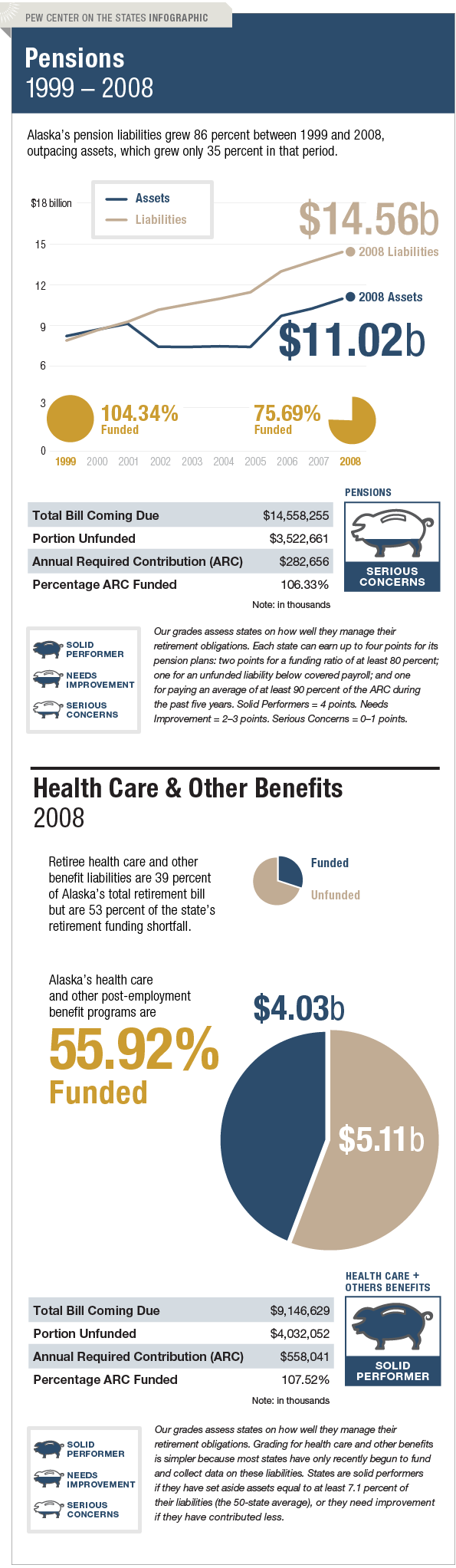

Alaska's management of its long-term pension liability is cause for serious concerns, but it is one of the nation's top two performers, along with Arizona, in addressing the bill coming due for retiree health care and other benefits. Alaska's pension liabilities were 100 percent funded in 2000.

But in 2005, the state began underpaying its annual bill, with only 47 percent contributed that year. As of fiscal year 2008, Alaska's pension system was only 76 percent funded, just below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. In an effort to help pay for this bill coming due, the state authorized a pension obligation bond for up to $5 billion.

The same year, the state stopped guaranteeing health care to new employees between their retirement and eligibility for Medicare. These efforts to reduce long-term costs built on legislation enacted in 2005 that switched new employees from a defined benefit plan to a defined contribution plan.