The Trillion Dollar Gap: Alabama

Underfunded State Retirement Systems and the Road to Reform

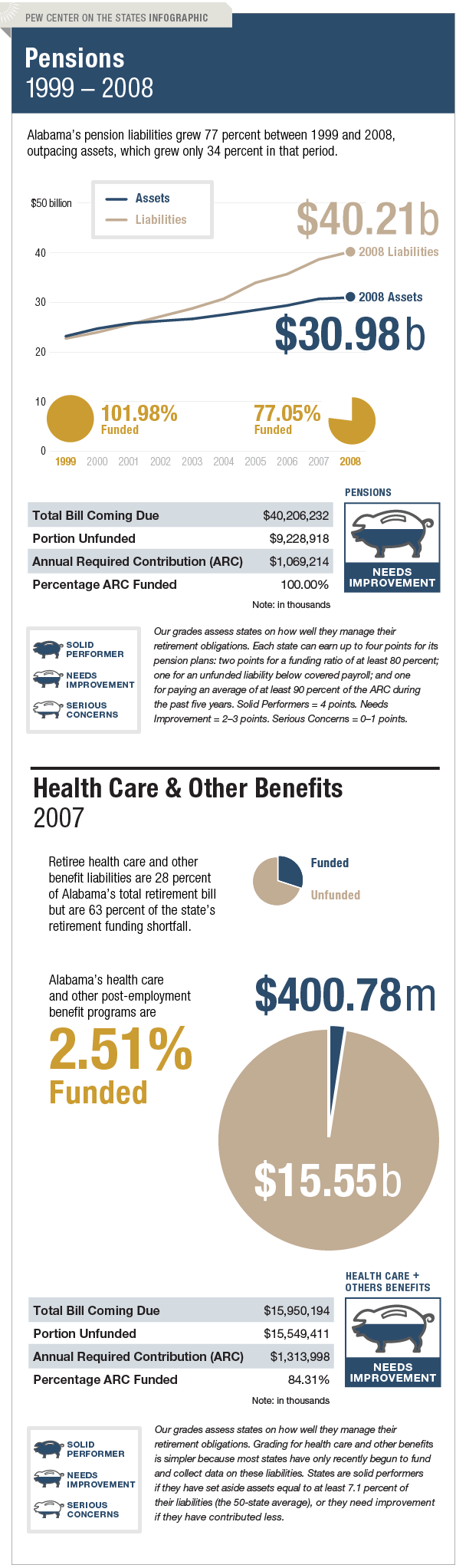

Alabama needs to improve how it manages its long-term liabilities for both pension and retiree health care and other benefits. While the state has made 100 percent of its annual required contribution for pensions for each of the past 12 years, this has not been enough to counter a downward trend in funding that started in 2000.

As of fiscal year 2008, Alabama had funded 77 percent of its total pension bill, just below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. In 2007, the legislature directed the state to create irrevocable trusts to begin setting aside assets to pay for Alabama's retiree health care and other benefits.

But at the end of fiscal year 2008, the state had set aside only $400 million of the $15.5 billion needed to pay those obligations, leaving 97 percent unfunded.