Who Reads 40 Pages of Disclosures?

The need for a disclosure box

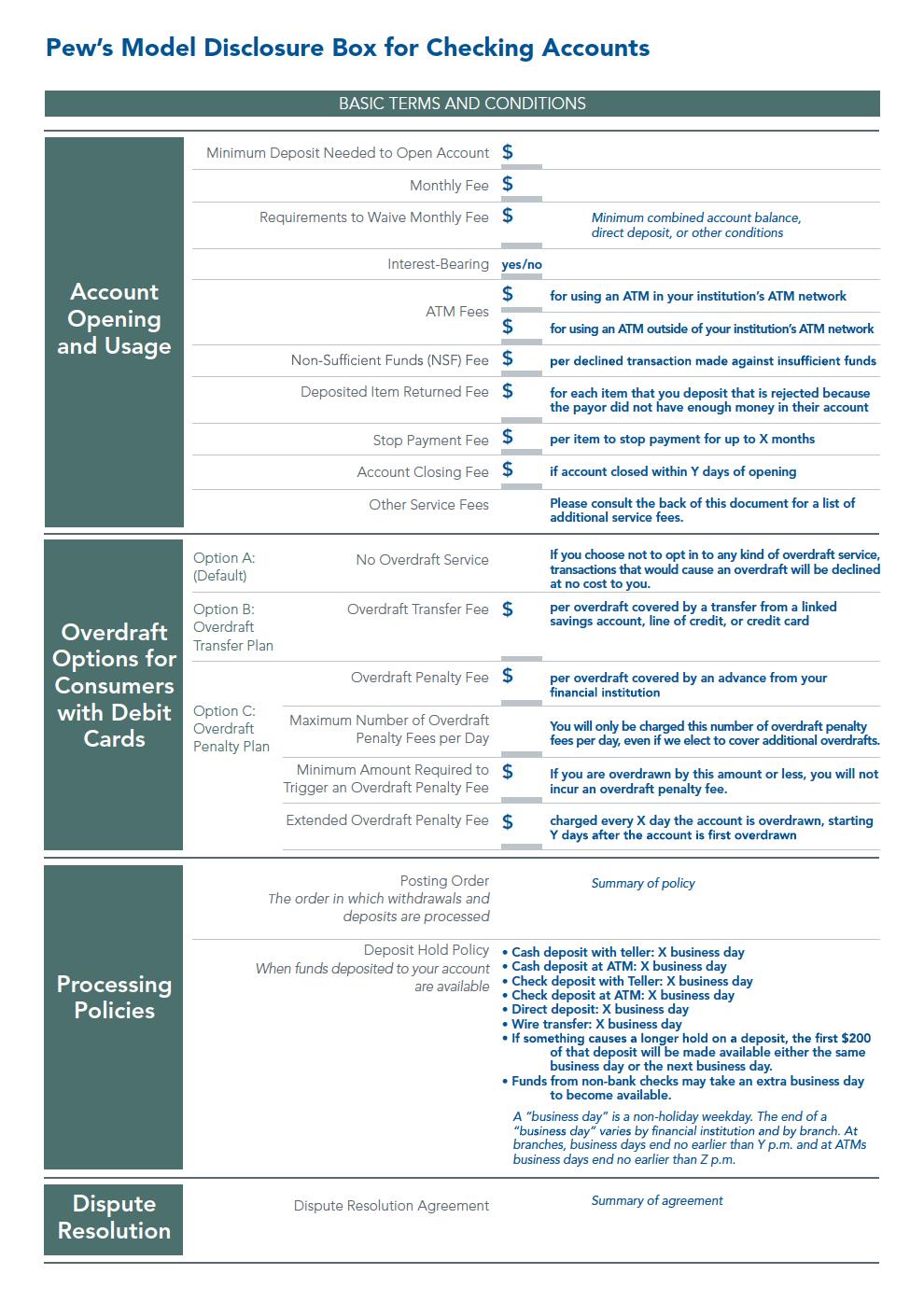

Pew’s Model Disclosure Box for Checking Accounts

The Pew Charitable Trusts consumer banking project’s 2015 survey of checking accounts, Checks and Balances: 2015 Update, found the median length of disclosure materials for checking account agreements and fee schedules to be 40 pages, excluding addenda and other supplementary documents. Previous research has shown that few consumers read such lengthy information.

Pew has developed a summary disclosure form, similar to a nutrition label for food or a Schumer box for credit card offers, that provides consumers with clear and concise information about the key fees, terms, and conditions of checking accounts. Consumers say the model disclosure box is a useful and valuable tool, because it helps them understand fees and important policies when comparing checking accounts.

Many banks have come to understand the value of transparency for such a fundamental product. More than 30 banks and credit unions—including the 12 largest banks and the three largest credit unions, covering more than half of U.S. deposit volume—have worked with Pew to adopt the model disclosure box.

Download the model disclosure form

The following banks have voluntarily adopted Pew’s simple disclosure for checking accounts:

|

|