5 Policies to Help Curb Housing Costs Immediately

These tools are effective ways to increase housing supply and homeownership opportunities

An estimated nationwide shortage of 4 to 7 million homes has pushed rents to all-time highs, with a record share of Americans spending more than 30% of their income on rent. Meanwhile, the median home price has reached $420,000, leaving millions of families unable to afford a home, forcing them to continue renting and miss out on the benefits of homeownership.

However, there are proven policy solutions that can help make a difference. By adopting targeted, evidence-based policies, states and municipalities have many options to increase the supply of both rental housing and homes for sale. These policies can open new homeownership opportunities and reduce financial risks for homebuyers. Here are five policy solutions that can make a difference right now.

1. Microapartments Can Make Office-to-Residential Conversions Feasible

American downtowns are facing a record 20% office vacancy rate, with more than 1 billion square feet of empty office space. Although office-to-residential conversions are generally expensive, The Pew Charitable Trusts and architectural design firm Gensler have proposed a new, more economically viable approach for such conversions that can increase the housing stock while also revitalizing downtowns by converting empty office buildings into dorm-style microunits.

Pew and Gensler studied converting empty office buildings in a range of cities including Denver, Seattle, Minneapolis, Los Angeles, Houston, Chicago, and Washington, D.C. Although costs varied, the study found that in each city, converting vacant offices into small apartments would cost less than building new ones, stretch scarce subsidy dollars, and make rents more affordable for those earning less than half the area’s median income.

The co-living designs reduce construction costs by 25% to 35% per square foot compared with traditional office-to-apartment conversions, largely by concentrating plumbing and kitchen facilities in central, shared spaces on each floor. Total development costs for each unit are one-quarter to one-half of those for conventional apartments. The size and number of microunits and efficient layouts allow lower rents—affordable for people earning 30% to 50% of an area’s median income. These rents are roughly half those of typical apartments in the studied cities.

By lowering the cost of new housing and repurposing existing infrastructure, local governments could produce significantly more units with the same level of public funding. In Denver, for example, a $300,000 subsidy is required to build a studio apartment affordable for someone earning 35% of the area’s median income—but the same subsidy amount can produce about 13 converted microunits. In Seattle and Minneapolis, the required subsidy for one studio apartment could pay for about four converted microunits.

2. Accessory Dwelling Units Can Immediately Add Affordable Options

Accessory dwelling units (ADUs), also known as tiny homes and in-law suites, are becoming a go-to method to quickly add viable and affordable housing stock. ADUs, which property owners can add in their backyard, garage, or basement and rent out, tend to have lower rents than either apartments or houses and are often affordable for lower-income residents. They also can generate income for owners or provide spaces where family members can care for elderly relatives or others.

ADUs have been legal for many years in cities ranging from Gainesville, Florida, to Anchorage, Alaska. Fourteen states, including Arizona, California, Massachusetts, Montana, and Utah, have passed laws to ensure that property owners can build ADUs. Cities including Denver; Richmond, Virginia; Phoenix; Spokane, Washington; and Salt Lake City have taken similar steps.

And ADUs are widely popular among the public. In Pew’s nationally representative survey on housing issues, 72% of respondents favored allowing ADUs on single-family lots in cities and towns in their state.

3. Single-Stair Buildings Can Boost Supply of Lower-Cost Homes

Construction of an apartment or condominium building with a single staircase is 6% to 13% less costly than similar-size dual-stairway buildings. These four-to-six-story buildings with up to four units per floor can fit on smaller infill lots that might otherwise go unused and can fit more easily in established neighborhoods near work, commerce, transit, and recreation. Smaller buildings consistently offer lower rents than single-family homes or high-rise buildings.

Most importantly, single-stair buildings are just as safe as large buildings with two or more stairs. A first-of-its-kind review of thousands of buildings in New York and Seattle conducted by Pew and the Center for Building in North America found no increased fire risk in single-stair apartment buildings compared with those with multiple stairs. Modern single-stair buildings include safety features such as sprinklers, fireproof stairs, self-closing doors, and smoke ventilation, and the smaller footprint provides quicker access to exits.

4. Modern Manufactured Housing Can Benefit Millions of U.S. Homebuyers

Manufactured housing has the potential to address two major challenges in the U.S. market: limited supply and affordability. Eighteen million Americans currently live in manufactured homes, which can cost two-thirds less than other single-family homes. Yet many jurisdictions are missing out on prime opportunities to expand high-quality, lower-cost housing because state manufactured housing titling laws make it difficult for homebuyers to access financing. Zoning barriers also block these homes from installation in many areas where single-family homes that are built on-site are allowed.

Traditionally constructed homes are automatically titled as real estate. But nearly every state automatically titles most manufactured homes as personal property—similar to the way cars are titled—regardless of the quality of the home or whether the homeowner also owns the land. This means would-be buyers of manufactured homes can’t get a traditional mortgage, leading many to seek riskier financing. States could modernize laws that now limit access to traditional mortgages for not only new homebuyers, but also those who bought a manufactured home using other financing that comes with higher costs and fewer protections than mortgages.

Updates to local zoning that permit placement of manufactured homes just like any other single-family house would allow more lower-cost homes to quickly fill vacant lots, replace dilapidated housing, serve as ADUs, or create new subdivisions. Maryland, Maine, New Hampshire, and Rhode Island enacted legislation in 2024 to allow the use of manufactured homes in all single-family neighborhoods.

5. Financing a Low-Cost Home Should Be Easier

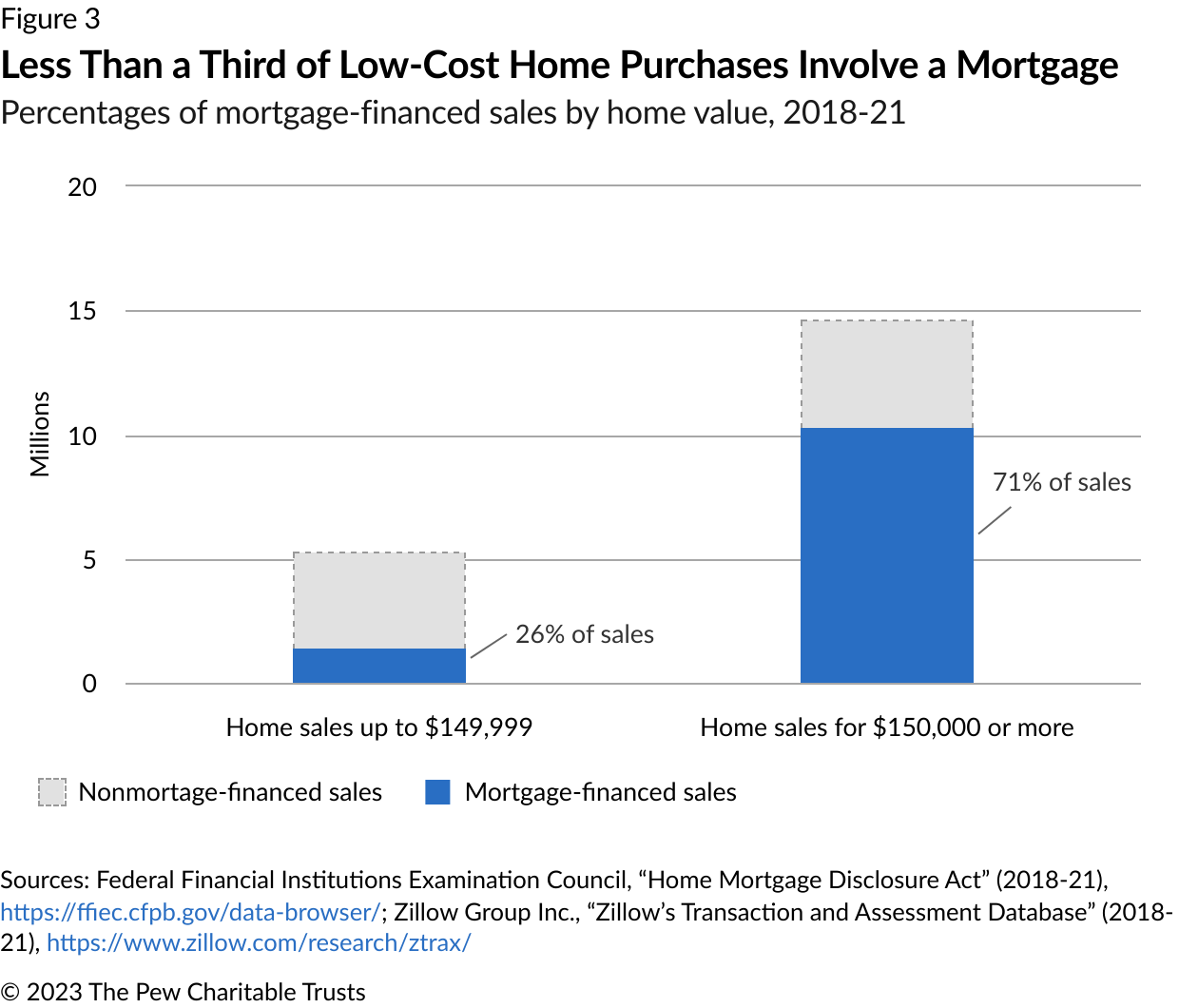

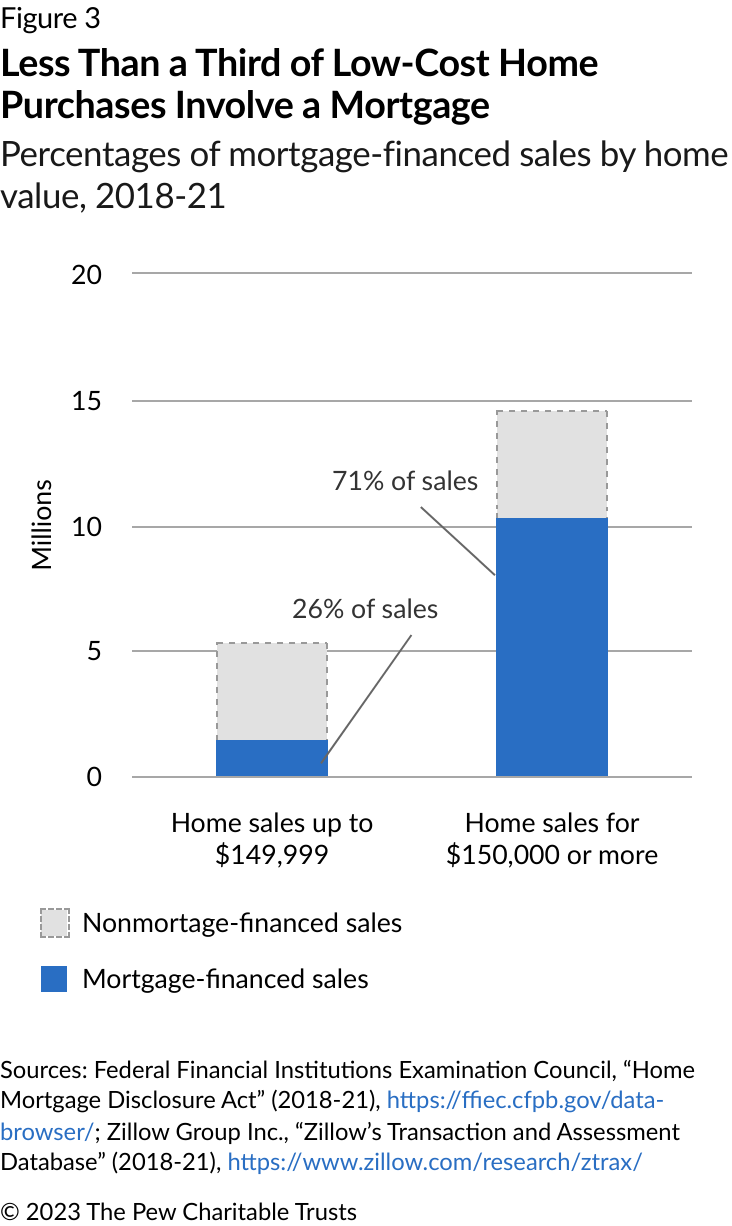

Millions of homes are sold each year for less than $150,000, yet a Pew analysis found that only 26% are financed using a mortgage, compared with 71% of higher-cost homes. Difficulty accessing small mortgages leads many families to forgo purchasing a home or to pursue alternative financing, such as lease-purchase agreements and land contracts, that leaves them vulnerable to financial losses. These arrangements lack many of the consumer protections afforded by mortgages, including inspection and appraisal contingencies that ensure that the homes meet minimum habitability standards and the ability to build equity and protection against quick evictions. Mortgages, unlike alternative financing, also include a clear process for transferring the property’s title from seller to buyer, guaranteeing that borrowers can demonstrate ownership.

There is momentum to change the patchwork of state and federal laws that govern land contracts, and some states, such as Kansas and Minnesota, have passed legislation to strengthen protections for homebuyers using these arrangements. More states can follow these examples to strengthen families’ pursuit of homeownership.

Alex Horowitz and Tara Roche are project directors with The Pew Charitable Trusts’ housing policy initiative.