Retirements at Risk: Many States Fall Short in Helping Mid-Career Workers Save

In past year, 2 systems have boosted benefits for employees, including those who may leave government jobs before retirement eligibility

States have made limited progress in improving the accumulated retiree savings for workers who leave public employment early or mid-career since The Pew Charitable Trusts published a 2022 analysis of how well these workers are financially prepared for retirement.

What is known as the retirement savings rate measures how much money, expressed as a percentage of annual salary, employees can withdraw from their pension funds when they separate from an employer prior to retirement eligibility. Workers typically have access to the funds taken from their paychecks, as well as compounded interest on those funds. In some cases, they also can withdraw some or all of employer contributions made on their behalf.

Combined with the replacement rate metric, which assesses how much income career workers can expect in retirement, the savings rate metric helps capture how workers are set up for retirement. Although the replacement rate indicates that states generally provide robust retirement benefits to career workers, the experience of those who leave public employment earlier is much more varied. In addition to ensuring that career workers can maintain their standard of living in retirement, state systems should consider how to increase the likelihood that workers who leave mid-career save enough to be on the path toward retirement security.

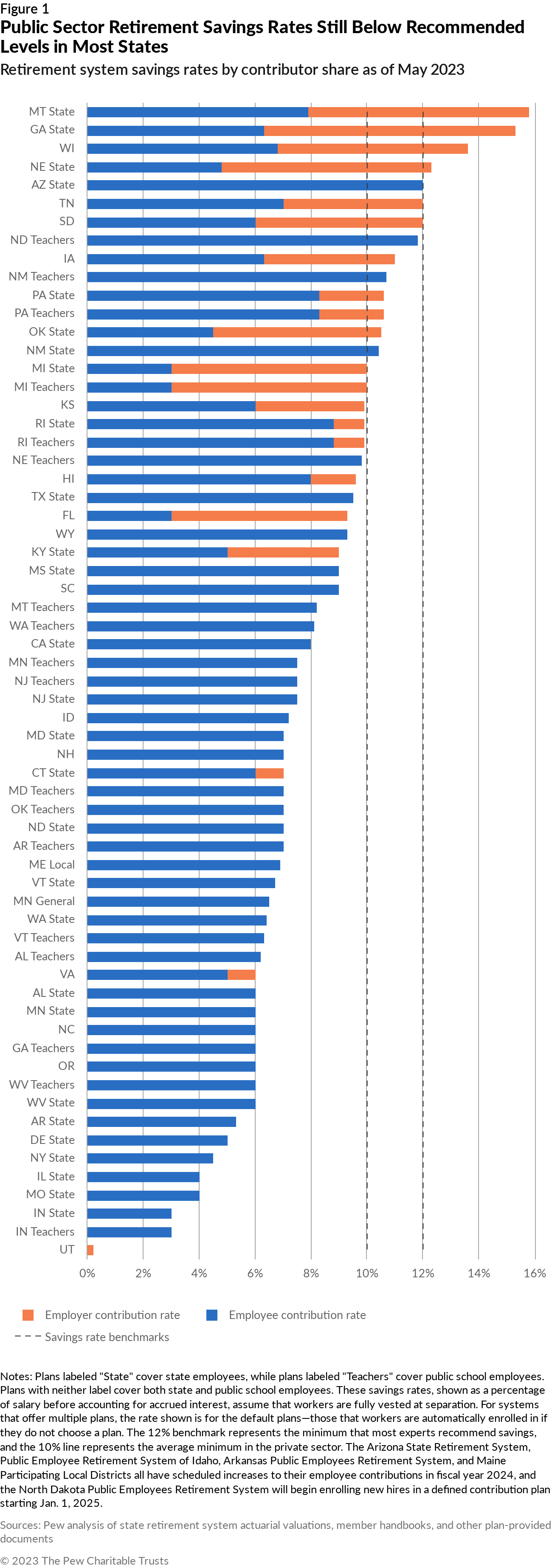

In a 2022 analysis, Pew found that most public retirement systems do not provide separating employees—those who leave before retirement eligibility—with an adequate level of savings. Just five states provided a savings rate of at least 12% of annual pay, the minimum that most experts recommend saving. In addition, only 14 achieved a rate of at least 10%, the average minimum provided in the private sector. Since that analysis, Georgia and Florida have passed legislation that increases their retirement savings rates: Georgia dramatically boosted the 401(k) employer match for members of the Georgia State Employees’ Pension and Savings Plan, and Florida enhanced required employer contributions to the Florida Retirement System Investment Plan.

The Georgia plan, the default choice for public employees in the state, combines a defined benefit plan or traditional pension with a 401(k) or defined contribution plan. Participants must contribute 1.25% of pay to the defined benefit portion. The default contribution to the 401(k) is 5% of pay, but employees can change that amount. Together, that amounts to a total employee contribution of 6.25% of pay. Before the recent changes, workers who contributed 5% to the 401(k) received a maximum 3% employer match for a total savings rate of 9.25%, well below the 12% recommendation.

Amid recruitment and retention concerns, however, the Employees’ Retirement System of Georgia proposed legislation that raised the 401(k) match to 5% effective July 1, 2022. Additionally, employees with at least six years of service are now eligible for an additional half percent match for every additional year of service, up to 9%. The additional match raised the system’s savings rate from 9.25% to a maximum of 15.25%, well above the 12% benchmark. Georgia is now one of only seven states that meet or exceed that threshold.

Florida also passed legislation last year that raised the savings rate for public workers in the state. The default plan, the Florida Retirement System Investment Plan, is a defined contribution plan similar to a 401(k). Until recently, employees contributed 3% of pay and employers contributed 3.3% for a total savings rate of 6.3%, which placed the plan in the bottom third of all plans analyzed.

However, effective July 1, 2022, public employers must contribute 6.3%, raising the total savings rate to 9.3%. Despite this increase, Florida’s savings rate still falls below the 12% benchmark.

In the new analysis, Pew also updated the savings rate data for all 63 of the systems included in the original research and found that:

- Most systems continue to provide separating employees with an inadequate level of retirement savings. Only seven systems—in Montana, Georgia, Wisconsin, Nebraska, Arizona, Tennessee, and South Dakota—provide a savings rate of at least 12%. In addition to Georgia, Arizona is new to that list because of an annual employee contribution increase that pushed the state system above the 12% threshold.

- 16 systems offer a savings rate of 10% or more, up from 14 in our previous analysis. The New Mexico Public Employees Retirement System eased its way above the 10% threshold this year because of mandated employee contribution increases.

- The average savings rate remains stable at around 8%, but now only about a quarter of plans have rates of 6% or less (down from a third). That can be attributed mostly to mandated employee contribution increases, not increased access to employer contributions.

- 13 systems boosted required employee contributions, leading to an increase in their respective savings rates. However, most of those states did not provide a subsequent increase in available employer contributions. Access to greater employer contributions continues to play a key role in pushing savings rates above the benchmarks. Twelve of 16 systems with a savings rate of at least 10% provide separating workers with some employer contributions, compared with only nine of the 47 systems with savings rates below 10%.

Despite positive policy change in Georgia and Florida, the updated analysis indicates that most states still fall below the 12% or 10% savings rate benchmarks. Several systems have increased their employee contribution requirements, thus increasing their savings rates slightly, but there has been little change in access to employer contributions, a key factor in reaching adequate savings rate goals. To ensure that separating workers are set up well for retirement, workers should be allowed to retain at least some of the employer contributions made on their behalf.

Aleena Oberthur is a project director and Mollie Mills is a principal associate with The Pew Charitable Trusts’ state fiscal policy project.