Recovering from Volatile Times

Note: For our latest research on this topic, see "Fiscal Health of Large U.S. Cities Varied Long After Great Recession’s End."

This report examines how America's big cities navigated fiscal challenges during the Great Recession and in the years following that downturn. It evaluates the fiscal conditions of 30 large American cities, identifies the factors that drove cities' decline and rebound during the Great Recession, and the mechanisms cities employed to address the fiscal strain.

OVERVIEW

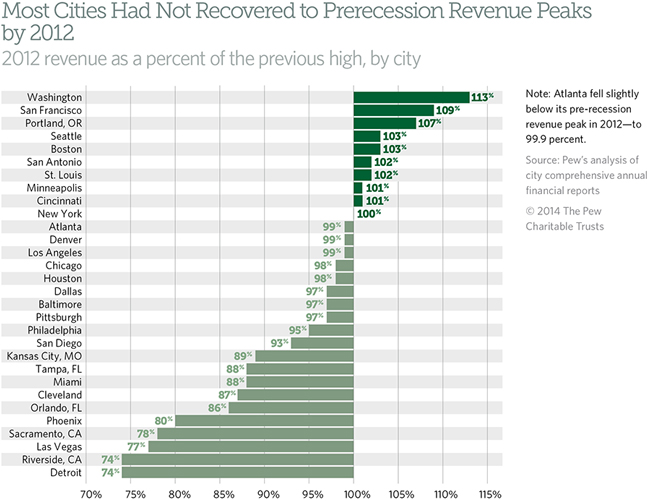

In the three years between 2009 and 2012, the U.S. economy began recovering from the Great Recession. Nationally, housing prices rose and the unemployment rate fell, but for many major U.S. cities, the fiscal crisis persisted, making the recovery a geographically uneven experience. In fact, in some major cities revenue declines continued into 2012—a full three years after the national recession ended.

The Pew Charitable Trusts reviewed the latest available data from 30 major U.S. cities and found that more than half—18—saw governmental revenue decline from 2011 to 2012 after adjusting for inflation.1 Of these, eight reported their lowest revenue since the downturn began in 2007.

In some major cities revenue declines continued into 2012—a full three years after the national recession ended.

An ongoing slump in property tax revenue is a significant contributing factor in the prolonged fiscal strain on some cities. City property assessments and tax collections typically lag behind the real estate market by 18 to 24 months. This time, however, the national housing crisis so dramatically undercut this important revenue source that Pew’s analysis found collections in many cities remained anemic a full three years after the national economy began to improve.2 In 2012, the majority of cities reported year-over-year losses in real property tax collections—the most to declare such losses in any year since 2007. Even today, “the recovery still feels like a recession,” said Federal Reserve Chair Janet Yellen.3

In addition to weak property tax revenue, city officials have faced the added challenge of cuts in state aid as state lawmakers strained to balance their own budgets. In 2011, federal aid began shrinking too, as cities’ share of federal stimulus money tapered off. City officials covered shortfalls by cutting spending, raising fees and taxes, and drawing down reserves.

City officials have faced the added challenge of cuts in state aid as state lawmakers strained to balance their own budgets.

Not all cities were worse off in 2012 than the year before, however. Boston, Cincinnati, Minneapolis, New York, and Seattle exceeded their prerecession revenue peaks in 2012—mostly due to gains in sales and income taxes and increased charges and fees.4 The boost in cash allowed Cincinnati to take a needed “breather,” as City Manager Milton Dohoney Jr. put it, from the deficit-driven budgets of the preceding three years.5

The findings of this analysis are explored in detail later in this report, but briefly:

- Governmental revenue fell in 18 of the 30 cities between 2011 and 2012, double the number from 2010 to 2011. In 2012, eight cities recorded their lowest level of revenue since the start of the recession.6

- In the majority of cities, drops in property tax revenue and state and federal aid accounted for most of the revenue loss; both fell 4 percent on average across the 30 cities.

- Revenue increases from sales and income taxes—in cities that collect them—and from charges and fees helped to mitigate losses in some cities.

- In 2012, 10 cities had revenue above their prerecession peaks, after adjusting for inflation.7

- Four of the nine cities that had surpassed their pre-downturn revenue peak in 2011 fell back below that level again in 2012.8

- Seventeen cities managed to increase spending on some programs and services and replenish reserves in 2012, but overall spending in most cities remained below prerecession levels. This cautious approach suggests that many city officials have adjusted to the reality of an unusually slow recovery.

The fiscal data reviewed in this report reflect conditions as of 2012, but analysts note that, even with improving property tax collections, the effects of the Great Recession are still being felt in some cities as of 2014. For example, Amy Laskey, managing director of U.S. public finance for Fitch Ratings, said in July 2014 that “both the degree of housing market improvement and the time lag vary by state and regions within states.”9

ENDNOTES

- Pew examined fiscal data collected from the audited financial statements of the central city in each of the nation’s 30 largest metro areas according to the 2010 decennial census. For more information, see the full methodology at http://www.pewtrusts.org/cities-methodology-2014.

- Michael A. Pagano and Christiana McFarland, “City Fiscal Conditions in 2013,” National League of Cities (October 2013),http://www.nlc.org/Documents/Find City Solutions/Research Innovation/Finance/Final_CFC2013.pdf. While the lag between city finances and market conditions can range from 18 months to several years, an 18- to 24-month lag is probably typical for most localities.

- Janet Yellen, “What the Federal Reserve Is Doing to Promote a Stronger Job Market” (speech to the National Interagency Community Reinvestment Conference in Chicago, March 31, 2014), http://www.federalreserve.gov/newsevents/speech/yellen20140331a.htm.

- These include licenses and permits; charges for services; and fines, penalties, and forfeitures.

- City of Cincinnati, 2012 Recommended Budget Update: City Manager’s Message (2012), 1, http://www.cincinnati-oh.gov/finance/linkservid/E804A735-A694-C8B6-C5EF4C4FA13F7607/showMeta/0.

- The eight cities are Dallas, Detroit, Kansas City, Las Vegas, Miami, Orlando, Phoenix, and Riverside. Dallas is unique among these cities. Its revenue surpassed its prerecession peak in 2011 only to fall a year later to its lowest point since 2007. Unlike many of the other cities hitting six-year revenue low points, Dallas’ decline was also moderate, just 3.6 percent below its 2011 high.

- The five cities that surpassed their prerecession revenue peak for the first time in 2012 are Boston, Cincinnati, Minneapolis, New York, and Seattle. Of the nine cities that were above peak in 2011, Portland, OR, San Antonio, San Francisco, St. Louis, and Washington remained there in 2012.

- The four cities that previously surpassed their prerecession revenue peak in 2011 only to fall back below it in 2012 are Atlanta, Chicago, Dallas, and Pittsburgh.

- Amy Laskey (Fitch Ratings), interview by The Pew Charitable Trusts, July 2014.