Why States Save

Using evidence to inform how large rainy day funds should grow

As revenue and spending pressures shift along with the booms and busts of the economy, states stand to benefit from the additional flexibility provided by robust rainy day funds to smooth over unexpected bumps in the road. But absent a clear purpose for saving, some states also find it extremely difficult to set a meaningful savings target, which can confound their efforts to manage the budgetary ups and downs of economic activity.

This report examines how state policymakers should design their funds to help inform an optimal savings target. It analyzes existing guidelines – set in statutory or constitutional language – around the management of rainy day funds and offers key questions to consider while crafting such guidelines.

KEY FINDINGS

To help leaders craft effective policies for their states’ rainy day funds, The Pew Charitable Trusts examined the statutory or constitutional language governing these funds.

The research found that:

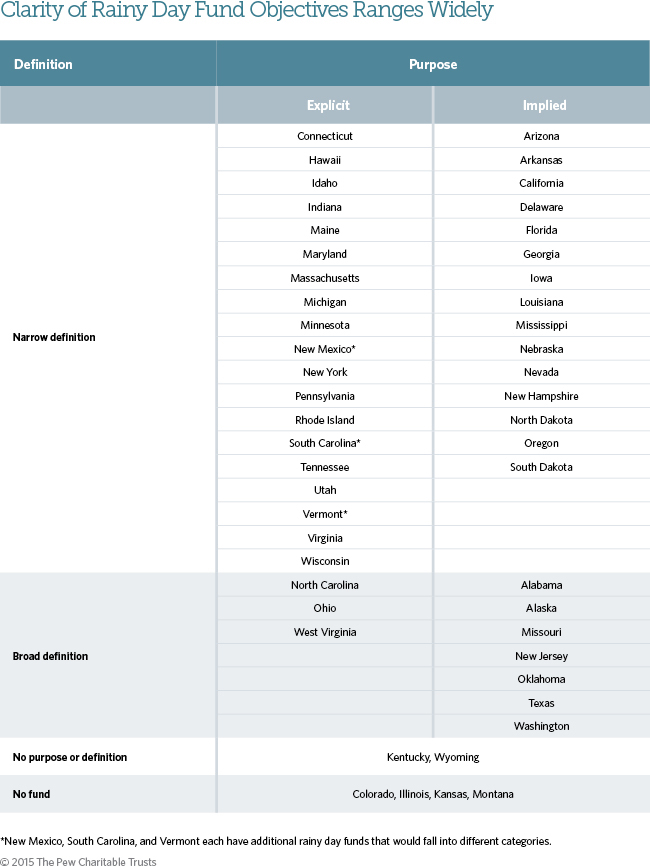

- Out of the 46 states with such funds, more than half – 27 – do not clearly express in state law what they are seeking to achieve with them. Only one state – Minnesota – sets the level of budgetary risk it wishes to offset by having a fund.

- During the growth years of the mid-2000s, rainy day funds in 21 states were prevented from growing larger because balances quickly swelled to their maximum levels, which resulted in most of those states relying more heavily on spending cuts and tax increases to balance their budgets during and after the Great Recession.

- Only five states – Connecticut, Minnesota, Nebraska, Oregon, and Utah – currently require by law regular, periodic evaluations of revenue volatility patterns in order to determine a sufficient maximum or targeted balance for their funds. The remaining 41 states with rainy day funds do not have a process for reexamining the size of their funds in response to changing fiscal and economic conditions.

RECOMMENDATIONS

In order to arrive at an optimal savings target, Pew recommends that state policymakers consider three factors:

- The fund’s purpose. In order to make evidence-based determinations about how much to save, policymakers must first decide what they want to accomplish with the fund and how and when its balances should be drawn upon. To that end, the fund should have an explicit purpose that should be narrowly defined in law.

- The volatility of the state’s revenue. States should study how their revenue systems react to the ups and downs of the business cycle so they can align their savings target with the state’s historical experience with volatility. If the purpose of the fund encompasses spending considerations such as maintaining program funding commitments or overall state spending at a certain level, the analysis should incorporate those factors as well. Rigorous examination of historical data on revenue volatility is essential to developing an evidence-based savings target.

- The degree of risk the state wishes to offset. Some states use their savings to cushion the impact of budget cuts in response to a recession, while others strive to put away enough to avoid cuts altogether. Still others may want to save more to offset large, mandatory spending commitments on entitlements or other spending pressures that may arise. Clear parameters can provide guidance to policymakers as they determine how much a state needs to save in order to achieve its goals.

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube